There's a particular kind of willful blindness that takes hold during market bubbles. Not ignorance—everyone can see the numbers. It's the collective agreement to explain them away. To insist that "this time is different." To dismiss warnings as pessimism masquerading as analysis.

We're there again. And the signals aren't subtle.

Valuation Metrics Screaming Into the Void

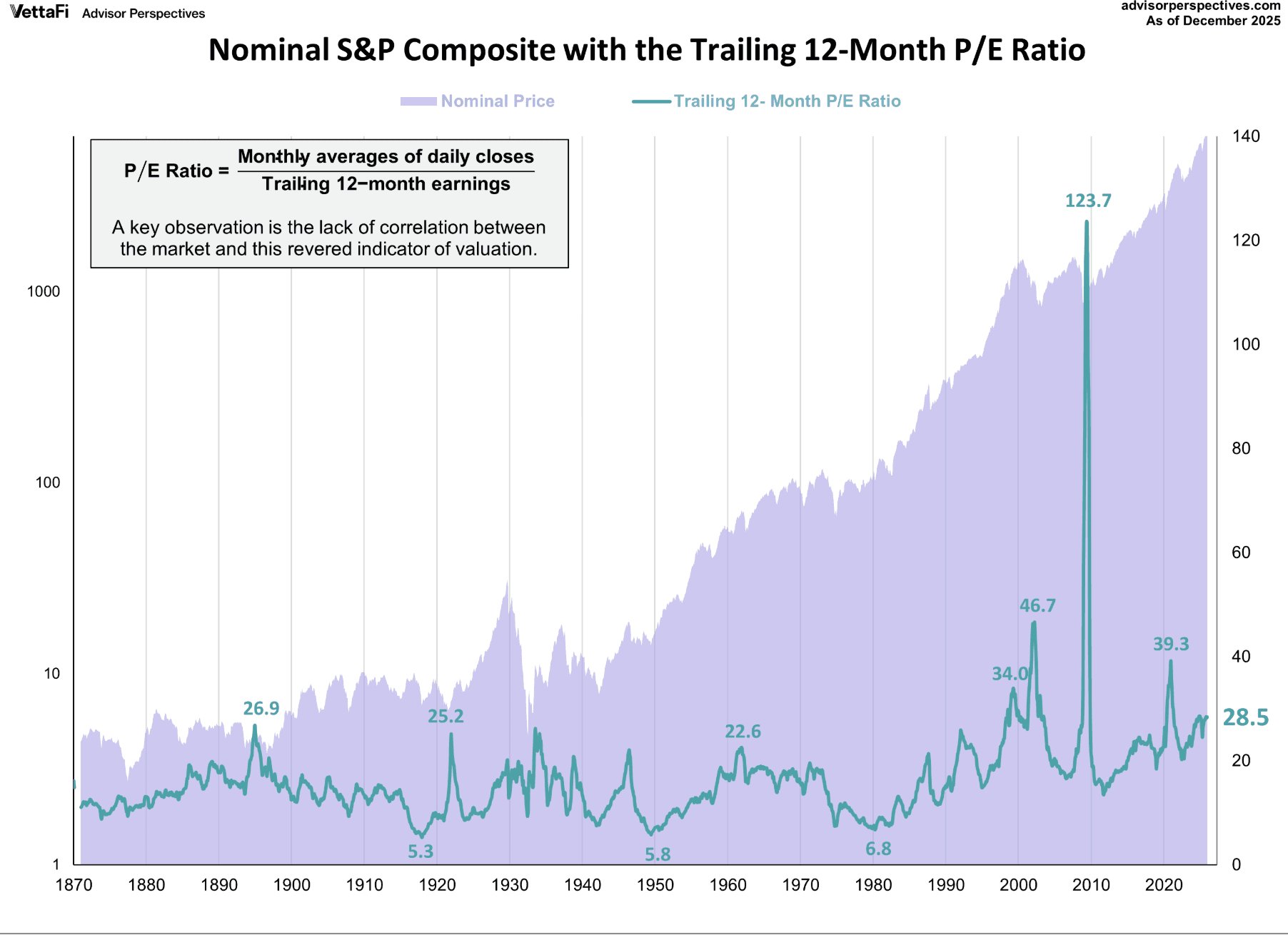

The Shiller P/E ratio sits at approximately 40—higher than at any point besides the turn of the millennium, right before the dot-com implosion. Let that sink in. We're at valuation levels exceeded only once in modern history, during a period that became synonymous with speculative insanity.

As of December 2025, the P/E10 ratio stands at 145% above its historic geometric average, sitting in the 99th percentile of its historical range. Translation: it's been this expensive for only 1% of market history.

But here's what Wall Street will tell you: earnings growth justifies it. AI is transformational. The fundamentals are sound. Look—tech companies are printing money!

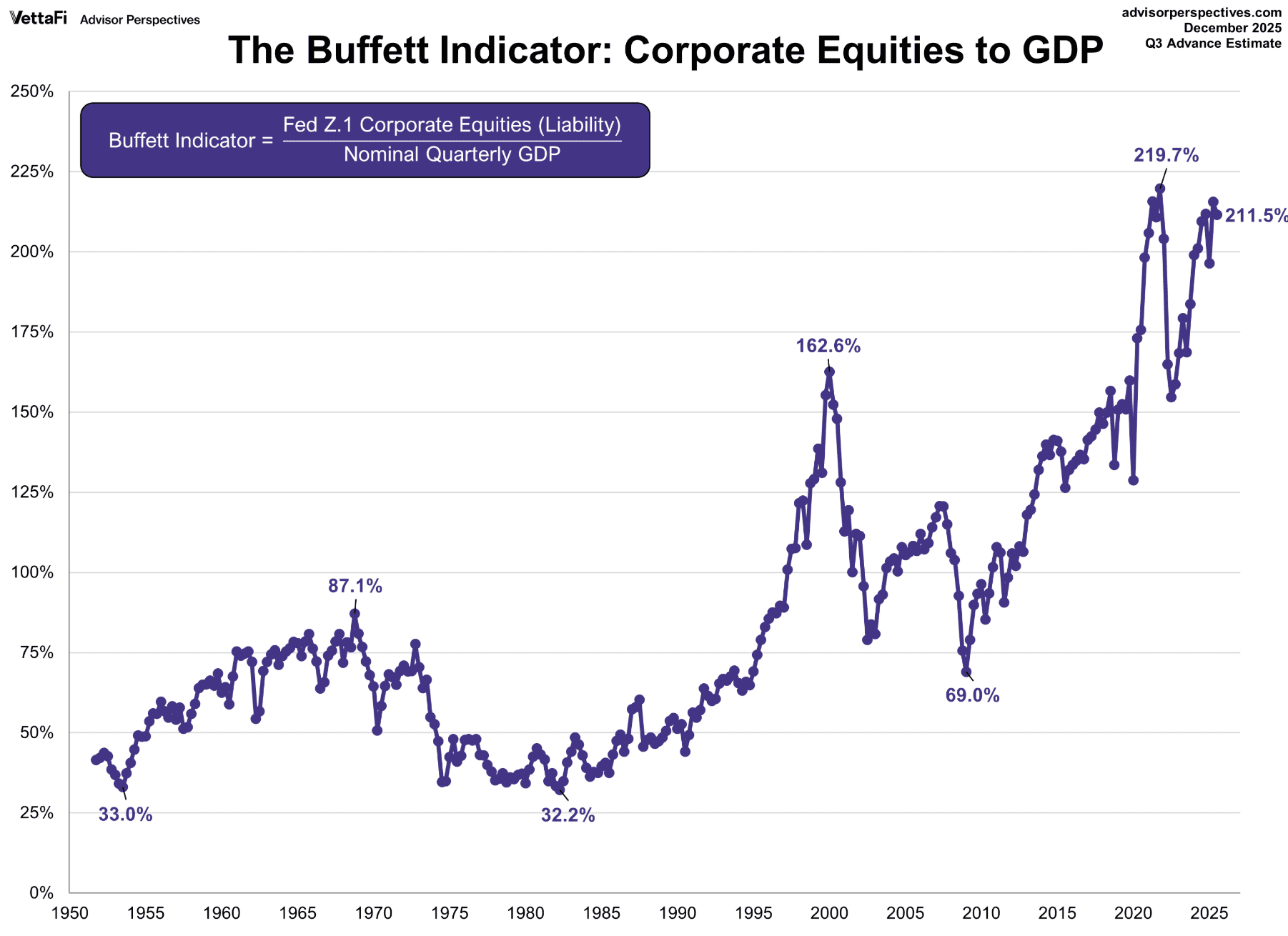

Fair enough. Except the Buffett Indicator—Warren Buffett's preferred metric of total market cap to GDP—is currently reading 211.5%, one of the highest levels on record. The market's price tag is more than double the economy's annual output. Some estimates put it even higher, at 223%—about 2.4 standard deviations above the historical trend line.

When stocks are priced at twice the size of the actual economy generating those earnings, you're not investing in fundamentals. You're betting on perpetual expansion of multiples.

The $600 Billion AI Spending Spree

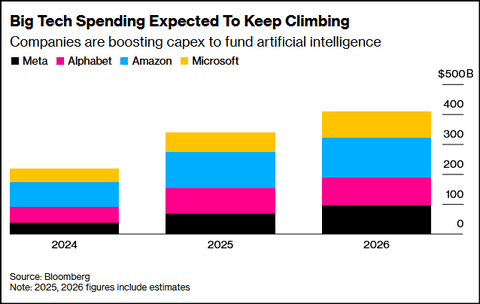

If you want to understand where bubble psychology lives today, look at Big Tech's capital expenditures. The numbers have gone from eye-watering to surreal.

Hyperscaler capex is forecast to exceed $600 billion in 2026, a 36% increase over 2025's already-record spending. Roughly $450 billion of that—75% of the total—goes directly to AI infrastructure: servers, GPUs, data centers, networking equipment.

Microsoft's 2025 guidance points to $80-120 billion in infrastructure capex—equal to 33-50% of its 2024 revenue. Amazon's capex projection: $125 billion, or about 17% of revenue. Google raised its 2025 capital budget to $92 billion. Meta now expects spending of about $100 billion in 2026.

These aren't incremental investments. These are bet-the-company wagers. And here's the uncomfortable part: AI capex is projected to consume up to 94% of operating cash flows by 2026, according to Bank of America. After dividends and buybacks, many of these companies are spending more than they generate internally.

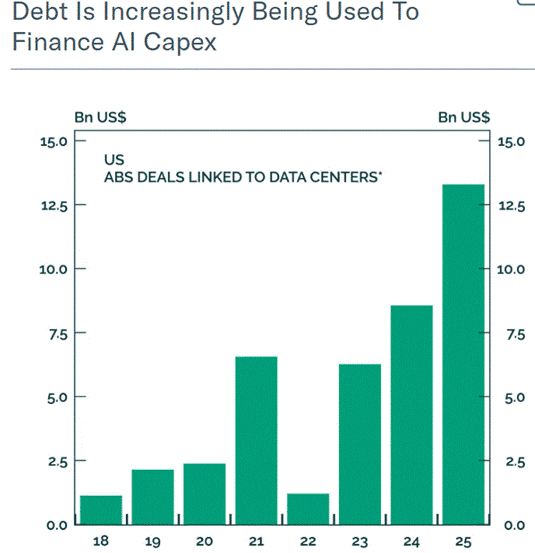

The result? Big Tech has raised a record $108 billion in debt in 2025—more than 3x the average over the past nine years. Some are using off-balance-sheet entities and special-purpose vehicles to fund AI investments. You know, those same financial structures with such a sterling track record from Enron.

When one analyst asked on Microsoft's earnings call, "Are we in a bubble?" the silence was deafening.

The Revenue Math Doesn't Add Up

Let's do some back-of-the-envelope arithmetic. If companies spend $400 billion on AI capex in 2025, and we assume a generous 10-year economic life for data center assets, that's $40 billion in annual depreciation costs alone.

Current AI-related revenues? Estimated around $15-20 billion.

Even assuming a generous 25% gross margin, you need revenues to scale to $160 billion annually just to break even on one year's investment. To generate a solid return on invested capital, you'd need $400-500 billion in revenue. And that's just for 2025's spending. If 2026 capex matches or exceeds it—which it will—the implied future revenue runs into the trillions.

Google CEO Sundar Pichai admitted he sees "elements of irrationality" in current AI investing. Not unlike the dot-com boom, he noted. If the AI bubble bursts, he added, no company will be immune.

Even OpenAI chairman Bret Taylor was blunt: "AI will transform the economy… and create huge amounts of economic value in the future. I think we're also in a bubble, and a lot of people will lose a lot of money."

Margin Debt: The Leverage Time Bomb

While institutions plow cash into AI infrastructure, retail investors are doing their part with borrowed money. Margin debt hit $1.23 trillion in December 2025, marking the seventh consecutive record high and the eighth straight monthly increase.

To put that in perspective: real margin debt has grown 482% while the market has grown 327% over the same period. Investors are borrowing aggressively, convinced returns will continue accelerating.

The investor credit balance—margin debt minus cash in accounts—sits at -$814.1 billion, just off the record low of -$817.8 billion from November. That's a record-breaking negative balance. Investors collectively owe more than they have in cash.

Historically, peaks in margin debt have an uncanny ability to precede market tops. The indicator preceded S&P 500 peaks by six months in 2000, four months in 2007, four months in 2018, and two months in 2021. In 2025? Zero months. Margin debt and the S&P 500 both sit at nominal and real peaks simultaneously.

Is it a perfect timing indicator? No. But it's a powerful measure of speculative temperature. And right now, the thermometer is melting.

The "It's Different This Time" Defense

Wall Street has its rebuttals ready. You'll hear them on every earnings call, in every research note:

"Valuations are high but earnings justify them." True—until they don't. The S&P 500's forward P/E is around 21, based on projections for the next 12 months. But forward earnings are just that—projections. They assume no recession, no tariff shocks, no AI monetization disappointments. The moment those assumptions crack, multiples compress fast.

"Interest rates are lower, so higher P/Es make sense." This was the rationale from 2008-2022 when rates sat near zero. It's less convincing when the 10-year Treasury is hovering above 4.5%. If rates climb to 5%, some analysts project unrealized losses across the banking system could hit $600-700 billion. That's a macro headwind, not a valuation tailwind.

"AI will generate massive productivity gains." Maybe. Probably, even. But productivity gains don't materialize overnight, and they don't guarantee the companies spending $600 billion will be the ones capturing the value. Remember the telecom spending spree of the late 1990s? Fiber optic networks got built. Most of the companies went bankrupt.

"The Magnificent Seven have real earnings, unlike dot-com stocks." Correct. But the S&P 500 excluding Big Tech trades at even more extreme multiples than the index itself. This isn't just a tech bubble. It's a broad market bubble with tech as the justification.

The Macro Reality Check

Strip out AI-related capex, and U.S. GDP growth looks significantly weaker than advertised. AI investment represents about 1.2% of GDP in 2025. Remove that, and growth is anemic.

U.S. GDP growth has stalled at 1.5%, down from 2.7% in 2024. The labor market is softening. Net interest margins are compressing. The economic engine supposedly justifying these valuations is sputtering.

And here's the kicker: the AI spending boom is highly concentrated. A handful of tech giants account for the bulk of capex. While those assets are capital-intensive, they're not labor-intensive. The productivity gains—if they materialize—won't necessarily translate into broad-based economic growth or employment.

We're in a peculiar situation where the stock market is priced for gangbusters growth while the actual economy slows. That gap doesn't persist indefinitely.

What History Teaches Us

Goldman Sachs put together a sobering comparison: current AI capex relative to GDP is 0.8%. That's below historical technology investment booms, which peaked at 1.5% of GDP or higher. To match the late 1990s telecom cycle, AI hyperscaler capex would need to hit $700 billion in 2026.

Translation: if this is a bubble, it could get bigger before it pops.

But here's what the optimists miss: the dot-com bubble didn't implode because companies stopped spending. It imploded because the revenue never showed up to justify the spending. Pets.com had a great Super Bowl ad. Webvan built an impressive logistics network. Neither had a viable business model.

The question isn't whether AI is transformative. It is. The question is whether the companies spending $600 billion today are the ones that will capture the value tomorrow—and whether that value will be enough to justify today's prices.

The Uncomfortable Truth

Every classic bubble indicator is flashing. Valuations at historical extremes. Debt-fueled speculation. Margin debt at record highs. Massive capital expenditures predicated on future revenues that may or may not materialize. Broad market participation in the euphoria. "This time is different" as the prevailing narrative.

None of this means the market crashes tomorrow. Bubbles can inflate for years. Timing tops is a fool's errand. As Keynes noted, markets can remain irrational longer than you can remain solvent.

But it does mean risk is mispriced. When the Buffett Indicator sits at 211%, when margin debt hits record highs month after month, when Big Tech is spending nearly 100% of operating cash flow on AI infrastructure, you're not in a normal market. You're in late-cycle euphoria.

The danger isn't that people are wrong about AI's potential. The danger is that they're right about the potential but wrong about the timeline, the profitability, and the distribution of winners.

History doesn't repeat, but it rhymes. And right now, it's rhyming hard with late 1999.

Wall Street will keep explaining why the signals don't matter. That valuations are justified. That this bull market has legs. That you're missing out if you're not all-in.

They always do. Right up until they don't.

NEVER MISS A THING!

Subscribe and get freshly baked articles. Join the community!

Join the newsletter to receive the latest updates in your inbox.