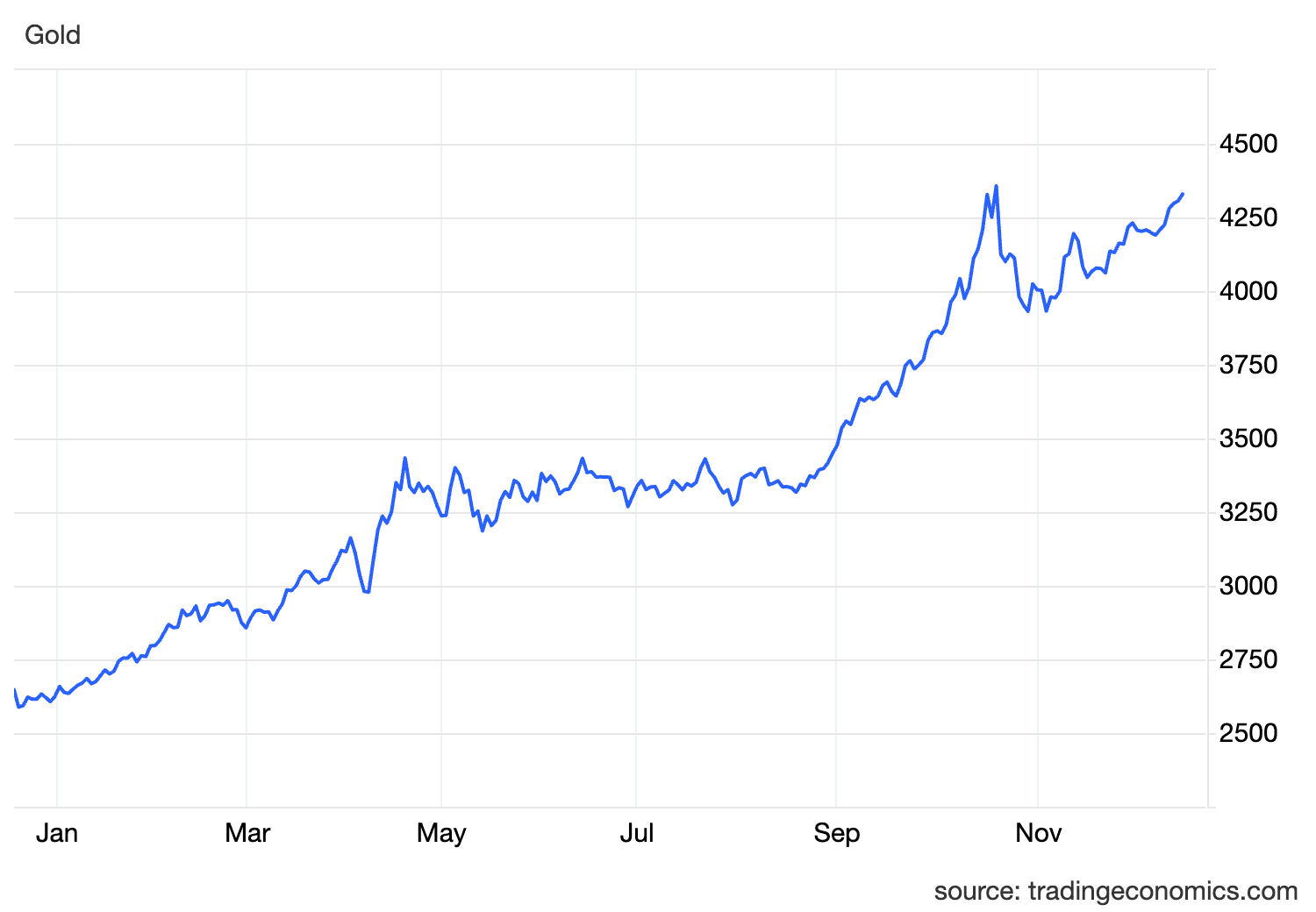

The timing is almost poetic. Gold trading at $4,323 and silver spiking to $63.94—both metals carving out fresh all-time territory—while President Trump stands at the podium demanding the Federal Reserve slash rates to 1% "or possibly even lower."

It's December 2025, and the financial system is broadcasting a signal so loud you'd have to be actively ignoring it: something fundamental has broken in the relationship between monetary policy, sovereign debt, and hard assets.

Trump told The Wall Street Journal he wants rates at 1% within a year—not because the economy is collapsing, but because the United States is drowning in $38 trillion of debt. The math is brutal: interest payments have nearly tripled in five years, hitting $981 billion over the past 12 months. That's more than defense spending. More than Medicare.

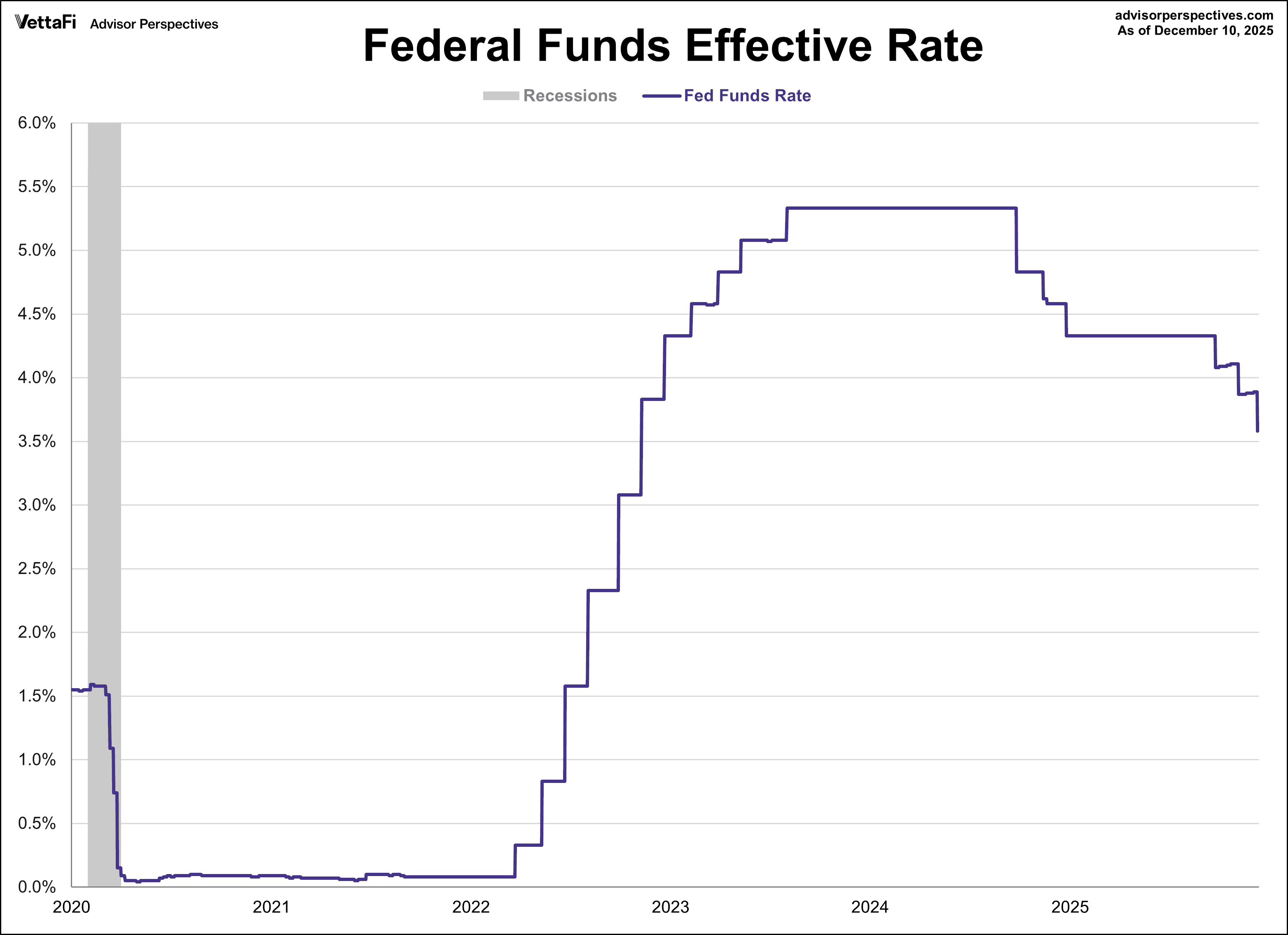

Meanwhile, the Fed just delivered its third consecutive rate cut, dropping the federal funds rate to 3.5%-3.75%. But here's the kicker: inflation remains at 2.8%—well above the Fed's 2% target—while unemployment ticks up to 4.4%. The vote wasn't even unanimous. Three dissenters. One wanted a 50-basis-point cut. Two wanted no cut at all.

This is what happens when monetary policy becomes trapped between a weakening labor market and persistent inflation—a classic no-win scenario that historically has been rocket fuel for precious metals.

The Precious Metals Explosion No One Saw Coming

Gold's up 61% year-over-year. Silver? Try 109% higher than last December. These aren't normal moves. These are panic-buy, safe-haven, end-of-cycle type moves.

Silver just smashed through the psychologically critical $60 barrier and touched $64.64 before pulling back slightly. For context, silver hasn't seen these levels since 1980—when the Hunt Brothers tried to corner the market and inflation was running at double digits.

What's different this time? The supply deficit is real. The Silver Institute projects industrial demand alone at 677.4 million ounces in 2025, with total consumption around 1.21 billion ounces against supply of just 1.03 billion. That's a 182 million ounce shortfall—the third consecutive year of deficits.

Solar panels, EVs, and AI data centers are eating silver alive

Central banks are now buying silver for the first time in decades (Russia announced $535 million in purchases)

ETF inflows and retail demand are at multi-year highs

Physical delivery stress in London markets is driving lease rates through the roof

When "Lower for Longer" Becomes "Lower Forever"

Here's where Trump's 1% fantasy gets interesting. The President isn't wrong about the debt spiral—he's just saying the quiet part out loud. At current interest rates, the U.S. is paying $6.12 billion per day in debt accumulation. By 2030, interest costs alone could consume 14-15% of the entire federal budget.

The only way out? Financial repression. Keep rates artificially low, let inflation run moderately hot, and slowly erode the real value of the debt. It's the playbook from the 1940s—and it's catnip for gold and silver.

Powell knows this. That's why his language at the December press conference was so carefully calibrated: "We're well positioned to wait for greater clarity." Translation: we're buying time while the economy decides whether it wants to implode from unemployment or inflation first.

The market heard something else entirely: more rate cuts are coming, just slower than Trump wants. The Fed's own dot plot projections show just one cut in 2026 and another in 2027. But if you believe that—given a weakening jobs market, persistent inflation, and a president screaming for 1% rates—I've got some AAA-rated mortgage bonds from 2007 to sell you.

The Uncomfortable Truth About What Happens Next

Let's play this out. If the Fed actually capitulates to Trump's 1% demand—or even gets close—you're looking at negative real rates in an environment where inflation refuses to die. That's jet fuel for hard assets.

The gold-to-silver ratio currently sits around 67:1, well above its 25-year average of 69:1. Some analysts are now projecting silver at $95+ over the next 12-24 months if the ratio reverts to historical norms and gold continues climbing.

And gold? Goldman Sachs and other institutions are projecting $5,000+ by 2026. That's not some moonshot prediction—it's simple math when central banks bought a record amount in 2024 and continue stacking in 2025 while sovereign debt spirals out of control globally.

But here's the dark scenario nobody wants to discuss: what if Trump gets his 1% rates and it doesn't work? What if inflation accelerates instead of moderating? We'd be looking at a genuine currency crisis—the kind where people lose faith in fiat altogether.

That's when gold doesn't just hit $5,000. That's when it becomes the numeraire, and we stop measuring wealth in dollars and start measuring it in ounces.

The Signal in the Noise

Markets are messy, noisy things. But sometimes they send clear signals. When the President of the United States openly campaigns for 1% interest rates while inflation sits at 2.8% and national debt grows by $6 billion a day—and precious metals simultaneously explode to multi-decade highs—that's not noise.

That's the market screaming that the endgame of the post-2008 monetary experiment is here. The Fed can't normalize rates without breaking the government's balance sheet. The government can't stop borrowing without triggering a political crisis. And the only way to square this circle is to quietly, slowly, deliberately destroy the purchasing power of the currency through negative real rates.

Gold at $4,300 and silver at $63 aren't bubbles. They're the market's vote of no confidence in the sustainability of current fiscal and monetary policy. And if Trump's 1% rate fantasy becomes reality? Those prices will look quaint by 2027.

The question isn't whether you believe in gold and silver. The question is whether you believe the U.S. government can thread the needle between insolvency and inflation while maintaining the dollar's reserve currency status.

Right now, the metals are betting: no chance in hell.

NEVER MISS A THING!

Subscribe and get freshly baked articles. Join the community!

Join the newsletter to receive the latest updates in your inbox.