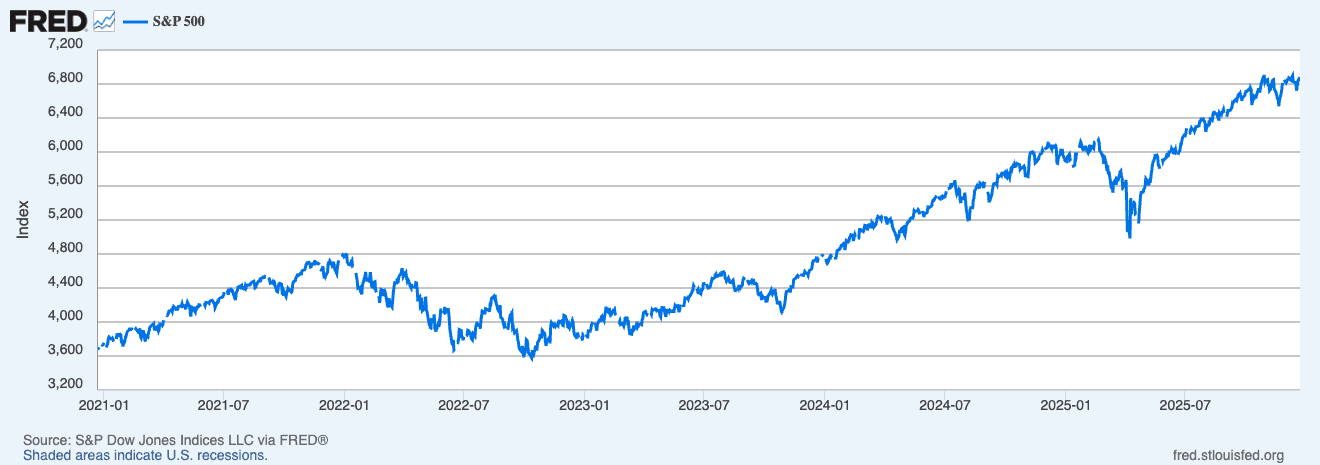

The Federal Reserve cut rates in December for the third consecutive time, bringing the fed funds rate to 3.5%-3.75%. Markets should have celebrated. Instead, the S&P 500 initially rallied, then promptly dropped 2.9% the following day when Powell signaled fewer cuts ahead. Two weeks later? The index was back at all-time highs.

Welcome to 2025, where Fed announcements have become theater and markets write their own script.

Something fundamental has broken in the relationship between monetary policy and asset prices. The old playbook—where inflation data moved markets, employment figures mattered, and Fed dot plots served as gospel—has been quietly shredded. In its place, we've got a market running on entirely different fuel. Understanding this shift isn't just academic curiosity. It's the difference between positioning for the next cycle and getting blindsided by it.

The Pavlovian Response That Stopped Working

For decades, the setup was simple: Fed tightens, markets fall. Fed eases, markets rise. Academic research confirmed that S&P 500 returns during FOMC meetings were five times higher than average days since 1980. The pattern was so reliable that quant funds built entire strategies around it.

Then 2024-2025 happened. The Fed delivered 100 basis points of cuts by year-end 2024. Traditional theory says this should have turbocharged risk assets. Instead, the market's reaction became increasingly... selective. Some cuts rallied stocks. Others barely registered. The most recent December cut? The S&P 500 briefly turned positive then reversed, ultimately climbing back within days despite Powell's hawkish tone.

The message from markets was clear: we're done taking orders.

Liquidity: The Invisible Hand

Here's what actually moved the needle in 2025: liquidity. Not the employment report. Not CPI prints. Liquidity.

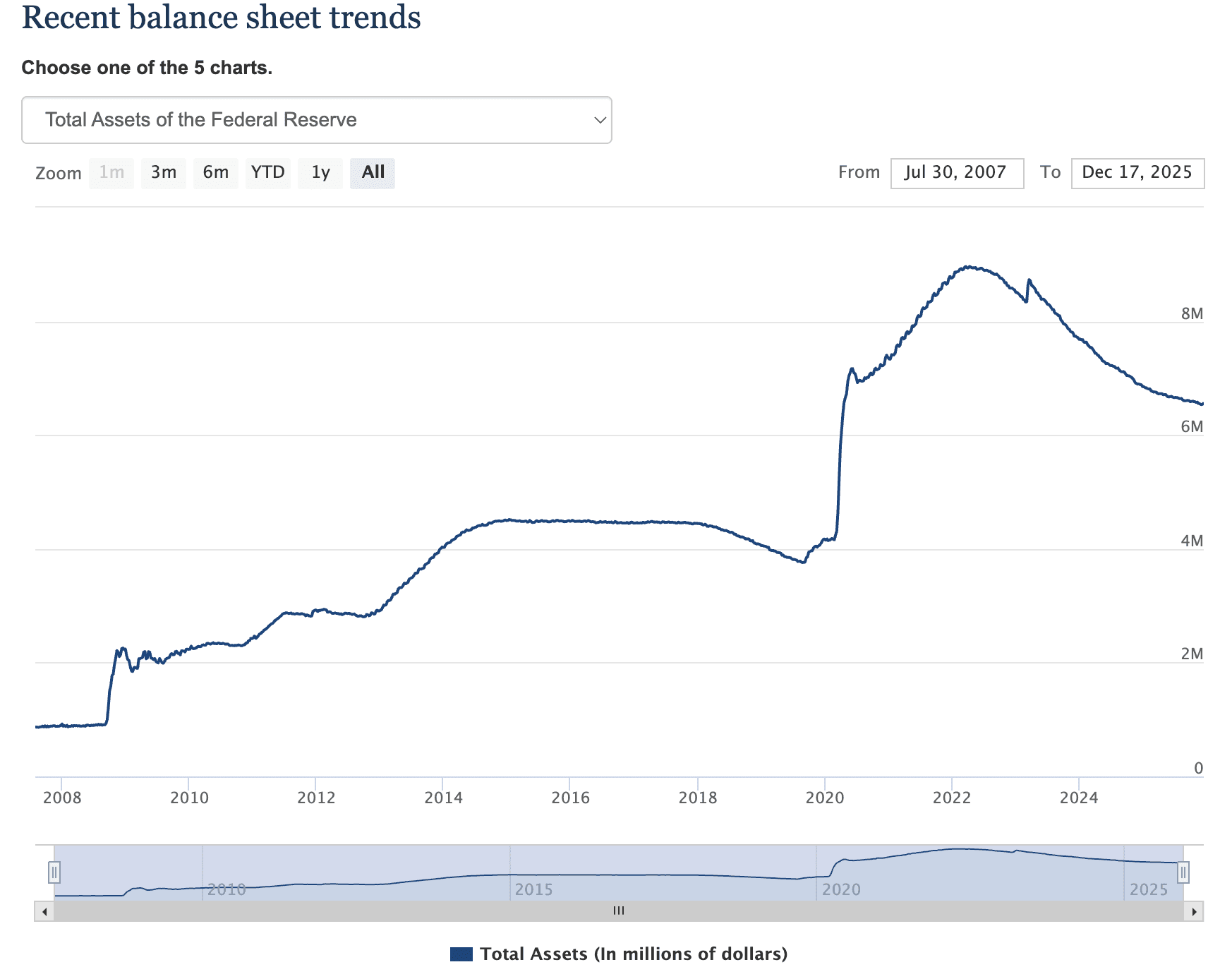

The Fed officially ended quantitative tightening on December 1, 2025, after withdrawing $2.4 trillion from the financial system since June 2022. That same week, the Fed injected $13.5 billion through overnight repo operations—the second-largest single-day liquidity operation since COVID.

Bank reserves, which fell to near $3 trillion in September (the lowest since 2019), suddenly became the market's focal point. Not inflation. Not growth. Whether banks had enough cash sitting at the Fed to keep the plumbing functional.

This is the new regime. Markets don't react to macro signals anymore—they react to money supply dynamics that most investors don't even track. The old measures like CPI and payrolls? Lagging indicators of a system that's moved on.

The AI Exceptionalism Premium

Then there's the elephant in the trading floor: artificial intelligence has created its own gravitational field, bending market physics in unprecedented ways.

AI-related stocks accounted for roughly 80% of S&P 500 gains in 2025. The Magnificent Seven alone now represent nearly 30% of the entire index. Nvidia's market cap alone makes it larger than most countries' GDP. The index has delivered back-to-back years of 20%+ returns—something not seen since the late 1990s.

This concentration has effectively immunized the market from traditional economic signals. When AI companies plan to invest over $500 billion in 2026, representing nearly 1% of GDP, employment data becomes background noise. The narrative has shifted from "will the economy slow?" to "how fast can we build data centers?"

Critics point to valuations trading at 23 times forward earnings—levels only seen twice in 40 years. But here's the kicker: earnings forecasts keep getting revised upward. What looked expensive in July proved conservative by December. The traditional valuation framework assumes mean reversion. AI bulls are pricing in a regime change.

The Currency Nobody's Tracking

While everyone obsesses over the Fed's interest rate decisions, the real action happens on the Fed's balance sheet—the $6.5 trillion elephant that determines actual liquidity conditions.

Here's where it gets interesting. The Fed's balance sheet composition matters more than its size. Reverse repo operations declined from $2.2 trillion in May 2023 to near-zero by late 2024, injecting stealth liquidity into the system even as official QT continued. Treasury General Account (TGA) swings, driven by government cash management and debt ceiling theatrics, have caused 5-20% swings in Fed liability composition, mechanically determining commercial bank liquidity.

These aren't esoteric details. They're the actual transmission mechanism. When the TGA drawdown in early 2025 more than offset QT's liquidity drain, markets rallied—regardless of what Powell said about inflation risks. The plumbing mattered more than the rhetoric.

This explains why markets can shrug off "hawkish" Fed meetings. If liquidity conditions are actually easing (via TGA drawdowns or reduced reverse repos), the stated policy stance becomes irrelevant. Markets trade the reality of reserve balances, not the theater of dot plots.

Employment Growth Without Employment Mattering

The December FOMC meeting was particularly instructive. Powell called it an "insurance cut" to prevent labor market weakness from accelerating. But here's the thing: the labor market data was already stale, stuck in a "data void" because of a government shutdown halting official statistics.

Markets didn't care. The S&P 500 closed the month near record highs above 6,900 for the first time, up over 15% for the year. Employment figures, historically the Fed's most closely watched indicator under its dual mandate, had become a secondary concern to capital flows and AI infrastructure spending.

The disconnect is stunning. Traditional macro says weak employment should pressure equities. The 2025 playbook says weak employment might justify easier policy, which could mean more liquidity, which is bullish. The relationship inverted.

The New Hierarchy of Signals

So what does move markets now? In order of importance:

Actual liquidity conditions (bank reserves, repo rates, TGA balances)

AI capex announcements and infrastructure spending

Corporate earnings from mega-cap tech

Policy that affects capital flows (regulation, taxes)

Everything else the Fed says

Notice what's not on that list: inflation data, GDP growth, employment figures, Fed rate projections. These metrics still matter for the real economy. For markets? They're noise unless they directly threaten liquidity or earnings.

This hierarchy explains seemingly contradictory market moves. Stocks fell 2.9% after the December Fed meeting not because of the rate cut itself, but because updated projections suggested tighter liquidity ahead. Days later, when AI stocks rallied on infrastructure news, the index recovered completely. Different inputs, different outcomes.

The Regime Question

The critical question isn't whether this decoupling is sustainable. It's whether we're witnessing temporary dislocation or permanent regime change.

Bulls argue AI represents a fundamental productivity shift comparable to electrification or the internet. Goldman Sachs forecasts the S&P 500 could reach 6,900 by late 2026, driven by earnings growth that exceeds historical patterns. In this view, traditional metrics failed because they're measuring the old economy while pricing the new one.

Bears counter that every bubble looks different until it pops. They point to circular investments—OpenAI funding Oracle while Oracle buys from Nvidia while Nvidia invests in OpenAI—as artificial demand inflation. MIT research found 95% of organizations getting zero return on $30-40 billion in enterprise AI investment. The Case-Shiller P/E ratio exceeds 40 for the first time since the dot-com crash.

Fed Chair Powell himself noted equity prices appear "fairly highly valued" by many measures, though he's careful not to call tops. Even Ray Dalio drew comparisons to the late 1990s.

What It Means Going Forward

The practical implications for investors are profound. Traditional diversification strategies built around economic cycles and Fed policy may no longer provide the intended protection. When markets ignore macro signals, correlation assumptions break down.

The new regime demands different tools: tracking liquidity metrics like bank reserves and reverse repo facility usage. Monitoring AI infrastructure spending and power grid capacity. Understanding that the handful of companies driving index returns operate in a different reality than the rest of the economy.

KPMG's analysis captures the conundrum: "The Federal Reserve is in an untenable place: cut rates and risk stoking an asset bubble and a more persistent bout of inflation or sit idly by as employment further decouples from growth."

This is where we are. Markets running on liquidity and AI momentum while traditional indicators flash mixed signals. The Fed caught between mandates, with its traditional tools losing effectiveness. And investors forced to navigate by instruments that didn't exist in previous cycles.

The decoupling isn't a bug. It's the feature of a market that's moved beyond conventional macro entirely. Whether that ends in vindication or tears depends on whether AI lives up to the hype and whether liquidity stays abundant. But pretending the old relationships still work is a recipe for getting run over.

The Fed may still set rates. But it stopped setting the narrative months ago. Markets are writing their own story now, and traditional economic data is increasingly relegated to footnotes.

NEVER MISS A THING!

Subscribe and get freshly baked articles. Join the community!

Join the newsletter to receive the latest updates in your inbox.