The financial press is fawning over Warren Buffett's newest toy—a $4.9 billion stake in Alphabet, Google's parent company. Headlines breathlessly describe it as "the best of the bunch" among Berkshire's Q3 purchases, with analysts tripping over themselves to explain why this signals Alphabet's bright AI future.

But let's pump the brakes.

This is the same Warren Buffett who has preached value investing for six decades. The same man who famously "blew it" by not buying Google in the early days when GEICO was paying $10-11 per click for ads—clear evidence of an extraordinary business model he failed to act on.

Now, after 15+ years of watching from the sidelines, Buffett finally pulls the trigger. After Alphabet has already ripped 50% year-to-date. After the stock rallied 37% in Q3 alone.

This isn't value investing. This is capitulation—or worse, momentum chasing dressed up in Buffett's credibility.

The Timing Couldn't Be Stranger

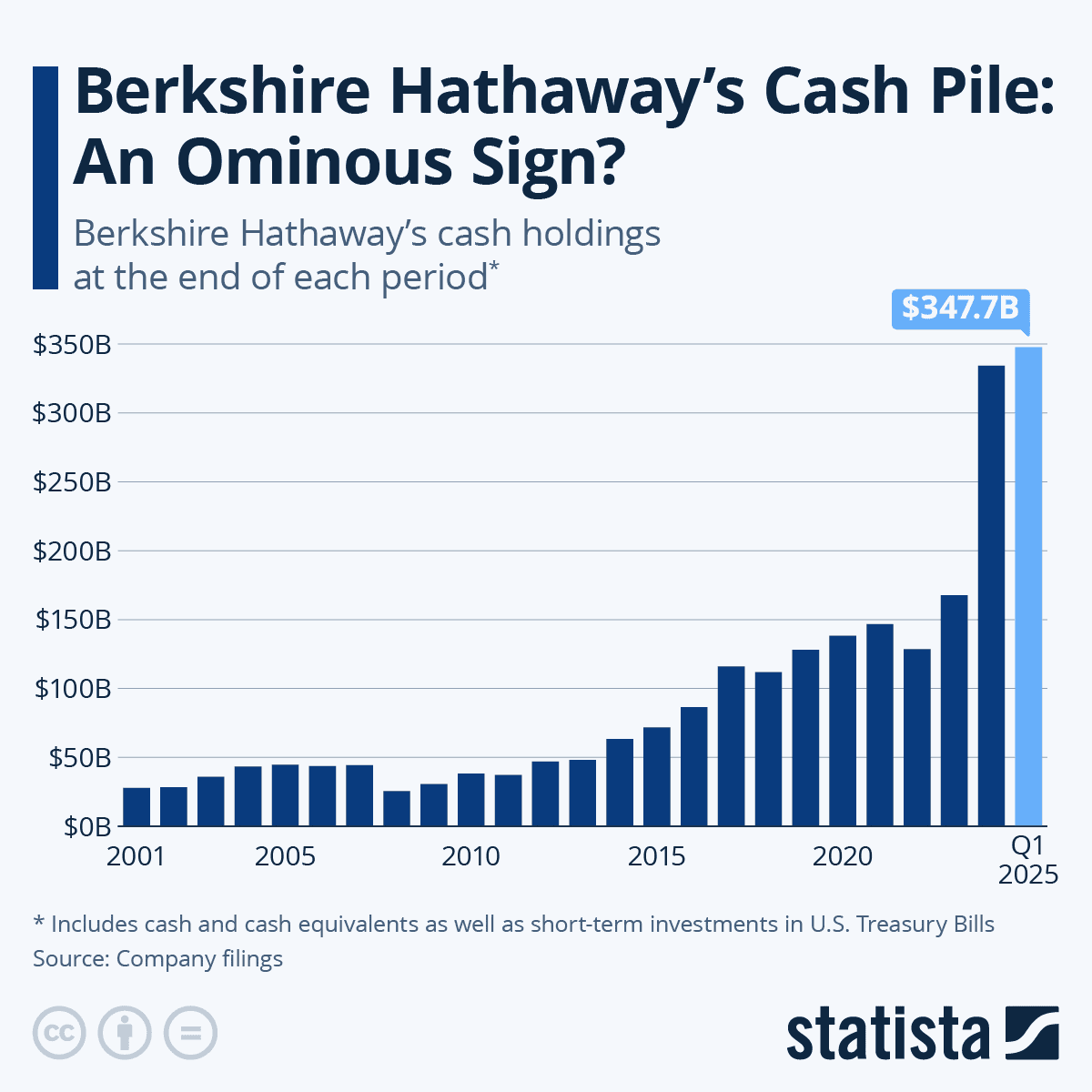

Consider what else Buffett did in Q3: he was a net seller of equities for the twelfth consecutive quarter. Berkshire's cash pile swelled to a record $381.7 billion. He hasn't bought back a single share of his own stock for five straight quarters—even though he once vowed buybacks were his favorite use of capital when shares traded cheap.

So Buffett's message to the market all year has been clear: everything is overpriced.

Except, apparently, Alphabet—which trades at 28x trailing earnings, 26% higher than its 12-month average P/E. The stock now sits at 10% above its 10-year historical valuation average.

This cognitive dissonance is deafening.

The S&P 500's Shiller CAPE ratio currently hovers around 38-40—a level reached only during the dot-com bubble and the pre-2007 housing crash. It's 42% above the 20-year average. Buffett himself has historically sold aggressively during such stretched valuations.

Yet he's buying a Magnificent Seven stock that has already participated in the AI euphoria.

The Antitrust Elephant in the Room

Here's what the Alphabet cheerleaders conveniently downplay: the company is facing two separate antitrust judgments finding it operated illegal monopolies.

In August 2024, a federal judge ruled Google illegally monopolized the search market. In April 2025, another judge found Google holds illegal monopolies in ad tech.

The September 2025 remedies ruling was framed as a "win" for Alphabet because the company avoided forced divestiture of Chrome. But the remedies are far from toothless:

No more exclusive search contracts with device makers

Mandatory data sharing with competitors

Restrictions on bundling search and AI products

The $20 billion Apple deal—which accounts for nearly a quarter of Alphabet's operating income—now exists in legal limbo. The judge allowed payments to continue but banned exclusivity. Apple can now shop around.

And let's not forget: Google is appealing these rulings. This legal uncertainty could drag on for years.

The AI Search Threat Is Real

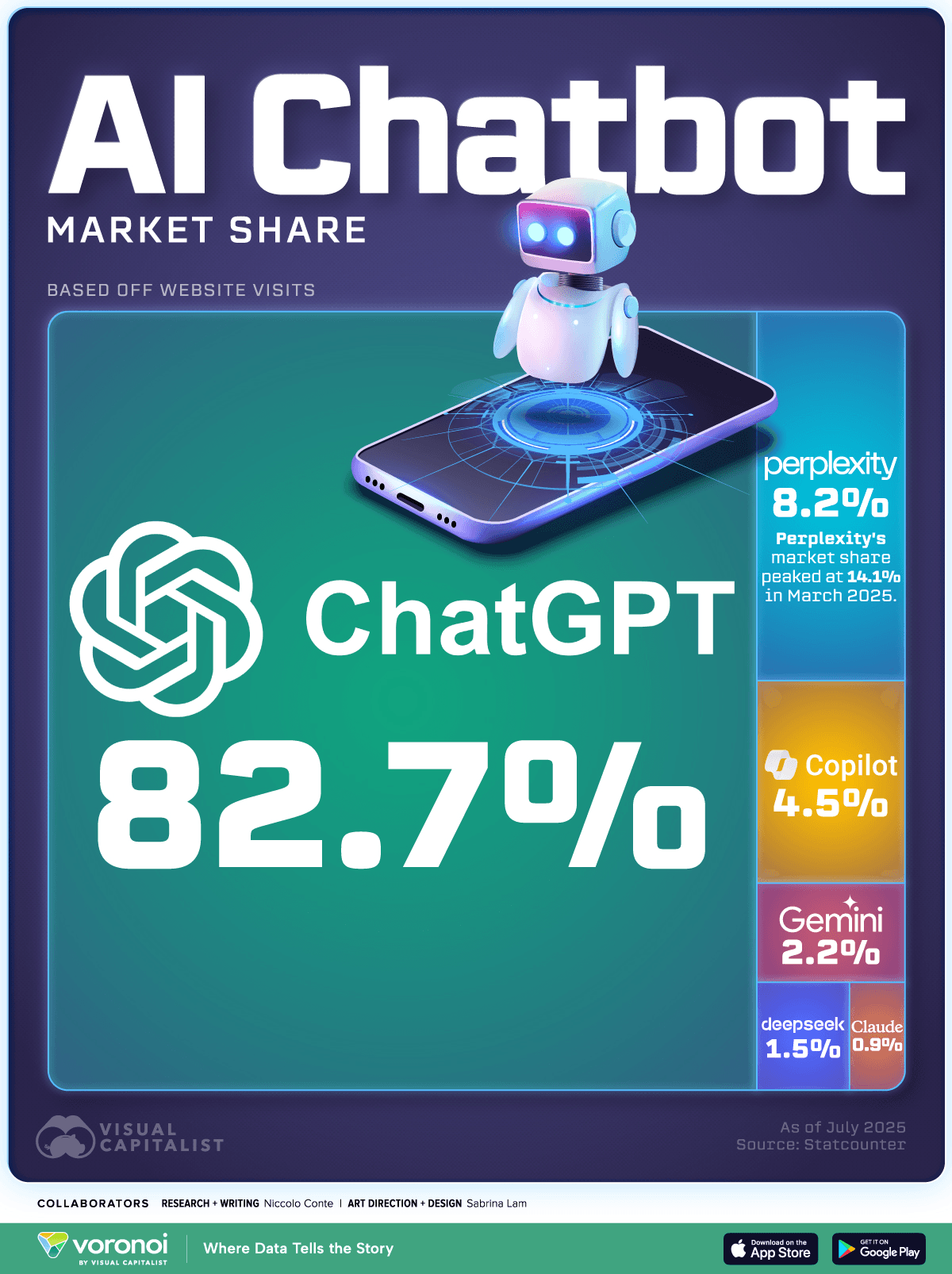

Buffett bulls argue Alphabet is positioned to dominate AI search through Gemini and Google Cloud. But the data tells a more nuanced story.

Google's global search market share has dipped below 90% for most of 2025—a milestone it hadn't hit since 2015. That might sound like a rounding error, but when you process 5 trillion searches annually, even 1% market share equals billions in lost ad revenue.

Meanwhile, ChatGPT commands 80% of the AI chatbot market. Among 18-24 year olds, 66% now use ChatGPT to find information, compared to 69% who still use Google. The gap is closing fast.

The generational shift is even more concerning:

53% of Gen Z users now turn to TikTok, Reddit, or YouTube before Google when searching for information

ChatGPT traffic doubled between January and April 2025

Perplexity achieved 243% year-over-year growth in visits

Google's response—AI Overviews and AI Mode—has shown some traction, with 75 million daily active users in the U.S. But here's the problem: AI summaries reduce the need to click on ads. Google users are less likely to click on result links when an AI summary appears.

If AI search works too well, it cannibalizes the advertising model that generates 72% of Alphabet's revenue.

The Capex Arms Race Is Alarming

To compete in AI, Alphabet is spending like there's no tomorrow.

The company has raised its 2025 capex forecast three times—from $75 billion to $85 billion to now $91-93 billion. And they've already warned of a "significant increase" in 2026.

That's not a typo. Alphabet will spend nearly $93 billion on infrastructure this year alone, mostly on data centers and AI chips.

For context:

Combined Big Tech capex (Alphabet, Meta, Microsoft, Amazon) will exceed $380 billion in 2025

Alphabet's capex is now 24% of its total revenue

OpenAI incurred $5 billion in losses in 2024 running ChatGPT

The assumption is that this spending will generate outsized returns through cloud and AI services. But history shows that infrastructure arms races don't always end well for participants. The telecom capex bubble of the early 2000s comes to mind.

Worse, DeepSeek's emergence in early 2025 demonstrated that competitive AI models can be trained at a fraction of the cost, potentially undermining the entire premise that more capex equals better AI moats.

Waymo: The Overhyped Moonshot

Bulls love to cite Waymo as Alphabet's secret weapon—the robotaxi leader that could unlock a $480 billion market by 2032.

And yes, Waymo has genuine achievements:

250,000+ weekly trips across San Francisco, Phoenix, and LA

20 billion combined miles in real-world and simulated testing

First mover advantage after GM's Cruise collapsed in 2023

But let's be honest about the challenges:

Tesla just entered the ring. The company launched its robotaxi pilot in Austin in June 2025. Early results were chaotic—vehicles driving on the wrong side of the road, phantom braking, poor drop-offs—but Tesla has something Waymo doesn't: millions of vehicles already on the road collecting real-world driving data.

The economics are brutal. Waymo's multi-sensor approach costs $12,000+ per vehicle in lidar technology alone, compared to Tesla's $400 camera-only system. Each Waymo vehicle requires extensive pre-mapping of streets before deployment, limiting scalability.

Public sentiment is volatile. Angry residents have sabotaged Waymo vehicles with traffic cones. Protesters torched Waymos during LA civil unrest earlier this year. The Cruise debacle showed how quickly a single high-profile accident can derail an entire robotaxi program.

Waymo may well dominate the robotaxi market eventually. But "eventually" could be 5-10 years away, and the path is littered with regulatory, technological, and competitive landmines.

Who Actually Made This Buy?

Here's a detail the financial press mostly glosses over: we don't know if Buffett himself bought Alphabet.

Berkshire has two investment managers—Todd Combs and Ted Weschler—who handle smaller positions within the portfolio. Most analysts suspect they initiated the Alphabet stake, not Buffett.

The $4.9 billion position sounds massive, but it's only 1.4% of Berkshire's total equity portfolio. For perspective, Berkshire holds $382 billion in cash—the Alphabet buy represents 1.3% of that cash pile.

This isn't Buffett going all-in on a high-conviction bet. This is a rounding error for a company that has been a net seller of stocks for three straight years.

And here's the uncomfortable irony: at 95 years old, with just weeks left as CEO before passing the baton to Greg Abel, Buffett is finally buying a tech stock he admitted missing 15 years ago. That's not visionary investing. That's a lifetime of FOMO finally finding an outlet.

The Succession Question

Speaking of Greg Abel: what happens next?

Buffett has run Berkshire for six decades with 19.9% compound annual returns, nearly doubling the S&P 500. Abel is a skilled operational manager—he ran Berkshire Hathaway Energy—but he has no track record as a stock picker.

The Alphabet purchase may be less about conviction and more about legacy management. Buffett is handing over a $382 billion war chest and a portfolio that has underperformed the S&P 500 by 32 percentage points since May.

Adding Alphabet—a popular, liquid, "can't get fired for buying" stock—gives Abel optionality. It's insurance against looking foolish if AI takes over the world.

But that's not the same as value investing.

What the Bulls Are Really Saying

Strip away the breathless coverage and here's the bull case:

Alphabet is the "cheapest" Mag Seven stock at ~27x earnings

Google Cloud is growing 32-34% annually with healthy margins

AI Overviews and Gemini show Google can compete in AI

Search remains a cash cow with 90% market share

Waymo leads robotaxis; quantum computing offers optionality

All of this may be true. But it doesn't justify buying a stock after a 50% run—especially when the purchaser has been selling everything else and screaming about overvaluation through his actions.

The financial media is doing what it always does: reverse-engineering a bullish narrative from a famous investor's actions. But Buffett has made mistakes before. He held airline stocks too long, bought Kraft Heinz at a premium, and admitted he "screwed up" by not buying Google years ago.

Maybe this time is different.

Or maybe the Oracle of Omaha is just another mortal chasing a stock that got away.

The Bottom Line

Warren Buffett buying Alphabet is newsworthy, but it's not gospel. The timing is questionable, the valuation is stretched, the legal risks are real, and the competitive threats are mounting.

Most importantly, the purchase contradicts Buffett's own behavior: selling stocks, hoarding cash, refusing buybacks, and warning through every action that this market is too expensive.

If you're thinking about following Buffett into Alphabet, ask yourself: Would you buy this stock if you didn't know Buffett owned it?

At 28x earnings after a 50% rally, with $20 billion in annual payments at legal risk and AI competition intensifying, Alphabet looks less like a value play and more like the high-multiple growth stock Buffett has spent his career avoiding.

The Oracle may be buying. But that doesn't mean you should too.

NEVER MISS A THING!

Subscribe and get freshly baked articles. Join the community!

Join the newsletter to receive the latest updates in your inbox.