The dollar's slow-motion collapse isn't making headlines. It's buried in central bank purchase orders, BRICS summit communiqués, and the quiet hum of new payment rails being built outside Washington's control.

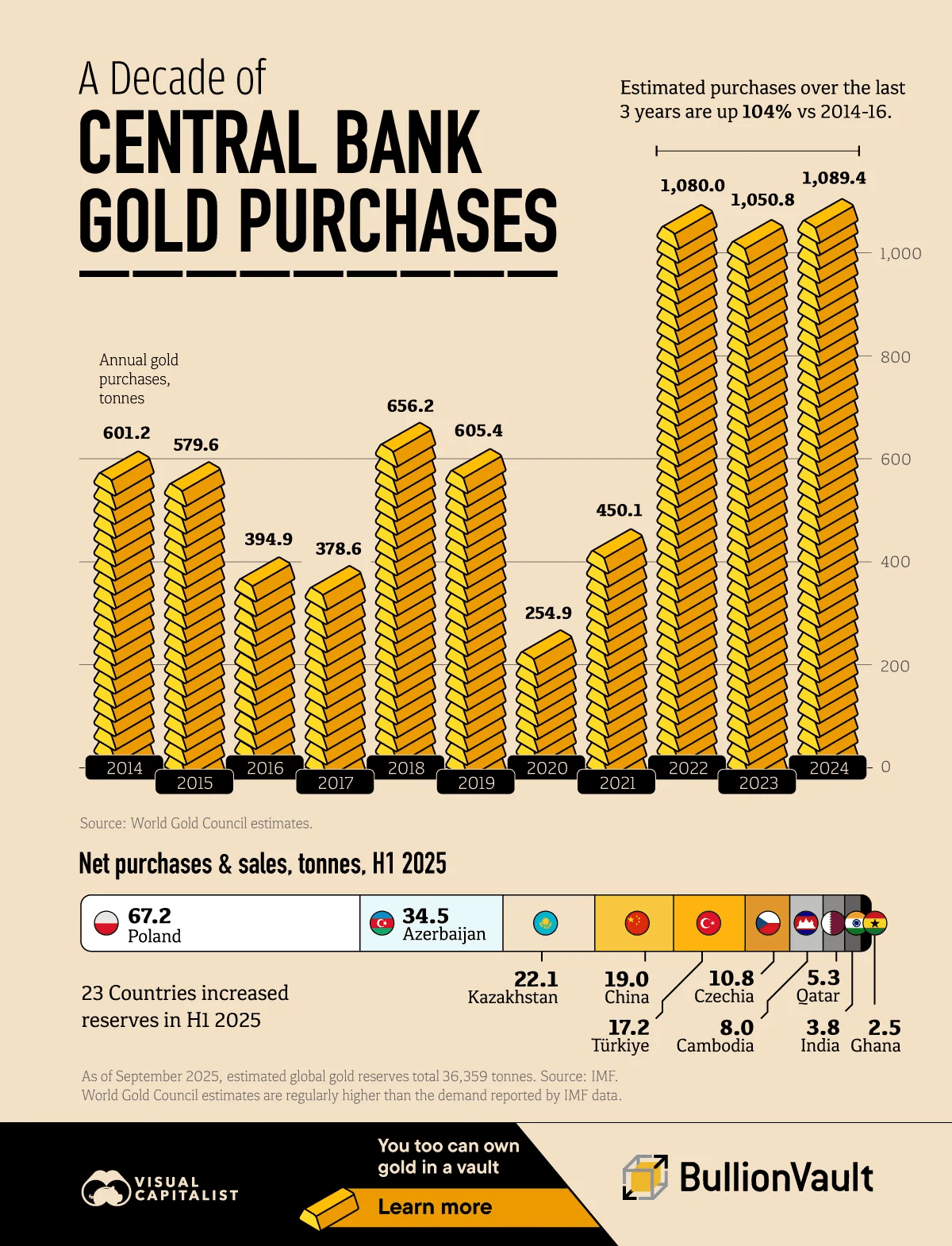

The dollar's share of global foreign exchange reserves has dropped to 57.4% as of Q3 2024—the lowest level since 1994. That's a slide of nearly 9 percentage points in just a decade. Meanwhile, central banks purchased over 1,000 metric tons of gold for the third consecutive year, with Poland, Turkey, and India leading the charge. When monetary authorities stockpile physical gold at record pace while their dollar holdings shrink, that's not portfolio rebalancing—that's a vote of no confidence.

The macro backdrop should terrify anyone paying attention:

U.S. debt-to-GDP has exploded from 35% in 1970 to 124% at the end of 2024

Congressional Budget Office projects it could hit 155% by 2055

The sheer scale of dollar creation required to service this debt mountain creates existential risk for reserve holders

Central banks get this. They're voting with their vaults.

BRICS Isn't Waiting for Permission

Forget the breathless headlines about a unified BRICS currency—that was always a distraction. The real story is operational infrastructure being built brick by brick. At the October 2024 BRICS summit in Kazan, members discussed BRICS Pay, a decentralized payment messaging system designed to facilitate transactions in local currencies. Think of it as a SWIFT alternative that doesn't route through New York clearing houses or give Treasury bureaucrats veto power over your international payments.

The numbers tell you everything:

In 2023, one-fifth of oil trades were conducted in non-dollar currencies—up from nearly zero a decade ago

Over 95% of trade between Russia and Iran now happens in rubles and rials

China's CIPS system now connects 4,800 banks across 185 countries

India opened special Vostro accounts allowing 22 countries to trade in rupees

These aren't pilot programs—they're live financial infrastructure supporting actual commerce.

The Gold Standard 2.0

Central banks aren't just diversifying away from dollars—they're running toward something specific. The 2022 freezing of $300 billion in Russian central bank assets sent shockwaves through the global financial system, forcing every finance ministry to ask: "Could this happen to us?"

The answer drove massive gold accumulation:

Poland's central bank added 90 tonnes in 2024, bringing its total to 497 tonnes

Czech Republic targeting 100 tonnes by 2028

Turkey has been a net buyer for 27 consecutive months

Central banks purchased 3,220.2 tonnes from 2022-2024—double the amount from 2014-2016

This isn't about inflation hedging or portfolio theory—it's about sanctions insurance. Gold held domestically can't be frozen by a Treasury Department lawyer with a phone call.

With global debt exceeding $300 trillion and persistent inflation above central bank targets, gold provides a hedge against currency debasement. But the real driver is geopolitical: when the U.S. weaponizes the dollar, it destroys trust in the system.

The Petrodollar Myth Unravels

Here's what nobody wants to admit: the petrodollar was always more myth than mechanism. There was no formal treaty requiring oil to be priced in dollars—just an informal 1974 understanding that worked because it worked. That consensus is fracturing in real time.

Saudi Arabia—the cornerstone of the petrodollar system—has been exploring yuan-denominated oil sales with China, its largest customer. The kingdom didn't "end" the petrodollar agreement in June 2024 (there was no formal agreement to end), but the writing's on the wall.

The dollar still accounts for about 90% of all currency trading, but that dominance masks serious erosion at the margins. International trade increasingly happens in bilateral currency arrangements that bypass dollar clearing entirely. Each arrangement is small—until suddenly there are hundreds of them, and the network effects run in reverse.

Trump's Tariff Threats Backfire

President Trump's threats of 100-150% tariffs on BRICS nations pursuing de-dollarization reveal both awareness of the threat and a fundamental misunderstanding of how to stop it. You can't tariff your way to reserve currency status.

Brazil's President Lula stated that "BRICS+ is committed to ending U.S. dollar dominance no matter what" after Trump's initial threats. The tariff bluster might slow formal de-dollarization initiatives, but it can't stop the underlying momentum:

Countries reducing dollar exposure through trade invoicing changes

Reserve diversification accelerating

Alternative payment systems gaining traction

Local currency settlement agreements multiplying

The irony is thick. America's aggressive use of sanctions and financial pressure is the primary driver pushing countries toward alternatives. Threatening tariffs for seeking those alternatives only validates their concerns.

What the Data Actually Shows

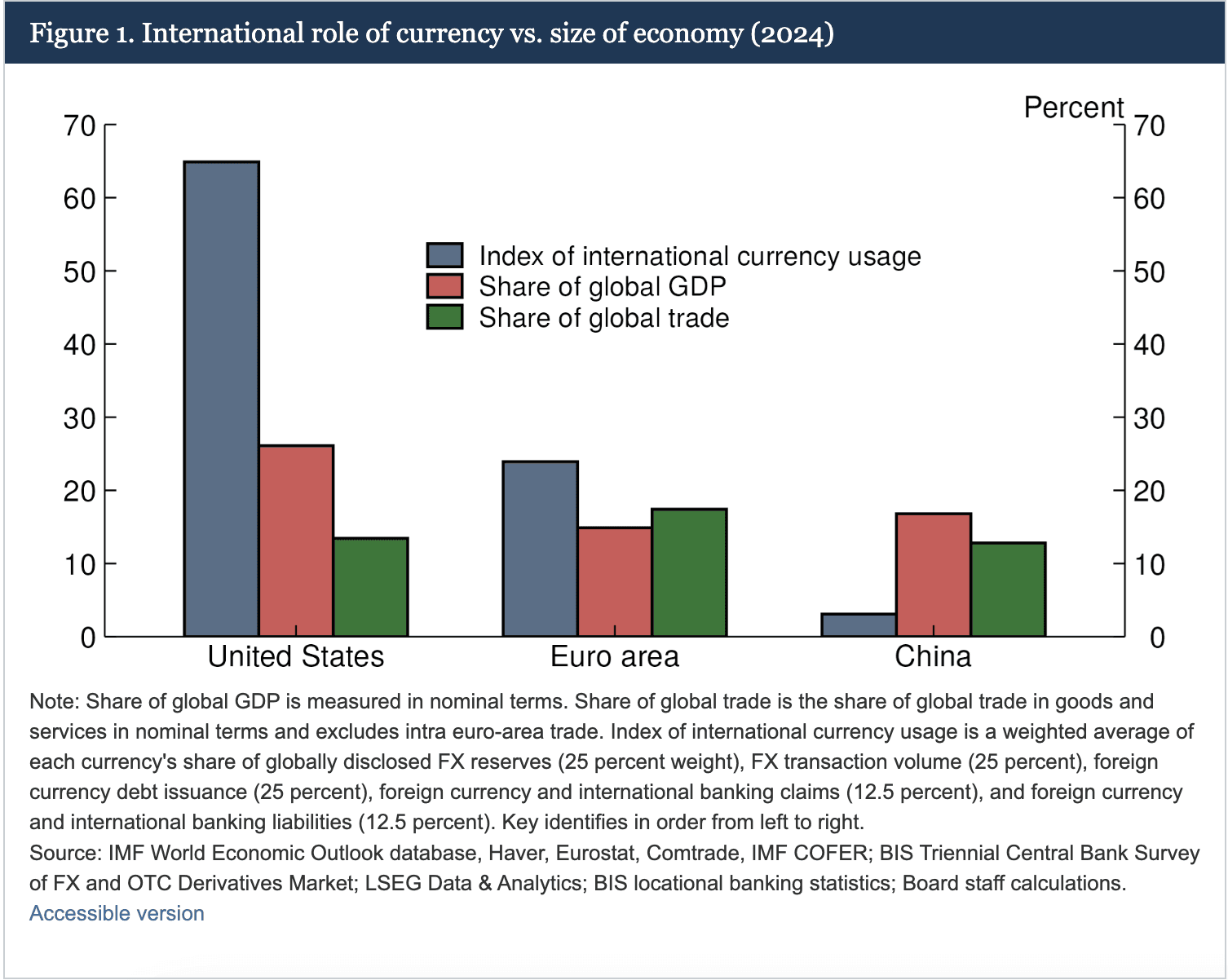

Strip away the geopolitical rhetoric and focus on the numbers. The dollar's share of allocated reserves has fallen from 66% in Q1 2015 to 57.4% in Q3 2024. That's not a cliff—it's erosion. The kind that looks manageable year-by-year until you look up and realize you've lost 13 percentage points from the 2001 peak.

Meanwhile, "nontraditional reserve currencies" like the Canadian dollar, Australian dollar, and Swiss franc have been gaining share. Not the yuan—China's currency still represents just 2.2% of reserves. The real story is diversification into a basket of alternatives rather than replacement with a new hegemon.

If gold is included in reserve asset portfolios, the dollar's share drops to 48.2% instead of 54.8% of total reserves. That's a psychological threshold that matters. Once you're below half, the story shifts from "dominant reserve currency" to "first among equals."

The Infrastructure Is Being Built

BRICS Pay remains in pilot stages, with full deployment expected by late 2025 or early 2026. The system faces real obstacles:

Currency convertibility issues

Regulatory coordination challenges

Technical complexity of connecting diverse payment systems

But dismissing it as impossible ignores what's already operational. Russia's SPFS network and China's CIPS are live alternatives to SWIFT handling real transaction volumes. India's UPI and Brazil's Pix are proven domestic systems being linked internationally.

The pieces exist—BRICS Pay is just the interoperability layer connecting them. The network doesn't need to handle majority global trade volume to succeed. It just needs to provide a viable alternative for countries facing sanctions risk or seeking to reduce dollar exposure.

What This Means for Markets

De-dollarization doesn't mean the dollar collapses tomorrow. It means the premium America pays for reserve currency status—the ability to run massive deficits, borrow cheaply, and project power through financial markets—gradually erodes.

Expect:

Rising U.S. borrowing costs as foreign demand for Treasuries softens

Increased volatility in currency markets as bilateral trade arrangements proliferate

Continued strength in gold as both central banks and private investors seek alternatives

Pressure on dollar-denominated commodity prices as more trade happens in local currencies

The transition will be messy, not catastrophic. No currency is remotely positioned to replace the dollar's role. But a multipolar currency system where the dollar is first among equals rather than the unquestioned hegemon? That's already emerging.

The Unspoken Truth

Here's what the establishment won't tell you: de-dollarization isn't driven by BRICS ambition or Chinese economic warfare. It's driven by American policy choices that weaponized the financial system for geopolitical ends.

Every frozen asset, every secondary sanction, every SWIFT expulsion teaches the world's central banks a lesson: dollar dependence is a national security vulnerability. When you demonstrate that holding dollars means accepting American veto power over your foreign policy, you've created the exact incentive structure driving de-dollarization.

The tragedy is that it didn't have to be this way. The dollar could have remained the global reserve currency through:

The strength of American institutions

The depth of U.S. capital markets

The rule of law

Instead, short-term policy wins through financial coercion are destroying long-term structural advantages.

A BRICSIZATION index measuring independence from the dollar showed founding members averaging over 72% progress toward de-dollarization from 2003 to 2022. That number only moves in one direction.

Central banks are voting. The gold purchases tell you they've made their choice. The only question is whether anyone in Washington is paying attention—or whether they'll keep pretending the emperor's clothes look just fine.

NEVER MISS A THING!

Subscribe and get freshly baked articles. Join the community!

Join the newsletter to receive the latest updates in your inbox.