The champagne's gone flat, the confetti's been swept up, and Wall Street is hung over. Not from excess celebration—from excess complacency.

Every January, without fail, the financial media dusts off the same tired narrative: fresh capital flows, new year optimism, the "January Effect" sending stocks skyward. It's become market folklore, the investing equivalent of believing in Santa Claus. And right now, with the S&P 500 flirting with 7,000 after a record-breaking 2025, that folklore is getting dangerous.

Here's what they're not telling you: the rally you're watching isn't real. It's a hologram projected onto the thinnest liquidity conditions we've seen in years. And when the music stops, there won't be enough chairs for everyone.

When Liquidity Becomes a Weapon

December's market action should terrify you, not reassure you. Trading volumes collapsed to roughly 45-70% below normal as institutional desks closed for the holidays. The S&P pushed higher on fumes—retail momentum and zero-day options flow, not institutional conviction.

Think about what that means. The market just printed all-time highs on volume that wouldn't fill a bathtub. When you can move major indices with pocket change, you're not witnessing strength. You're witnessing fragility dressed up as a Santa rally.

The VIX is crushed down near 14.50, telling everyone to relax. But here's the tell: vol of vol refuses to collapse. The curve stays steep. Translation? Dealers are comfortable collecting premium today while quietly hedging for chaos tomorrow. They know what retail doesn't: this calm is artificial, mechanically engineered by option flows in a market where nobody's actually at their desk.

The January Effect Is Dead (But Nobody Told You)

Let's kill a zombie. The "January Effect"—that magical phenomenon where stocks, especially small caps, supposedly surge in the new year—has been arbitraged into irrelevance for two decades.

From 1928 to 2000, January averaged a 1.7% gain for the S&P 500 and 3.2% for small caps. Classic tax-loss harvesting, year-end bonus deployment, behavioral patterns that were as predictable as sunrise.

Then everyone learned the trick. And in markets, once everyone knows the secret, it stops being profitable.

Since 2000? The effect has deteriorated to essentially zero, sometimes even negative. The Russell 2000's January average collapsed from a spectacular 4.37% pre-1993 to a loss in subsequent decades. November and December became the real winners.

Why? Because hedge funds, algorithms, and institutional arb desks started front-running it. By late December, the trade's already crowded. Come January 2nd, there's nobody left to buy—just a lot of people looking to exit a now-obvious positioning.

If you're betting on a January surge in 2026, you're playing yesterday's game with today's rulebook.

Valuations That Would Make Buffett Laugh

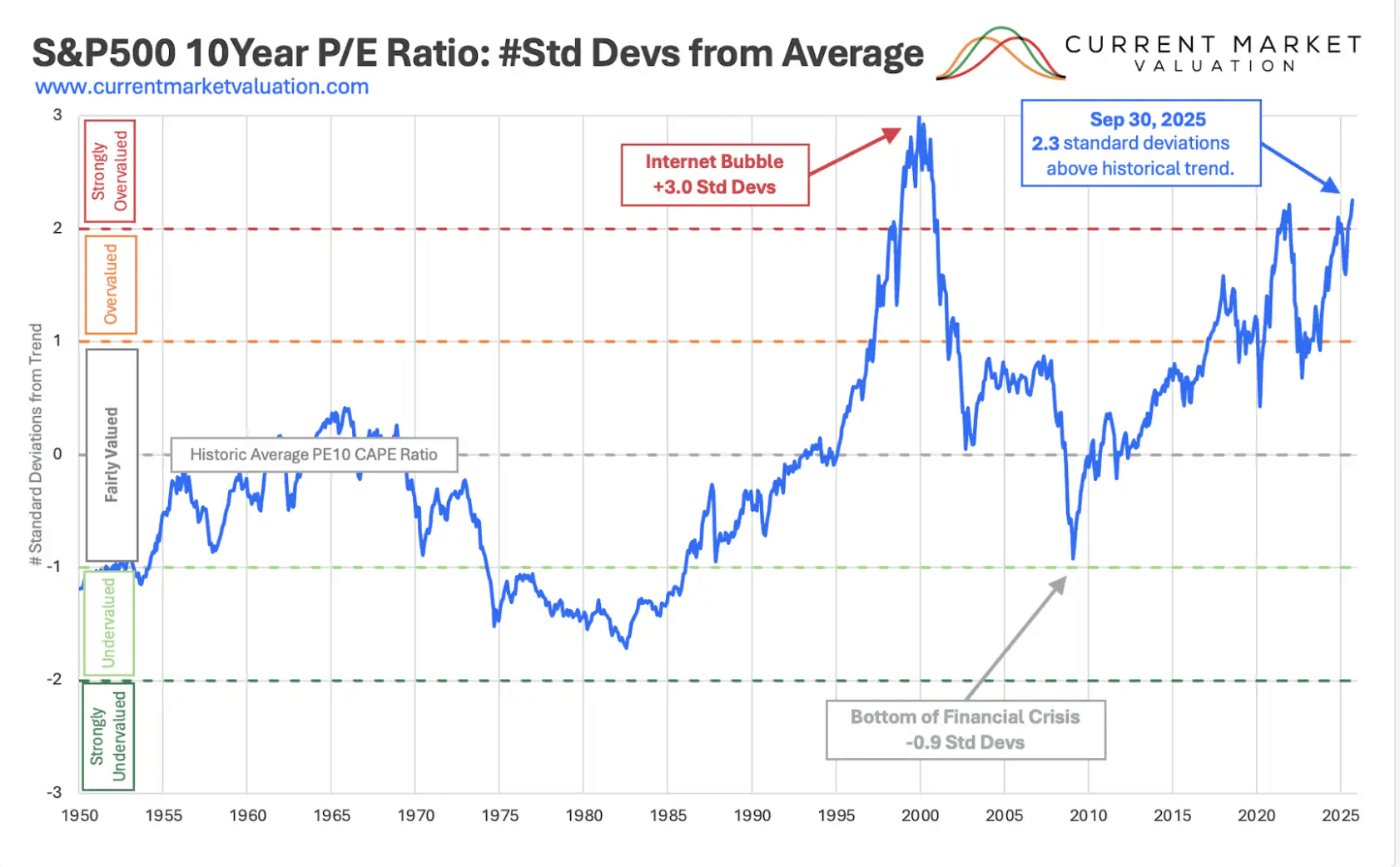

Let's talk about what you're actually paying for this rally. The S&P 500's P/E ratio sits at 27.83, roughly 90% above its modern-era average according to some measures. The Shiller P/E10? A cool 38.9—a level that's only been higher about 1% of the time in market history.

These aren't "growth at a reasonable price" multiples. These are "priced for perfection with a side of delusion" multiples.

And that's before we factor in what happens when institutional money returns. Right now, the market's levitating on systematic flows and the absence of sellers. The second week of January typically marks the return of full institutional participation—real money with real mandates to rebalance, derisk, and lock in gains from a monster 2025.

If you think those guys are showing up to chase stocks at 28x earnings after a 17% annual gain, I have a bridge in Brooklyn to sell you.

The Algo Mirage

Here's where it gets properly dystopian. The market isn't even human anymore.

High-frequency trading algorithms dominate thin-liquidity sessions. These systems provide liquidity when it's profitable—and vanish the instant it's not. They're programmed to pull back during uncertainty, creating what one analyst perfectly termed a "liquidity mirage." The market looks stable until a real order hits. Then the algos disappear, bids evaporate, and prices collapse into the void.

We saw this playbook in the 2010 Flash Crash. We saw it in December 2018 when the market lost 9% in a liquidity vacuum. And we're seeing the setup again right now.

The difference? This time there's even less human oversight. More zero-day options. More gamma hedging. More mechanical flows that amplify rather than dampen swings. When the reversal comes—and it will—it won't be gradual. It'll be a gap down that traps everyone at once.

What Comes Next

The macro setup couldn't be more contradictory. Q3 GDP printed at 4.3%—strong growth. But Core PCE remains sticky at 2.9%, meaning the Fed's still in "higher for longer" territory despite the December rate cut.

The bond market sees the trap. Yields aren't behaving like we're heading into a soft landing—they're behaving like we're heading into a stagflationary mess where growth slows but inflation persists.

Meanwhile, breadth is deteriorating. The rally has narrowed back into the Magnificent 7 and a handful of AI plays. Small caps tried to squeeze higher in late December and failed. The Russell 2000's "January Effect" pop already fizzled.

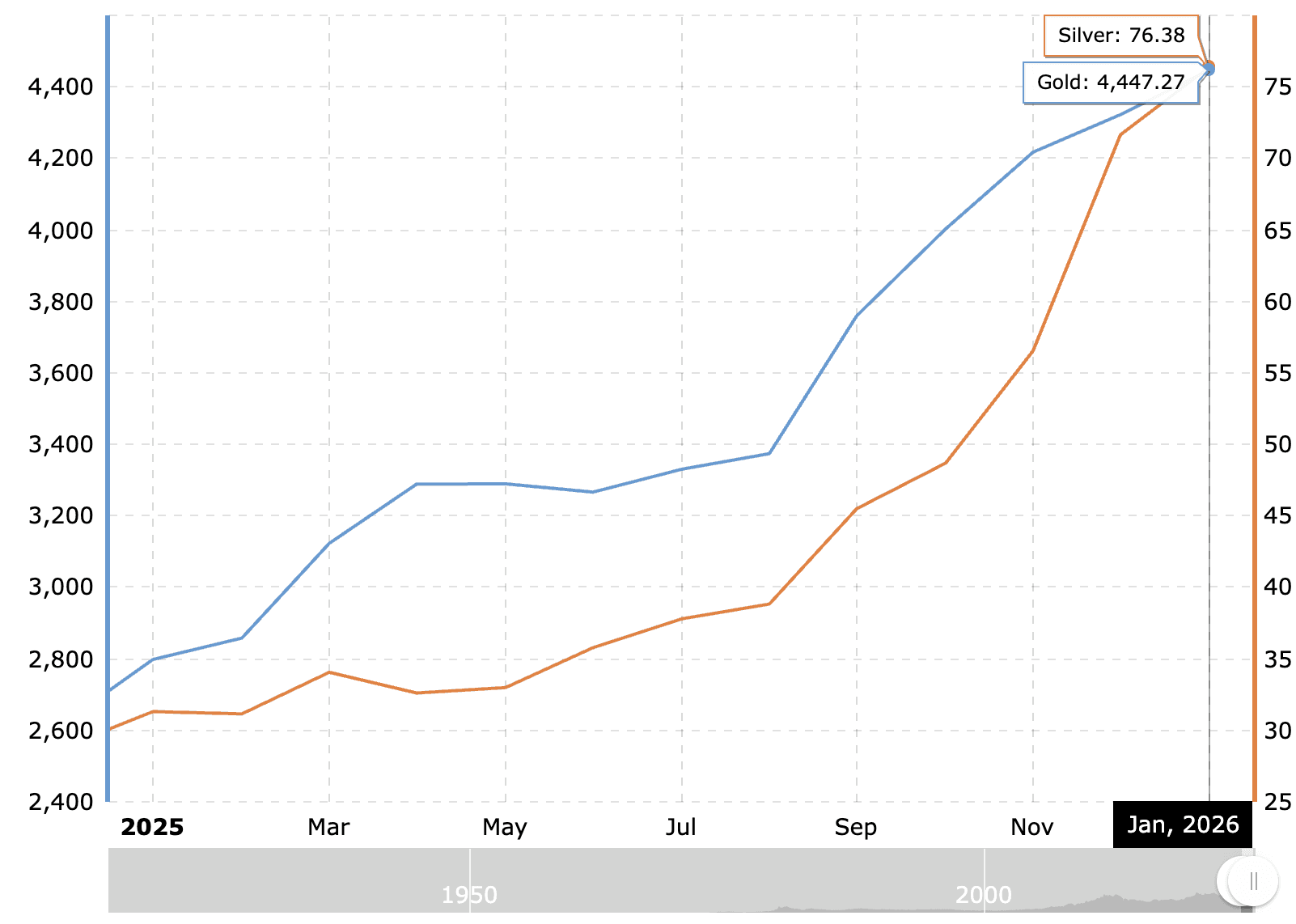

Gold's at $4,500, not because of rates but because of geopolitics and hedging demand. Silver just ripped 40% in a month on physical shortages—not enthusiasm, stress.

These aren't signs of a healthy risk-on environment. These are warning shots.

The January Barometer Lie

Oh, and let's not forget the "January Barometer"—the idea that "as goes January, so goes the year."

It's 77% accurate! Except when you dig deeper, you realize it's basically a coin flip when January is negative—only 54% predictive of negative years. The stat works primarily in one direction: up. Which tells you nothing except that markets tend to go up most of the time anyway.

So when someone breathlessly tells you January's action predicts 2026, ask them how their crystal ball did in 2022. Or 2018. Or any year where the macro narrative shifted mid-stream and January's signal became worthless noise.

The Trade Nobody's Talking About

Here's the real risk: a violent rotation out of consensus.

If the first two weeks of January see institutions returning and immediately taking profits—rebalancing portfolios after a 17% 2025 gain—you'll get a "mean reversion" so fast retail won't know what hit them. The December gains built on no volume will be surrendered on high volume. Small caps that rallied on fumes will get hammered. Overleveraged momentum trades will unwind in hours, not days.

And then? Then we get to see if the S&P 500's 50-day moving average around 6,815 holds. If it doesn't, we're looking at a test of the 200-day around 6,700. Below that, all bets are off.

But here's the kicker: even if we bounce, it won't be on conviction. It'll be on dip-buying habit and systematic rebalancing. The same mechanical flows that levitated prices in December will try to catch the knife in January. Whether they succeed depends entirely on how fast liquidity drains once fear takes over.

The Bottom Line

January rallies aren't bullish signals anymore. They're liquidity illusions built on holiday-thin volume, stretched valuations, and algorithmic vapor. The January Effect is dead, front-run into oblivion. The January Barometer is statistically meaningless. And the current setup—low VIX, record highs, collapsing volume—is textbook late-cycle fragility.

Does this mean you sell everything? Not necessarily. But it absolutely means you stop confusing seasonal noise for structural strength. It means you recognize that the market you're watching is 70% machine, 30% human, and 100% capable of turning on a dime when liquidity evaporates.

The liquidity mirage works until it doesn't. And when it breaks, it breaks fast. January might surprise to the upside—stranger things have happened—but betting your portfolio on a folklore-driven rally in the most overvalued, overleveraged, algorithmically-dominated market in history?

That's not investing. That's gambling. And the house edge just got a lot steeper.

Watch the volume. Watch the breadth. And for god's sake, watch the exits.

NEVER MISS A THING!

Subscribe and get freshly baked articles. Join the community!

Join the newsletter to receive the latest updates in your inbox.