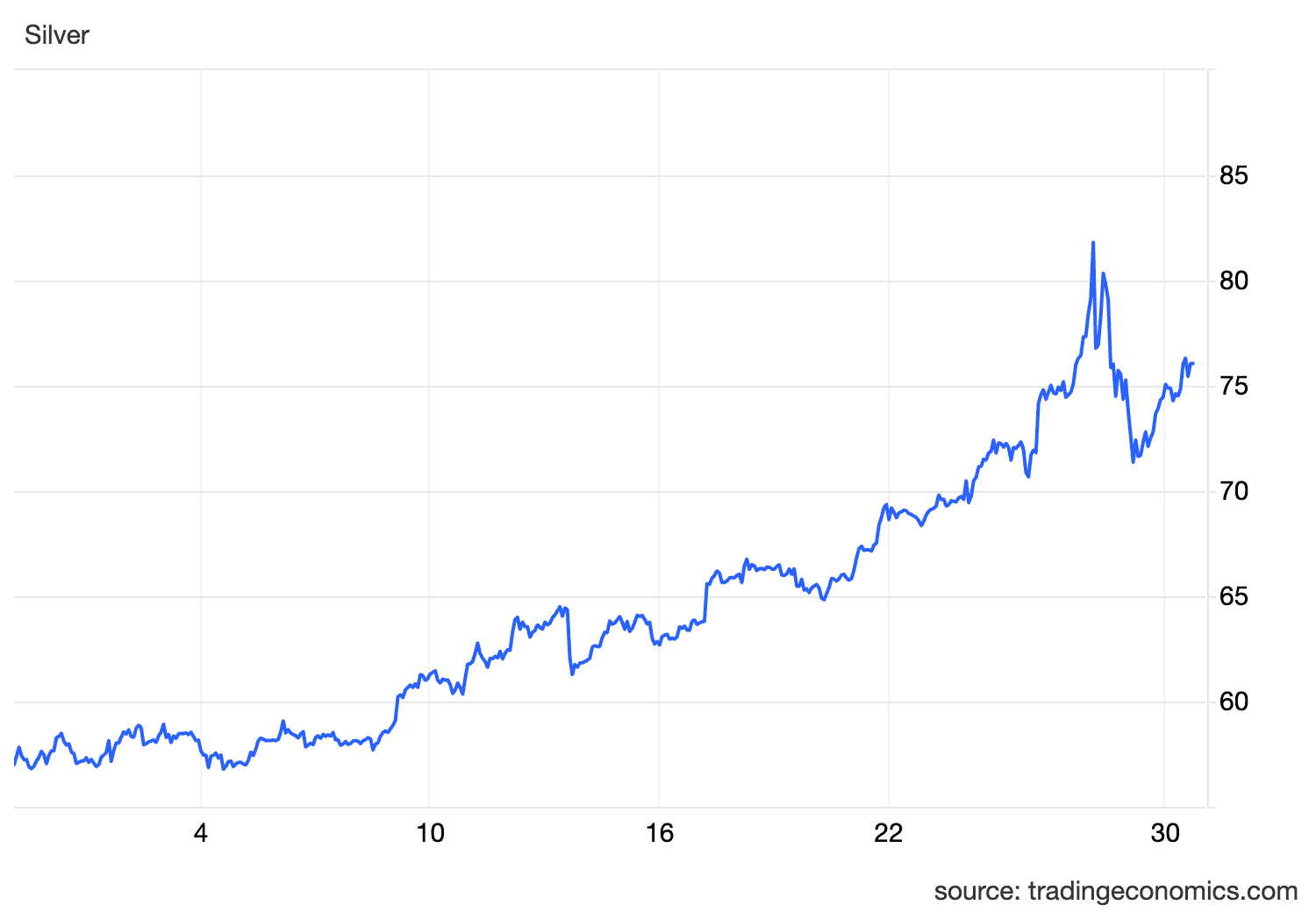

Silver just pulled off something that hadn't happened in 45 years—and then, in spectacular fashion, reminded everyone why it's called the "devil's metal."

On December 28, 2025, silver hit an all-time high of $83.90 per ounce, shattering the 1980 record that had stood for more than four decades. Hours later, it crashed 14% intraday to $70 in one of the largest single-day reversals in the metal's history.

Even after the violent pullback, silver is up 160% for 2025—tripling gold's 73% gain and obliterating the S&P 500's 18% return. It's the best annual performance for silver since 1979, driven by a toxic combination of supply deficits, industrial demand shocks, and monetary debasement fears that finally broke the metal out of its multi-decade consolidation pattern.

So is silver going higher? Or did we just witness the blowoff top that marks the end of the run?

The Rally That Broke Every Rule

Let's start with what actually happened. Silver entered 2025 trading around $30 per ounce—respectable but unremarkable. By October, it broke through its 2011 high of $49.95, a level it had tested and failed at for more than a decade.

Then things got interesting.

Key milestones in silver's 2025 surge:

October 9: First breakthrough above the 2011 peak of $49.95

November 28: Breakout accelerated following a 10-hour COMEX trading shutdown

December 10: Silver crossed $60 after the Fed cut rates by 25 basis points

December 23: Blasted through $70 as the dollar weakened and geopolitical tensions escalated

December 28: Hit the all-time high of $83.90 before the wheels came off

The move wasn't just fast—it was parabolic on monthly charts, with momentum indicators screaming overbought for months. Traditionally, that's when traders start looking for exits. But silver kept climbing, burning shorts and sidelining value buyers who kept waiting for "the pullback" that never came.

Until it did.

The Crash: CME Margin Hikes Meet FOMO Mania

On December 29, reality hit like a freight train. Silver plummeted from $83.62 to as low as $70—a 16% intraday swing that wiped out weeks of gains in hours.

The catalyst? The CME Group raised margin requirements for March 2026 silver futures from $22,000 to $25,000 per contract—a 13.6% increase that marked the second hike in two weeks. For leveraged traders, that meant either posting more cash immediately or liquidating positions. Most chose the latter.

What triggered the crash:

CME margin hike: Raised collateral requirements by $675 million across the market

Forced deleveraging: Traders had to sell to meet new capital requirements

Thin holiday liquidity: Lower trading volumes amplified price swings

Profit-taking tsunami: After a 160% gain, institutional players locked in "generational profits" before year-end

The move drew immediate comparisons to "Silver Thursday" in 1980, when the Hunt Brothers' attempt to corner the silver market collapsed spectacularly. This time, there was no market manipulation—just momentum running headfirst into exchange rules designed to prevent exactly that kind of blowup.

Even Robert Kiyosaki, who had predicted $200 silver for 2026, pumped the brakes: "I love silver... but this looks like FOMO mania. Wait for a crash then GO or NO."

The crash came faster than anyone expected.

The Supply Deficit No One's Talking About

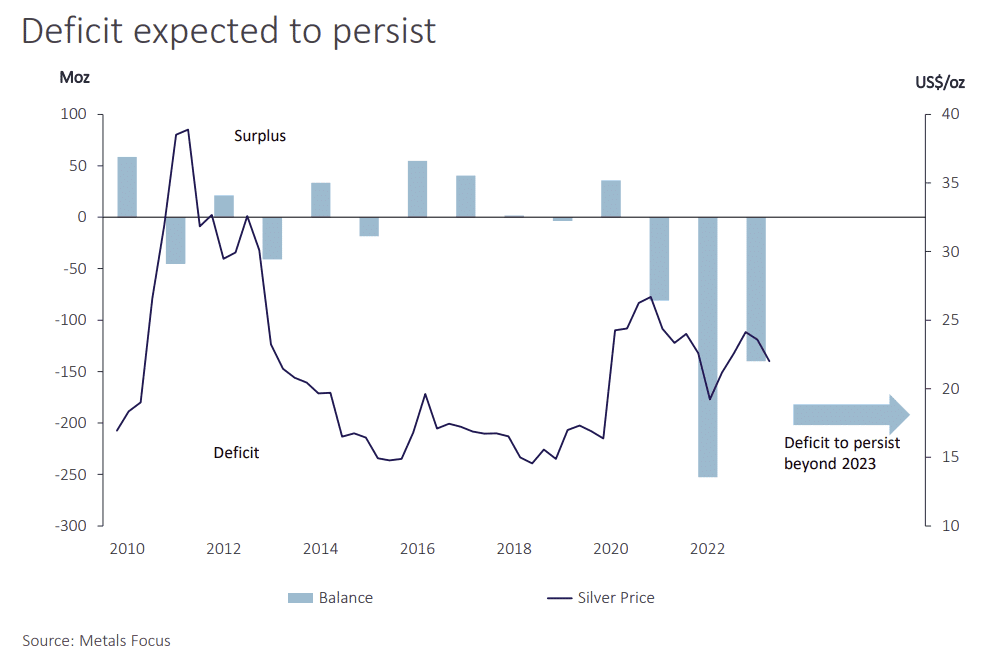

Here's what didn't change during the volatility: silver's fundamental supply-demand imbalance remains brutally tight.

Silver has been in deficit for five consecutive years, with 2025's shortfall projected at 117.6 million ounces. Cumulatively, the world has consumed nearly 800 million ounces more than it produced since 2021—equivalent to about 10 months of total mine output.

Why supply can't catch up:

Silver is a byproduct: 72% of silver comes from mining other metals like copper, lead, and zinc

Mine production has declined: Down 7% since 2016 despite higher prices

New projects take forever: Average timeline is 8.5 years from discovery to production

Permitting hell: Mining jurisdictions now average 7-10 years for approvals

When you're producing a metal mostly as a side effect of mining something else, price signals don't work the way they should. Copper miners don't ramp up because silver hit $80—they ramp up if copper demand justifies it. Silver supply comes along for the ride, or it doesn't.

Meanwhile, above-ground inventories are declining from historical peaks as consumption accelerates. The market isn't just tight—it's getting tighter.

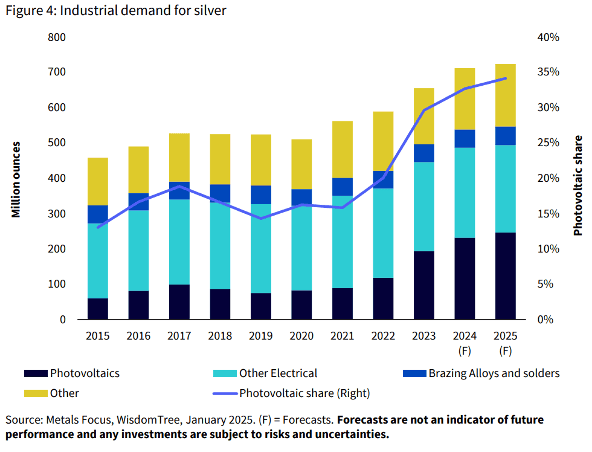

Industrial Demand: The Engine That Won't Quit

Silver isn't just a monetary metal anymore. It's become mission-critical infrastructure for the energy transition and AI buildout, with industrial demand now representing 59% of total consumption—up from 50% a decade ago.

Where the demand is coming from:

Solar power (the biggest driver)

Solar accounts for 14% of global silver demand in 2025, up from 5% in 2014

New TOPCon solar cells require up to 50% more silver than traditional panels

Solar demand jumped 25% in 2024 and could exceed 300 million ounces annually by 2030

China's $10 billion solar subsidy is projected to boost silver consumption by 5%

Electric vehicles (the sleeper demand shock)

EVs use 25-50 grams of silver per vehicle—67-79% more than gas-powered cars

EV silver demand is growing at 3.4% annually through 2031

EVs will overtake internal combustion as the primary source of automotive silver demand by 2027

Charging infrastructure adds parallel demand that compounds the effect

Data centers and AI (the new wildcard)

IT power capacity increased 53 times from 2000 to 2025

Silver used in computing hardware, servers, and AI systems

Electronics and electrical sector consumed 445.1 million ounces in 2023—a 20% year-over-year increase

This isn't speculative demand that disappears when sentiment sours. It's structural consumption driven by global decarbonization goals and technological infrastructure buildout. The University of New South Wales warns that solar industry growth could exhaust 85-98% of global silver reserves by 2050.

That's not a forecast. That's a countdown timer.

China's Physical Shortage: The Canary in the Coal Mine

While Western traders were getting margin-called, something more ominous was happening in China. Chinese spot and futures markets traded at persistent premiums to London and COMEX benchmarks, with some contracts briefly moving into backwardation—a sign of immediate supply stress.

China accounts for more than half of global industrial silver demand, making local shortages a global problem. The pressure comes from multiple sources:

Solar manufacturing: Still the largest driver of Chinese silver demand

EV production: Continuing to rise despite broader economic headwinds

Electronics: Consumer demand for phones, tablets, and AI-related devices

When the world's factory can't source enough physical metal, paper price crashes become academic. The divergence between COMEX paper prices and Chinese physical premiums suggests the real tightness is in actual metal, not futures contracts.

What Wall Street Is Forecasting for 2026

Despite the year-end volatility, analyst forecasts for 2026 remain aggressively bullish. The crash didn't change the fundamentals—it just reset positioning.

Major bank targets for 2026:

Bank of America: $65 per ounce average, with peaks potentially higher

BNP Paribas: As high as $100 per ounce by end of 2026

UBS: $85-$100 average for the year, viewing silver as the "primary strategic metal of the green transition"

Standard Chartered: Targeting $95, expecting continued outperformance versus gold

The consensus average for 2026 sits around $97 per ounce, with a range of $65-$100 and high-end outliers reaching $200.

Even after the crash, 57% of retail investors expect silver to trade above $100 in 2026, according to Kitco News polling.

Technical targets paint an even wilder picture:

$100: First major psychological resistance and likely 2026 test

$250-$300: Long-term projections based on cup-and-handle pattern breakout

$200: Robert Kiyosaki's 2026 target, viewing silver as wealth preservation against dollar debasement

The bears argue these targets are delusional. The bulls counter that two years ago, $80 silver sounded equally insane.

The Monetary Backdrop: Why Silver Benefits from Fed Chaos

Silver's 2025 run coincided with three Fed rate cuts and the quiet return of balance sheet expansion. While Fed Chair Powell insists the Fed's bond purchases are purely "technical operations," markets aren't buying it.

The Fed is effectively running stealth QE through its Repo Market Program, expanding its balance sheet while claiming it's not easing policy. The dollar index has dropped below 99, and real yields remain suppressed despite the hawkish rhetoric.

Monetary factors supporting silver:

Weakening dollar: Makes dollar-denominated silver cheaper for international buyers

Negative real yields: When inflation exceeds interest rates, hard assets benefit

Central bank buying: While focused on gold, spillover effects boost silver

Currency debasement trade: Countries with low debt (Sweden, Switzerland) see currencies moving with precious metals

As Robin Brooks of Brookings Institution noted, the "debasement trade" roared back after Powell's dovish Jackson Hole speech in August. With U.S. debt approaching unsustainable levels, investors increasingly fear governments will inflate their way out of the problem rather than implement austerity.

Silver benefits from that fear.

The Case for Higher Prices

Strip away the volatility and you're left with a setup that looks structurally bullish:

Supply side:

Five years of consecutive deficits with no end in sight

Mine production declining despite record prices

Above-ground inventories depleting

Demand side:

Industrial consumption growing at 3-4% annually

Solar and EV adoption accelerating globally

AI infrastructure requiring more silver-intensive hardware

Investment demand recovering as ETFs see inflows

Macro backdrop:

Fed easing cycle intact despite hawkish rhetoric

Dollar weakness making metals attractive

Geopolitical tensions supporting safe-haven flows

Inflation concerns driving hard asset allocation

The gold-to-silver ratio has collapsed, signaling silver's leadership phase within the metals complex. Historically, when silver breaks out relative to gold, the moves are violent and sustained.

The Case for Lower Prices

But there's a bear case, and it's not trivial:

Valuation stretched:

160% annual gain creates profit-taking pressure

Momentum indicators remain in extreme overbought territory

Speculative positioning crowded after year-end flush

Demand risks:

Industrial demand could slow if global growth weakens

Solar manufacturers finding substitutes or reducing silver content per panel ("thrifting")

EV adoption could plateau if subsidies roll back

Macro headwinds:

If Fed hikes instead of cuts in 2026, real yields rise

Higher yields make bonds competitive with non-yielding metals

Manufacturing slowdown reduces industrial consumption

Technical damage:

Margin-driven crash created momentum reversal

Key support at $70-$75 now needs to hold

Failure below $70 could trigger cascade to $60

The volatility alone will scare off risk-averse capital. Silver's historical volatility is roughly double gold's, making it unsuitable for conservative portfolios.

So Is Silver Going Higher?

The honest answer: probably, but not in a straight line.

The year-end crash was a forced deleveraging event, not a fundamental breakdown. Silver didn't crash because solar demand disappeared or mine supply surged—it crashed because the CME changed the rules and overleveraged traders got liquidated.

Those are the conditions that create buying opportunities, not sell signals.

What to watch in 2026:

Support levels: Can silver hold above $70-$75? Break below signals deeper correction

Industrial data: Are solar installations and EV production maintaining growth?

Fed policy: More cuts support metals; surprise hikes would be bearish

China physical premium: Persistent backwardation signals real tightness

Speculative positioning: CFTC data shows whether momentum traders are rebuilding longs

The supply deficit isn't going away. Industrial demand isn't collapsing. The monetary environment remains supportive. And the technical breakout from a 40-year consolidation pattern suggests the structural repricing has only begun.

But if you're buying here, understand what you're signing up for. Silver moves in violent, gut-wrenching swings that will test your conviction and your risk tolerance. The path to $100 won't be smooth—it'll be a series of 20% rallies followed by 15% crashes that shake out weak hands at every stage.

The Takeaway: Volatility Is the Price of Admission

Silver just reminded everyone why it's both the most hated and most loved metal on the planet. It delivered a 160% gain, broke a 45-year record, then crashed 14% in hours—all while the fundamental case for higher prices got stronger.

That's not a bug. It's a feature.

If you can't handle the volatility, silver isn't for you. Stick with gold, bonds, or index funds. But if you believe the supply deficit is real, industrial demand is structural, and monetary debasement is accelerating, then silver offers asymmetric upside that few assets can match.

Just don't bet the farm. And don't use leverage. The CME will change the rules when you least expect it.

NEVER MISS A THING!

Subscribe and get freshly baked articles. Join the community!

Join the newsletter to receive the latest updates in your inbox.