Treasury Issuance Is About to Detonate the "Everything Rally"

There's a $1.1 trillion problem coming in the next six months, and Wall Street is pretending it doesn't exist.

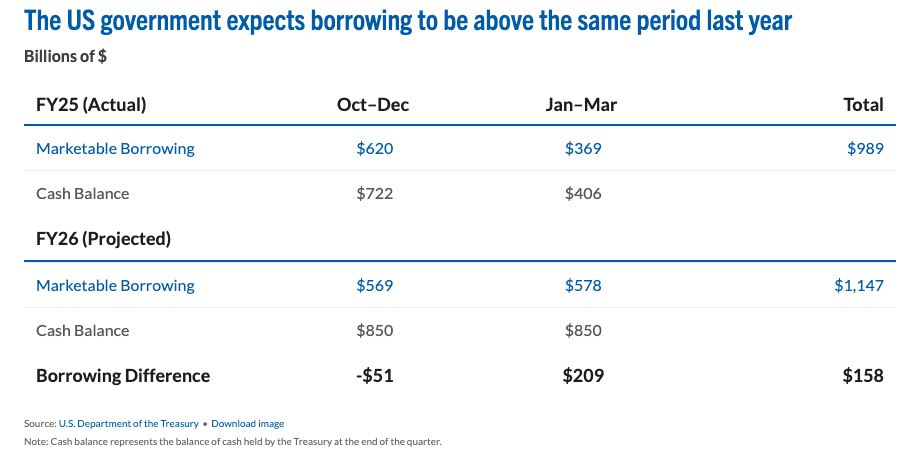

The U.S. Treasury just announced it needs to borrow $1,147 billion across Q4 2025 and Q1 2026—that's $158 billion more than the same period last year. We're talking about nearly $200 billion in fresh debt issuance per month, every month, for the foreseeable future.

And here's the kicker: the federal government has already spent $104 billion on interest payments in just the first nine weeks of fiscal 2026. That's $11.5 billion per week going straight to bondholders, representing 15% of all federal spending.

When your debt service costs more than your defense budget, you don't have a budget problem. You have an existential crisis.

The Supply Tsunami Nobody's Pricing In

Let's put these numbers in perspective. Treasury issuance has more than doubled in the past decade while the economy hasn't. Municipal bond supply is up only 10% over the same period. Corporate America is about to flood the market with $2.25 trillion in investment-grade debt in 2026, largely to fund AI infrastructure buildouts.

So you've got the Treasury competing with hyperscalers like Microsoft and Amazon for the same pool of bond investors. Somebody's going to lose that bidding war. Spoiler alert: it won't be the companies that can actually generate cash flow.

"The significant increase in hyperscaler issuance raises questions about who will be the marginal buyer," wrote Apollo Chief Economist Torsten Slok. Translation: there aren't enough buyers for all this paper, and yields are going higher whether the Fed likes it or not.

This is what's known in the trade as a supply shock. And supply shocks don't care about your portfolio allocation.

Foreign Buyers Are Tapping Out

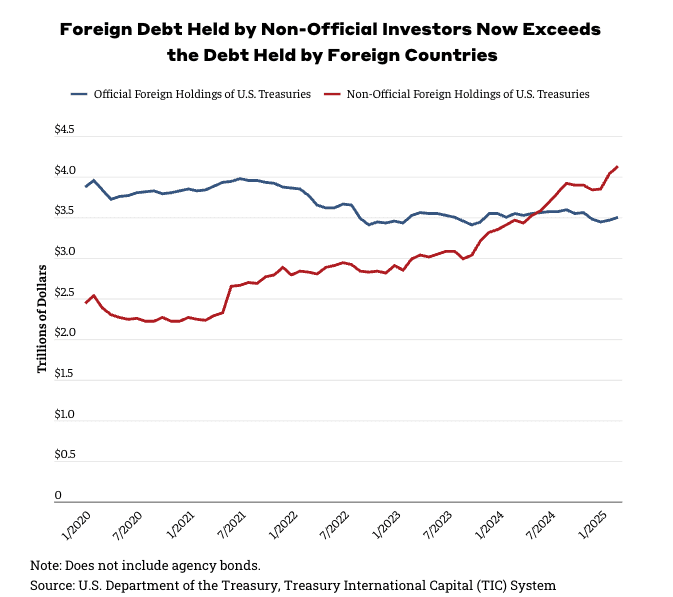

For decades, the U.S. could issue debt with impunity because foreign central banks—primarily China and Japan—would hoover it up. Those days are over.

Foreign holdings of U.S. Treasuries have dropped from 50% in the early 2010s to just 30% today. China has been systematically reducing its Treasury holdings since 2014, now sitting at just $700 billion. Even that number overstates their commitment—much of it is legacy positioning they're working to exit.

Why? Sanctions risk, for one. After the U.S. froze Russia's dollar reserves in 2022, every non-aligned country got the message: dollar assets aren't actually safe if Washington decides they're not. China's been rotating into gold at a record pace—14 consecutive months of central bank purchases as of January 2026.

Recent research shows foreign official institutions sold $113 billion in dollar reserves since September 2024 alone. That's not portfolio rebalancing. That's a run for the exits in slow motion.

Japan, bless them, is still buying. But Tokyo's holdings are driven more by currency intervention needs than any love affair with 4% yields. And with the yen strengthening, that support could evaporate fast.

The bottom line: the buyer base for Treasuries has shifted from price-insensitive foreign governments to price-sensitive private investors. When your marginal buyer is a hedge fund instead of the People's Bank of China, volatility goes through the roof.

The Deficit Math Is Worse Than You Think

The Congressional Budget Office projects the deficit will hit $1.9 trillion in fiscal 2025, rising to $2.6 trillion by 2035. As a share of GDP, we're talking about 6.1% deficits by 2035—nearly double the 50-year average of 3.8%.

But those are the optimistic numbers. They assume current law, which includes tax provisions that expire in 2028 and defense spending that stays flat as a share of GDP. Neither of those assumptions will survive contact with reality.

The One Big Beautiful Bill Act (OBBBA) is projected to add $4.1 trillion to the debt through 2034, according to the Committee for a Responsible Federal Budget. If its temporary provisions are made permanent—and they always are—that number balloons to over $7 trillion.

Trump has vowed to boost defense spending from $1 trillion to $1.5 trillion annually. That's an extra $500 billion per year that has to be borrowed. The Supreme Court might strike down his tariff regime, which would eliminate the $3 trillion in projected tariff revenue that's currently offsetting some of the fiscal damage.

Oh, and Social Security hits insolvency in 2030, not 2034 as previously projected. Immigration restrictions have shrunk the worker base faster than anyone anticipated. When that happens, either benefits get cut across the board or Congress raids the general fund to cover the shortfall. Guess which one they'll choose?

Term Premium: The Hidden Time Bomb

Here's where it gets technical, and where most people's eyes glaze over. But pay attention, because this is the mechanism that blows everything up.

Treasury yields can be decomposed into two components: the expected path of short-term interest rates and the term premium. The term premium is what investors demand as compensation for the risk of locking up their money for 10 years instead of rolling over short-term bills.

For most of the post-2008 era, term premiums were negative or near zero. Quantitative easing had suppressed them. The Fed was buying so many long-dated Treasuries that private investors didn't need much compensation for duration risk.

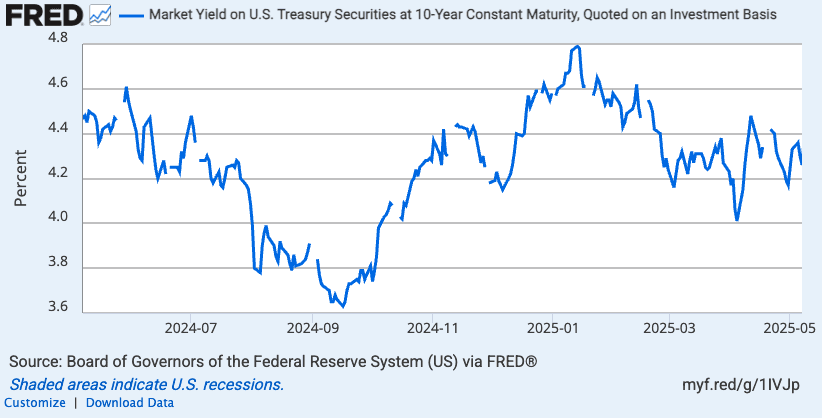

Those days are over. The 10-year term premium hit 0.8% in January 2025—its highest level since 2011. It's since pulled back to around 0.5%, but that's still elevated. The long-term average is 1.48%, and term premiums spent 60% of their history above 1%.

Why does this matter? Because research from the Kansas City Fed shows that Treasury supply shocks increase the term premium. During periods of high debt growth, a supply shock can push the five-to-ten-year term premium up by 100 basis points. That's a full percentage point added to long-term yields regardless of what the Fed does with short-term rates.

Think about what that means: The Fed could cut rates to zero, and 10-year yields could still rise if the term premium expands. That's exactly what we're seeing now—the Fed has cut 100 basis points since September, and 10-year yields are up 100 basis points over the same period.

This is what former Treasury Secretary Janet Yellen warned about when she said "the preconditions for fiscal dominance are clearly strengthening." Fiscal dominance is a polite way of saying the bond market stops listening to the central bank and starts pricing in fiscal insolvency risk.

The Everything Correlation

Normally, when stocks fall, bonds rally. That's the whole point of a 60/40 portfolio—negative correlation provides diversification.

But when the problem is Treasury supply overwhelming demand, both stocks and bonds fall together. We saw this in April 2025 during the "Sell America" trade triggered by tariff chaos. We're seeing it again now with the Powell investigation drama.

Here's how the doom loop works:

Treasury yields rise because supply exceeds demand

Higher yields increase the government's interest costs, worsening the deficit

Worse deficits require more issuance, pushing yields even higher

Rising yields make borrowing more expensive for corporations, crushing profit margins

Equity valuations compress as the risk-free rate rises

Market volatility increases, further elevating the term premium

It's a self-reinforcing cycle. And once it starts, it's very hard to stop without either massive spending cuts (politically impossible) or Fed intervention (which would reignite inflation).

The scary part? Debt held by the public is projected to hit 118% of GDP by 2035, and 156% by 2055 under current law. We'd surpass our post-World War II peak of 106% by 2029.

What Happens When Buyers Strike?

Bond market strikes are rare, but they're catastrophic when they occur. The U.K. found this out in 2022 when Liz Truss tried to enact unfunded tax cuts. Gilt yields spiked 100 basis points in a matter of days, pension funds faced margin calls, and the Bank of England had to stage an emergency intervention.

Truss resigned after 49 days. Her finance minister lasted 38 days. The bond market ended both their careers without breaking a sweat.

The U.S. is different—we have reserve currency status and deeper, more liquid markets. But we're also testing the limits of that privilege. Research shows that a 1% decrease in China's dollar reserves leads to a 20-basis-point increase in Treasury yields. China holds nearly $700 billion. You do the math.

If foreign central banks continue their exodus and domestic buyers balk at current yields, the Fed would face an impossible choice: let yields spike and crater the economy, or restart QE and reignite inflation. Either way, somebody eats a loss. Probably you.

The AI Wildcard

There's one more wrinkle that nobody's talking about: the AI infrastructure boom is creating unprecedented competition for capital.

Hyperscalers are spending hundreds of billions on data centers, power generation, and specialized chips. Microsoft, Amazon, Google, and Meta alone are projected to issue $500+ billion in corporate bonds in 2026.

These are AAA-rated companies offering yields only slightly above Treasuries, with actual cash flows and growth prospects. When investors can earn 5.5% on Microsoft debt versus 4.2% on 10-year Treasuries, which would you choose?

The Treasury's competitive advantage used to be safety and liquidity. But safety is being questioned by the fiscal trajectory, and liquidity doesn't help if yields are structurally too low to compensate for the risk.

Where This Goes

There are three possible endgames here, none of them pretty.

Scenario 1: Yields Spike. The market reprices fiscal risk, term premiums surge to 2%+, and 10-year yields hit 5.5-6%. Mortgage rates go back to 8%, corporate borrowing freezes, equity valuations collapse, and we get a nasty recession. The Fed eventually caves and buys bonds, but not before significant economic damage.

Scenario 2: Slow Bleed. Yields grind higher over time, staying in the 4.5-5% range for years. This is the Japanese scenario—low growth, high debt, financial repression. Savers get destroyed by negative real rates, but outright chaos is avoided. The "everything rally" turns into the "everything sideways chop."

Scenario 3: Fiscal Reform. Congress actually addresses the deficit with spending cuts and/or tax increases totaling $7-8 trillion over a decade. Markets rally on renewed credibility. This is the fairy tale scenario. Don't hold your breath.

The smart money is positioning for Scenario 1 transitioning to Scenario 2. That means underweight duration, overweight credit, and gold as a hedge against both inflation and debasement risk.

The Bigger Picture

We're watching a slow-motion train wreck between unstoppable force (deficit spending) and immovable object (finite capital). Something has to give.

The Treasury can't keep issuing $200 billion per month indefinitely without consequences. Foreign buyers are backing away. Domestic buyers are demanding higher compensation. And the Fed can't paper over the problem without sacrificing its inflation credibility.

Charles Schwab projects 10-year yields will stay in the 3.75-4.5% range through 2026, but admits "there is a risk they will move back up toward 4.5% at times." That's Wall Street speak for "we have no idea, but we're worried."

The "everything rally" of 2023-2025 was built on a foundation of falling interest rates, abundant liquidity, and the assumption that someone would always buy the debt. All three of those pillars are crumbling.

You can't run 6% deficits indefinitely with debt at 100% of GDP and expect markets to shrug. Eventually, the bill comes due. We're a lot closer to eventually than most people think.

The Treasury supply shock is coming. The only question is whether it arrives as a tsunami or a slow rising tide. Either way, you'd better learn to swim.

NEVER MISS A THING!

Subscribe and get freshly baked articles. Join the community!

Join the newsletter to receive the latest updates in your inbox.