If you're still running the same portfolio allocation you had in 2023, you're probably making a mistake. Not because the world has changed (though it has) but because the math underneath your holdings has fundamentally shifted in ways most investors haven't processed yet.

Let's start with what actually happened over the past three years, because the numbers tell a story that contradicts almost every consensus narrative you heard along the way.

The Great Divergence: Three Years of Data That Nobody Talks About

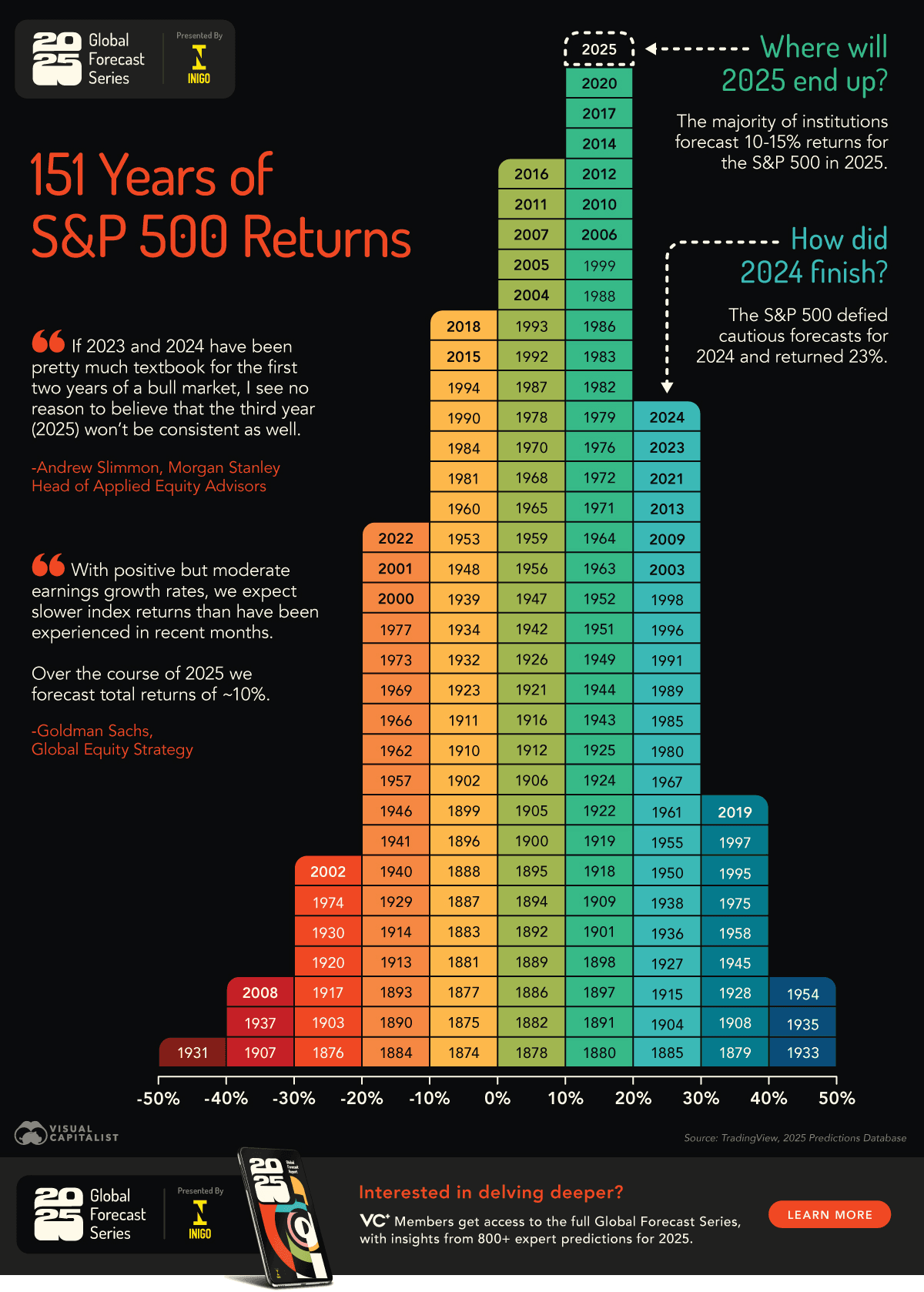

The S&P 500 climbed 53% from 2023 through 2025, posting returns of +26%, +25%, and roughly +25% year-over-year. That's three consecutive years of 20%+ gains—a feat that's only occurred 14.6% of the time since 1874.

Meanwhile, emerging markets? The MSCI EM Index delivered +10%, +8%, and +33% over the same period—cumulatively underperforming the S&P by roughly 20 percentage points. China's CSI 300 gained just 13% year-over-year despite massive stimulus, trading at a P/E of 14.9x while U.S. stocks sit at 29x.

Bonds? The 10-year Treasury yield swung from 3.88% at the start of 2023 to 5.00% by October 2023, back down to 3.80% in late 2024, and now hovers around 4.18%—delivering negative returns in 2022-2023 before modest recovery. Anyone who bought duration in early 2023 got crushed. Anyone who stayed short missed the rally.

This isn't a market. It's three different markets wearing a trench coat.

Valuation Reality Check: We're Not in Kansas Anymore

Here's the uncomfortable truth the cheerleaders won't tell you: the Magnificent 7 now represent 34% of S&P 500 market cap but only generate 27% of earnings. That's a bigger divergence than existed at the peak of the dot-com bubble.

The aggregate S&P 500 trades at a forward P/E of 22.5x—elevated but not insane. Strip out the Mag 7? You're looking at 20.3x for the other 493 stocks. Still rich by historical standards (10-year average is 18.6x), but not catastrophically so.

But here's where it gets interesting: only 28% of stocks beat the S&P 500 in 2024, making it the second-narrowest market since 1995. The last time concentration was this extreme? 1998-1999. We all remember how that ended.

The top 10 companies account for 39% of index weight vs. 27% at the 2000 peak

Technology sector P/E sits at a 23% premium to 10-year average

Magnificent 7 trade at 31x vs. 21x for the rest of the market—but they're actually generating the earnings to justify it (unlike 2000)

This is critical: today's concentration is expensive, but it's backed by real profit margins in the mid-20s and actual revenue growth of 14% annually. The 2000 analog had neither.

What 2026 Actually Looks Like (According to People Who Get Paid to Be Right)

The consensus from Morgan Stanley, J.P. Morgan, Goldman Sachs, and Schwab breaks down like this:

U.S. Growth: Moderate 1.8-2.5% GDP. Not recessionary, but certainly not robust. J.P. Morgan puts recession odds at 35%—low but not negligible.

Inflation: Sticky around 2.6-3.0% core PCE through year-end 2026. The 2% target? Forget about it. Tariffs, labor constraints, and services inflation create a floor.

Fed Policy: Another 50-75 basis points of cuts expected, bringing rates to 3.25-3.50% by late 2026. But here's the kicker: with inflation at 3%, real rates stay barely positive—not exactly restrictive.

Earnings: S&P 500 EPS growth of ~8-11% in 2026 vs. 20% for the Magnificent 7. The performance gap is structural, not cyclical.

International: Europe muddles through at 1.1-1.3% growth. China front-loads stimulus for 5% Q1 growth before slowing. Emerging markets ex-China trend at 3.3%—respectable but uninspiring.

The base case isn't catastrophic. It's just... mediocre. And mediocre at stretched valuations is a recipe for flat returns.

The Strategic Framework: Where to Actually Put Money

Forget the 60/40 portfolio. That died when bonds and stocks started moving together in 2022. Here's what actually makes sense given the data:

Equities: 50-55% (But Not Where You Think)

The S&P 500 can grind higher—maybe 6-8% total return—but you're paying top dollar for modest growth. The play isn't abandoning U.S. stocks; it's being selective about which U.S. stocks.

Mag 7 exposure: 10-15% maximum. They'll probably keep working, but at 31x forward earnings, the risk/reward has shifted. One earnings miss and you're down 15% in a day.

Equal-weight S&P or S&P 493: 20-25%. These trade at 20.3x vs. the cap-weighted index at 22.5x. You get broad U.S. exposure without concentration risk.

International developed: 15-20%. Europe trades at a discount to U.S. and benefits if Trump's tariff focus stays on China. Think German industrials, European pharma.

Emerging markets: 10-12%, but selective. Avoid broad EM. Focus on India (structural growth story), Vietnam (China+1 beneficiary), and select Latin America such as Argentina. China is un-investable until policy clarity emerges.

Fixed Income: 25-30% (Finally Worth Owning Again)

With yields at 4-4.5% and the Fed cutting, bonds actually offer real return potential for the first time since 2019. Schwab projects solid returns in 2026 driven by central bank easing.

Investment-grade corporates: 15%. Spread at 110bps by year-end per J.P. Morgan. You're getting paid 5.5-6% to lend to Apple. Take it.

Short-duration Treasuries (2-5yr): 10%. Locks in 4%+ yields with limited duration risk. If recession hits, these rally. If inflation spikes, you're not stuck long.

Emerging market debt (hard currency): 5%. EM local markets benefit from lower macro volatility and fading tariff fears. Get 6-7% in dollar-denominated bonds from quality issuers.

Alternatives: 15-20% (The Anti-Correlation Sleeve)

This is where you protect against the scenarios that break the base case.

Gold: 5-8%. Already at $4,300/oz, but J.P. Morgan targets $4,753 and Goldman sees $5,000+. Central banks keep buying, real rates stay low, and fiscal dominance is the new regime.

Real assets/infrastructure: 5-7%. AI data centers, energy transition, reshoring beneficiaries. These have pricing power in a 3% inflation world.

Crypto momentum: 3-5%. Not buy-and-hold Bitcoin. Tactical exposure through systematic momentum strategies that rotate in and out based on trend strength. In a year where correlations shift weekly, momentum-based crypto strategies can capture upside while limiting drawdown risk.

Commodity exposure: 2-3%. Not oil (oversupplied), but industrial metals benefit from AI infrastructure build and any China stimulus.

Cash: 5-10% (Dry Powder)

At 4.5% in money markets, cash doesn't suck anymore. Keep enough to buy the dip when—not if—volatility spikes.

The Scenarios That Keep Strategists Up at Night

Base case is fine. But 2026 has meaningful tail risks in both directions:

Upside Scenario (20% probability): AI productivity breakthrough accelerates, Fed cuts more than expected, consumer spending stays resilient, markets rip another 15-20%. Your Mag 7 positions print, everything works.

Downside Scenario (25% probability): Tariffs hit harder than expected, inflation stays at 3.5%+, Fed can't cut, labor market cracks, mild recession. Equities down 12-15%, but bonds and gold rally hard.

Stagflation Scenario (15% probability): The nightmare. Inflation at 3.5-4%, growth at 1%, Fed paralyzed. Equities flat to down, bonds don't help, only gold and real assets work. This is the one that requires alternatives.

The portfolio above is built to survive all three and profit in two of them.

Why Automation Isn't Optional Anymore

Here's the problem with everything we just laid out: it requires constant monitoring and tactical rebalancing that most investors simply won't do. When China announces surprise stimulus at 2am EST, your allocation to EM needs to adjust. When the Fed pivots hawkish mid-quarter, your duration exposure needs recalibrating. When crypto momentum breaks down, you need to be out—not riding it to zero while telling yourself it's "long-term."

The reality is that 2026 isn't a set-it-and-forget-it environment. Markets are moving faster, correlations are breaking down more frequently, and the edge increasingly goes to whoever can react systematically rather than emotionally.

This is why automated, rules-based investing is becoming the baseline for serious portfolios—not a novelty for tech enthusiasts. The days of manually rebalancing quarterly and hoping for the best are over. You need strategies that execute automatically based on predefined rules, not your gut feeling after reading headlines.

We just launched two new crypto momentum strategies on Surmount specifically designed for this kind of environment—systematic approaches that rotate into crypto when momentum is strong and move to cash when it breaks. No emotions, no FOMO, no hoping the dip keeps dipping. Just rules-based execution that lets you capture the explosive moves in digital assets without the sleepless nights.

The point isn't that everyone needs crypto exposure. The point is that whatever exposure you choose—whether it's equal-weight equities, international markets, or tactical alternatives—it needs to be managed with discipline that humans reliably fail at.

What the Data Actually Tells You

Strip away the narrative and focus on the math: U.S. stocks have had an unprecedented three-year run powered by seven companies at valuations that aren't quite bubble territory but aren't exactly cheap either. The rest of the world is cheaper but faces structural headwinds. Bonds are investable again but won't save you if inflation spikes. Gold is expensive but central banks don't care.

The 60/40 portfolio averaged 10.7% annually in stocks and 5-6% in bonds from 1971-2024. In 2026, you're looking at maybe 7% in equities and 4% in bonds—call it 6% blended. That doesn't get you to retirement.

The solution isn't to take more risk. It's to take different risk with better execution. Equal-weight instead of cap-weight. International instead of only U.S. Investment-grade credit instead of Treasuries. Gold instead of hoping the Fed has your back. And systematic strategies instead of discretionary panic.

Because here's the reality nobody wants to say out loud: the era of passive indexing delivering 10%+ with minimal thought is over. The S&P 500 might keep grinding higher on the backs of seven stocks, but concentration risk at these levels is an accident waiting for a catalyst.

You don't need to predict the catalyst. You just need to not be completely exposed when it arrives. And you need systems in place that react faster than your emotions do.

NEVER MISS A THING!

Subscribe and get freshly baked articles. Join the community!

Join the newsletter to receive the latest updates in your inbox.