Sunday night dropped a bomb that Wall Street couldn't ignore. Federal prosecutors served the Federal Reserve with grand jury subpoenas, threatening a criminal indictment against Fed Chair Jerome Powell. The ostensible reason? Powell's testimony last June about a $2.5 billion building renovation project.

But if you believe that's what this is really about, we've got a bridge to sell you.

Powell himself didn't mince words in an unusually direct video statement: "The threat of criminal charges is a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President."

Translation: The Trump administration wants lower rates. The Fed won't play ball. And now we're watching central bank independence get stress-tested in real time—with markets reacting accordingly.

When the Fed Chair Gets Subpoenaed, Gold Gets Bought

The market's immediate response? A flight to safety that would make a bird migration look disorganized.

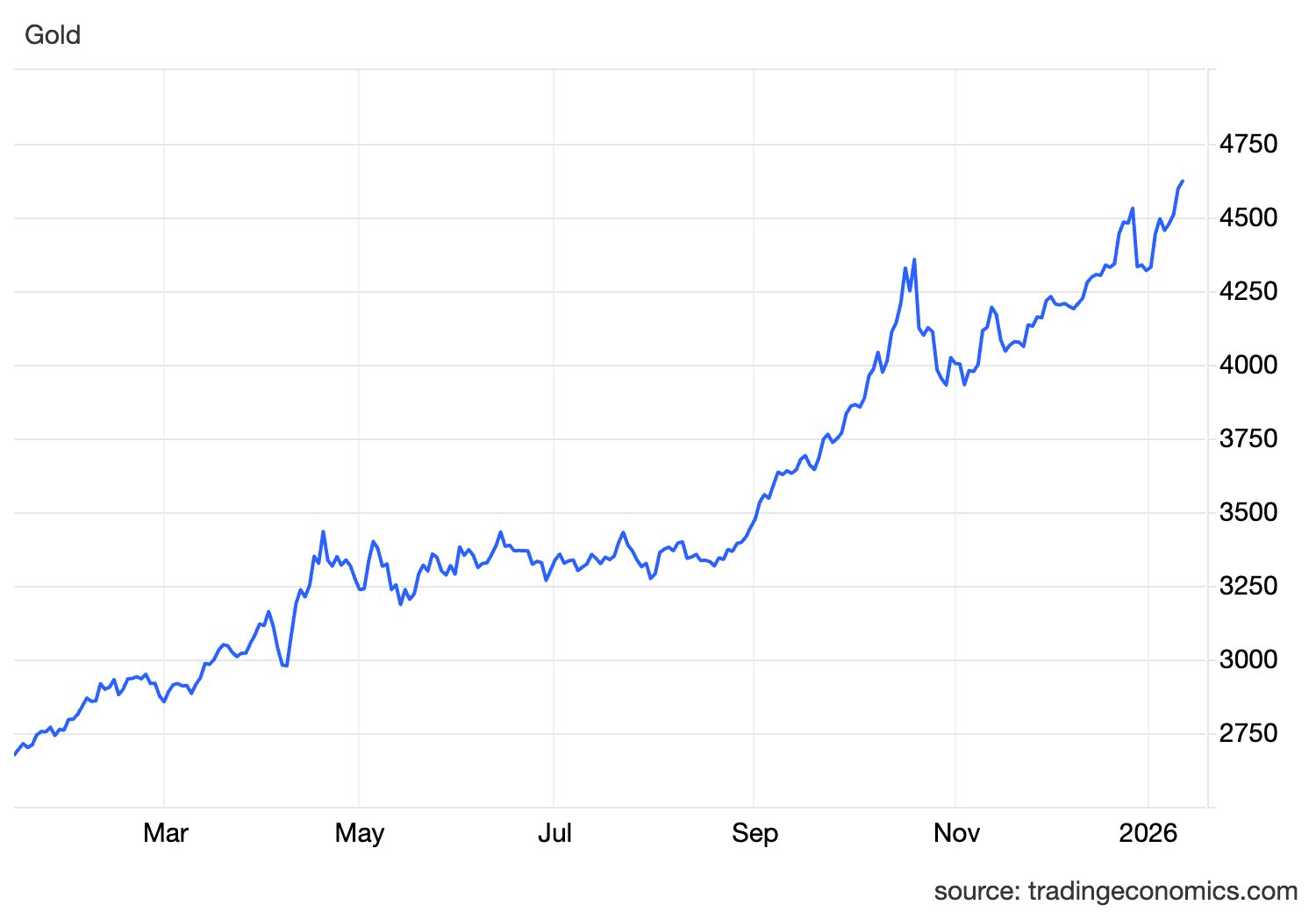

Gold prices exploded above $4,600 per ounce, smashing through records like they were made of tissue paper. The metal surged 2.5% on Monday alone, hitting an intraday high of $4,629.94. Silver wasn't far behind, rocketing 7.3% to touch $85.75—its own all-time high.

For context: gold has now gained roughly $1,800 per ounce over the past year. That's a 67% gain in 12 months. When was the last time gold moved like this? Try 1979, when Paul Volcker was jacking rates to 20% to kill inflation and everyone was convinced the world was ending.

The precious metals surge tells you everything you need to know about investor sentiment. When gold rallies this hard while U.S. stocks initially tank (before recovering), traders aren't just hedging—they're repositioning for a fundamentally different regime.

The Dollar Can't Catch a Bid

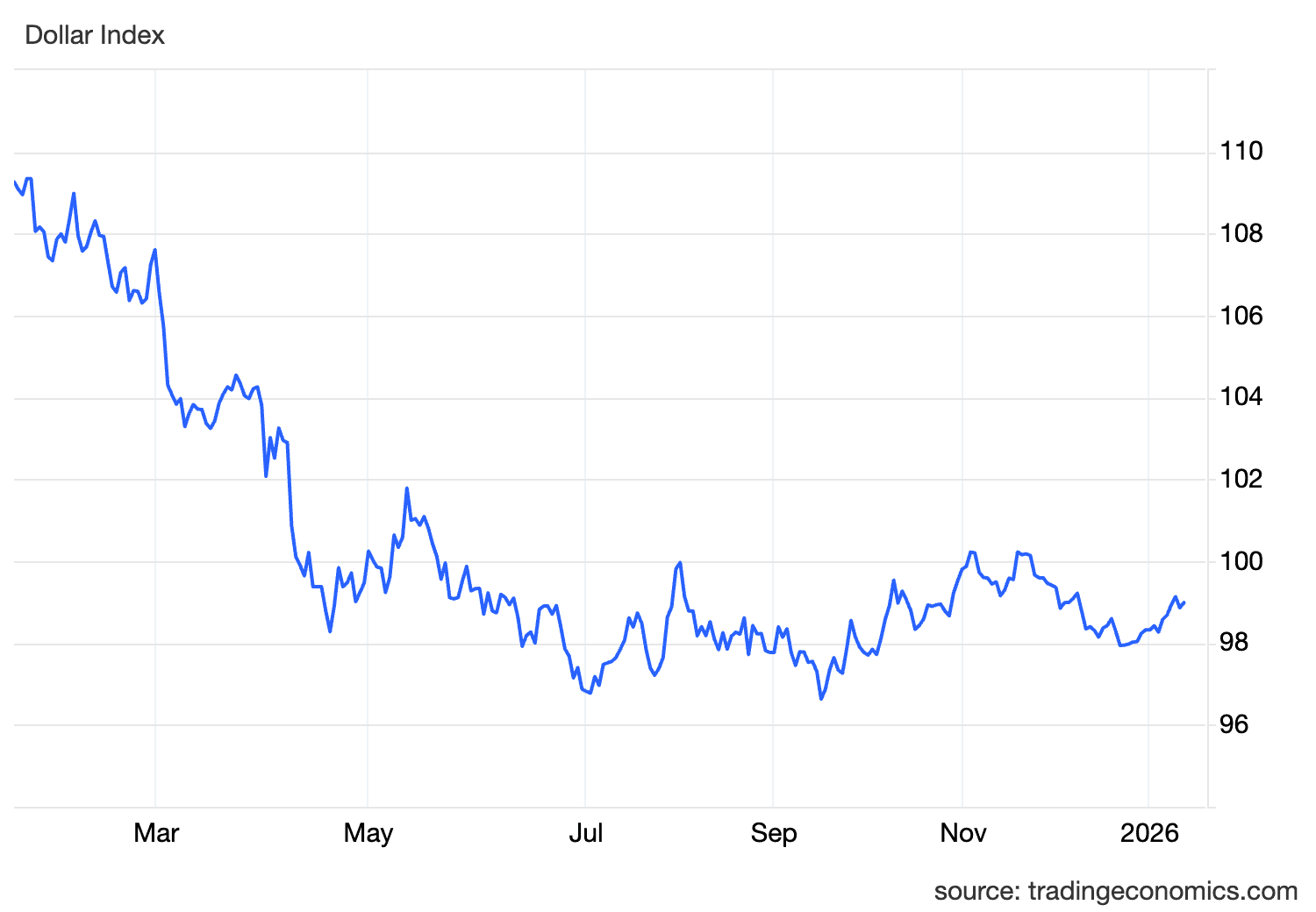

Meanwhile, the greenback is getting crushed. The U.S. Dollar Index (DXY) has been testing critical support around 98—a level that's held since 2011. Following the Powell probe news, the dollar weakened 0.24% and is now hovering dangerously close to multi-year lows.

This matters more than you think. The dollar dropped roughly 10% in 2025, its worst annual performance since 2017. Now it's starting 2026 on the back foot, with traders increasingly questioning whether the Fed can maintain any semblance of independence—and by extension, whether dollar assets deserve their traditional premium.

When a currency loses the backing of credible monetary policy, bad things happen. Ask Argentina. Ask Turkey. Hell, ask Britain after the Truss debacle in 2022.

The "Sell America" Trade Is Back

Remember April 2025? When Trump's tariff threats sent Treasury yields spiking, stocks tumbling, and the dollar into freefall? Wall Street dubbed it the "Sell America" trade—a coordinated dump of U.S. assets as investors fled perceived policy chaos.

Monday morning looked eerily similar. Stock futures tanked. Treasury yields ticked higher (bond prices fell). The dollar weakened. All three moving in tandem—a rare and ominous signal that typically screams "systemic risk."

By afternoon, equities had recovered. The S&P 500 and Dow both closed at record highs, up about 0.16% and 0.17% respectively. But don't let that fool you into thinking markets shrugged this off.

"We think the Sell America trade may well gather pace, and will in any event have legs, with Fed independence risks a key theme throughout '26," wrote Krishna Guha, vice chairman at Evercore ISI.

The stock market's resilience might just be inertia—or hope that this blows over. But the persistent dollar weakness and gold's parabolic move? Those are telling a different story.

It's Not About the Building, Stupid

Let's be clear: nobody actually believes this investigation is about building renovations. Not even Trump, who told NBC on Sunday: "I don't know anything about it, but he's certainly not very good at the Fed, and he's not very good at building buildings."

The subtext is deafening. Trump has been haranguing Powell for months over interest rates that he deems "far too high." The Fed has cut three times since mid-2025, bringing rates down to a 3.6% target range. But that's not fast enough for a president who wants cheap money to goose the economy—and lower the interest on a federal debt that's about to eclipse GDP for the first time since World War II.

Here's the rub: Powell's term as Fed Chair expires in May 2026. Trump will appoint his replacement. But Powell could—and might—stay on as a Fed governor until January 2028, effectively denying Trump the ability to stack the board with loyalists.

That's the real fight. And markets know it.

What History Says About Politicized Central Banks

The academic and empirical evidence here is unambiguous: when central banks lose independence, inflation rises, bond yields spike, and currencies weaken.

The textbook case is Arthur Burns in the 1970s. As Fed Chair under Richard Nixon, Burns kept rates too low heading into the 1972 election. Nixon feared that higher rates would cost him votes. He won in a landslide. But the country paid for it with a decade of stagflation that required Paul Volcker to nearly break the economy to fix.

Volcker pushed rates to 20% in the early 1980s. Unemployment hit 11%. Protesters burned him in effigy. But he didn't flinch. By the mid-1980s, inflation was back under control, and the dollar was king again.

That's what independence looks like. And it's precisely why economists, former Treasury secretaries, and even some Republican senators are sounding alarms over this DOJ probe.

Senator Thom Tillis (R-NC), who sits on the Banking Committee, called the investigation a "huge mistake" and vowed to oppose any Trump nominee to the Fed "until this legal matter is fully resolved."

When Republicans are breaking ranks over Fed independence, you know this is serious.

The Debasement Trade Is On

Here's where it gets interesting for your portfolio. The surge in gold and silver isn't just about Powell. It's about a broader theme that's been building for years: currency debasement.

Central banks around the world have been diversifying away from the dollar. China extended its gold-buying streak for a 14th consecutive month. J.P. Morgan forecasts central bank purchases will remain elevated at around 755 tonnes in 2026—down from the 1,000+ tonne peaks of recent years, but still well above historical averages.

Meanwhile, the U.S. fiscal picture is a disaster. The Treasury spent $276 billion just on interest payments in Q4 2025, up $30 billion year-over-year. With deficits ballooning and the debt-to-GDP ratio set to eclipse 100% this year, bond markets are getting twitchy.

If the Fed loses credibility—either through outright politicization or the perception thereof—Treasury yields will have to rise to compensate investors for the added risk. That means higher mortgage rates, higher corporate borrowing costs, and a feedback loop of fiscal pain.

Gold doesn't care about any of that. It has no counterparty risk. It doesn't depend on the "full faith and credit" of any government. And when governments start looking less than creditworthy, gold shines.

Where This Goes From Here

So what's the play? If you're asking that question, you're already behind. The smart money positioned for this months ago. But there's still time to adjust.

Gold: J.P. Morgan is forecasting $5,000/oz by Q4 2026, with $5,400 possible by late 2027. HSBC sees $5,000 as soon as the first half of this year. Even the conservative forecasts are projecting $4,500-$4,800 as a floor.

Dollar: The DXY is testing 14-year support. If it breaks below 96-97 on a sustained basis, the next technical level is somewhere around 92-94. That would be a seismic shift in global currency markets.

Equities: Stocks might keep grinding higher on momentum and buybacks. But don't confuse a rising market with a healthy one. When bonds, stocks, and the dollar all weaken together—even briefly—that's a warning shot across the bow.

Bonds: Treasury yields are up slightly despite the Fed cutting rates. That's not how it's supposed to work. If the market starts pricing in a loss of Fed credibility, yields could spike hard. Long-duration bonds are the most vulnerable.

The Big Picture

Powell said it best: "This is about whether the Fed will be able to continue to set interest rates based on evidence and economic conditions—or whether instead monetary policy will be directed by political pressure or intimidation."

We're watching a constitutional crisis play out in slow motion. The outcome will determine not just interest rates, but the dollar's reserve currency status, America's borrowing costs, and the stability of global financial markets.

Markets have a vote here. And so far, they're voting with gold, against the dollar, and pricing in a whole lot of uncertainty.

The debasement trade isn't a conspiracy theory. It's a rational response to an increasingly irrational policy environment. Ignore it at your peril.

NEVER MISS A THING!

Subscribe and get freshly baked articles. Join the community!

Join the newsletter to receive the latest updates in your inbox.