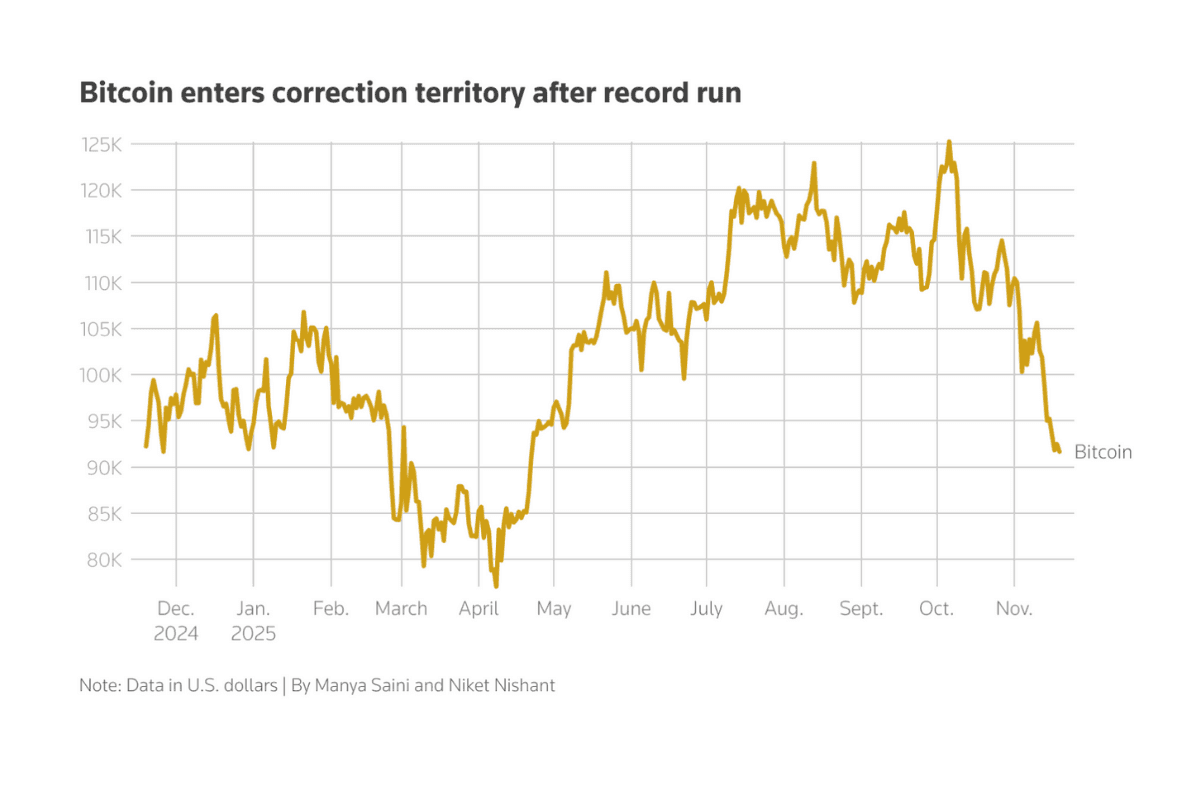

October's euphoria feels like a distant memory. Bitcoin kissed $126,000 in early October, a new all-time high that had maximalists screaming vindication and institutional money managers updating their year-end targets to $200,000. Fast forward eight weeks and BTC is trading around $94,000—down nearly 26% from that peak and stuck in a downward grind that's starting to feel uncomfortably familiar to anyone who lived through 2022.

The question isn't whether Bitcoin will recover. It always does, until it doesn't. The question is what's actually breaking under the surface this time—and why the narrative that carried BTC through 2024 is quietly unraveling as we close out 2025.

The ETF Honeymoon Is Over

Remember when spot Bitcoin ETFs were going to change everything? The approval in January 2024 was supposed to be the institutional holy grail—finally, a vehicle for pension funds, RIAs, and boomers who couldn't be bothered with Coinbase accounts. For most of 2024, that story held. BlackRock's IBIT alone pulled in $50+ billion in its first year, making it one of the most successful ETF launches in history.

Then October happened. And the flows reversed.

BlackRock's flagship Bitcoin ETF has now logged six straight weeks of net outflows through early December, shedding more than $2.7 billion. IBIT isn't alone—total US spot Bitcoin ETF assets have crashed back to December 2024 levels, wiping out a year's worth of growth in just two months. From a peak of $169 billion in October, assets under management have plunged to roughly $121 billion.

The culprit? Not panic selling from retail. It's worse: institutional positioning unwinds. Analysis from Amberdata suggests much of the $4 billion in outflows since October came from "basis trade" closures—arbitrage strategies where funds bought spot ETFs and shorted futures to capture the spread. When that trade broke, capital fled systematically, not emotionally.

Translation: the smart money that piled in during 2024 just took profits and walked. What's left are the true believers and the bag holders.

The Digital Asset Treasury Ponzi Unravels

If ETF outflows are the symptom, the collapse of the digital asset treasury (DAT) model is the disease. These are the MicroStrategy copycats—publicly traded companies that pivoted from actual business to "we buy Bitcoin with leverage and hope the stock trades at a premium to our holdings."

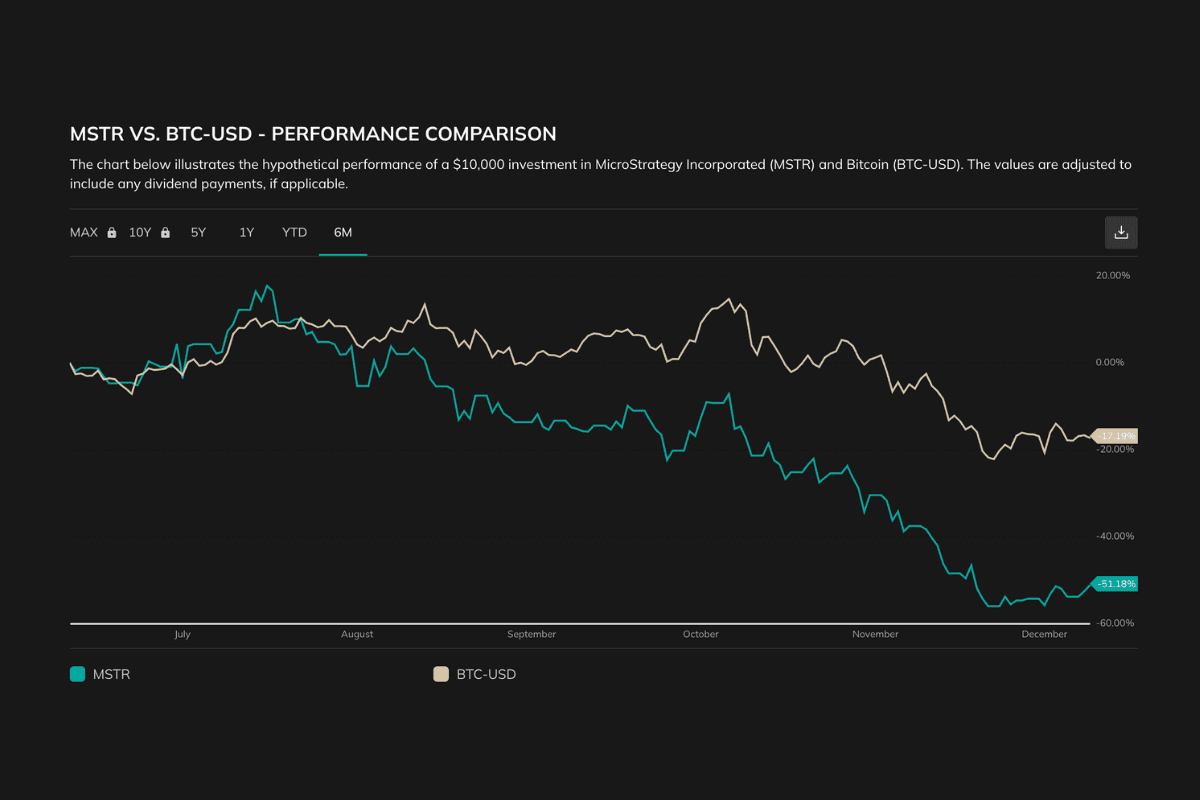

For a while, it worked. Strategy (formerly MicroStrategy) pioneered the model and briefly traded at 2.5-3x the value of its Bitcoin stack. Investors weren't buying software—they were buying leveraged BTC exposure with a premium tacked on for Michael Saylor's charisma.

That premium is gone. Strategy shares have cratered 60% since July, falling from $456 to $186 by late November. The company now trades below the net asset value of its Bitcoin holdings for the first time since early 2024. Standard Chartered, which previously had a $500,000 price target for 2028, just slashed its outlook to $100,000 for year-end 2025 and pushed that half-million target to 2030.

Why? Because the entire model depended on DAT companies continuously raising capital at premium valuations to buy more Bitcoin, which would push the stock higher, which would justify more capital raises. It's a reflexive loop that works beautifully in a bull market and collapses spectacularly when it reverses.

Now institutional investors like BlackRock, Vanguard, and JPMorgan are dumping Strategy shares, shedding $5.4 billion in Q3 alone. JPMorgan is warning that Strategy could be kicked out of major equity indices, including the MSCI USA Index, because it holds more than 50% of assets in digital currencies. If that happens, another $9 billion in forced selling could hit the market as passive index funds mechanically dump the stock.

The smaller DAT wannabes? Some are already buying back their own shares just to keep stock prices from collapsing below their Bitcoin holdings' value. Others, like ETHZilla and FG Nexus, have sold chunks of their crypto stacks to prop up plunging valuations. This is how Ponzi dynamics end: with desperate measures and forced liquidations.

The Fed Pivot That Wasn't

Bitcoin was supposed to love rate cuts. Lower borrowing costs, weaker dollar, more liquidity sloshing into risk assets—the macro setup looked perfect heading into Q4.

The Fed did cut rates in September and November, dropping the fed funds rate from 5.5% to 4.5%. Bitcoin rallied initially, surging past $108,000 in mid-December on hopes of continued easing. Then Jerome Powell opened his mouth.

At the December FOMC meeting, Powell made it clear: the Fed cannot and will not hold Bitcoin without congressional authorization. He compared it to gold—a store of value, not a currency. That distinction matters. It reinforces that BTC isn't becoming part of the monetary system; it's a speculative asset that competes with bonds and equities for capital.

Worse, Powell signaled a "hawkish pause" on further cuts, delaying the expected December reduction. Markets immediately repriced. Bitcoin dropped 11% in the week following Powell's comments, briefly touching $80,000 before stabilizing in the low $90,000s.

The correlation is undeniable: Bitcoin moves with global liquidity conditions, not fundamentals. When M2 money supply expands, BTC rises. When it contracts, BTC falls. The Fed pivot narrative worked as long as cuts kept coming. Now? The macro tailwind is gone, replaced by a slog through tighter-than-expected policy into 2026.

December's Historically Grim Pattern

Here's the part Bitcoin bulls don't want to talk about: December is statistically bearish for BTC. Over the last 12 years, December has closed positive only five times. The median performance for the month is a -3.2% decline.

Worse, every year since 2013 when November closed in the red, December followed suit. November 2024? Down 21% in the last 30 days. If that pattern holds, December could be another disappointment rather than a Santa rally.

The current price action supports this. Bitcoin is trapped between $86,000 support and $100,000 resistance, grinding sideways while bulls hope for a year-end surge that historically doesn't materialize. Technical analysts are watching $86,000 closely—lose that level and the next stop is $80,000 or lower.

What Happens Next

The bull case isn't dead. Bitcoin always recovers. The four-year halving cycle suggests 2025 should be bullish, and on-chain data still shows strong accumulation with exchange balances declining. If ETF flows turn positive again and macro conditions stabilize, BTC could easily reclaim $100,000+ by Q1 2026.

But the Q4 2025 selloff exposed structural weaknesses that weren't supposed to exist. ETF demand was supposed to be sticky institutional capital, not hot money chasing basis trades. Digital asset treasury companies were supposed to create permanent Bitcoin buyers, not leveraged speculators vulnerable to forced liquidations. Rate cuts were supposed to juice risk assets, not get walked back by a hawkish Fed.

The narrative that carried Bitcoin through 2024—mainstream adoption, institutional acceptance, macro tailwinds—is fraying. What's left is the same volatility, the same speculative flows, and the same painful reminder that BTC is a risk asset first and "digital gold" second.

December will tell us whether this is just a healthy mid-cycle correction or something more structurally concerning. Either way, the party that started in October is definitively over. Now comes the hangover.

NEVER MISS A THING!

Subscribe and get freshly baked articles. Join the community!

Join the newsletter to receive the latest updates in your inbox.