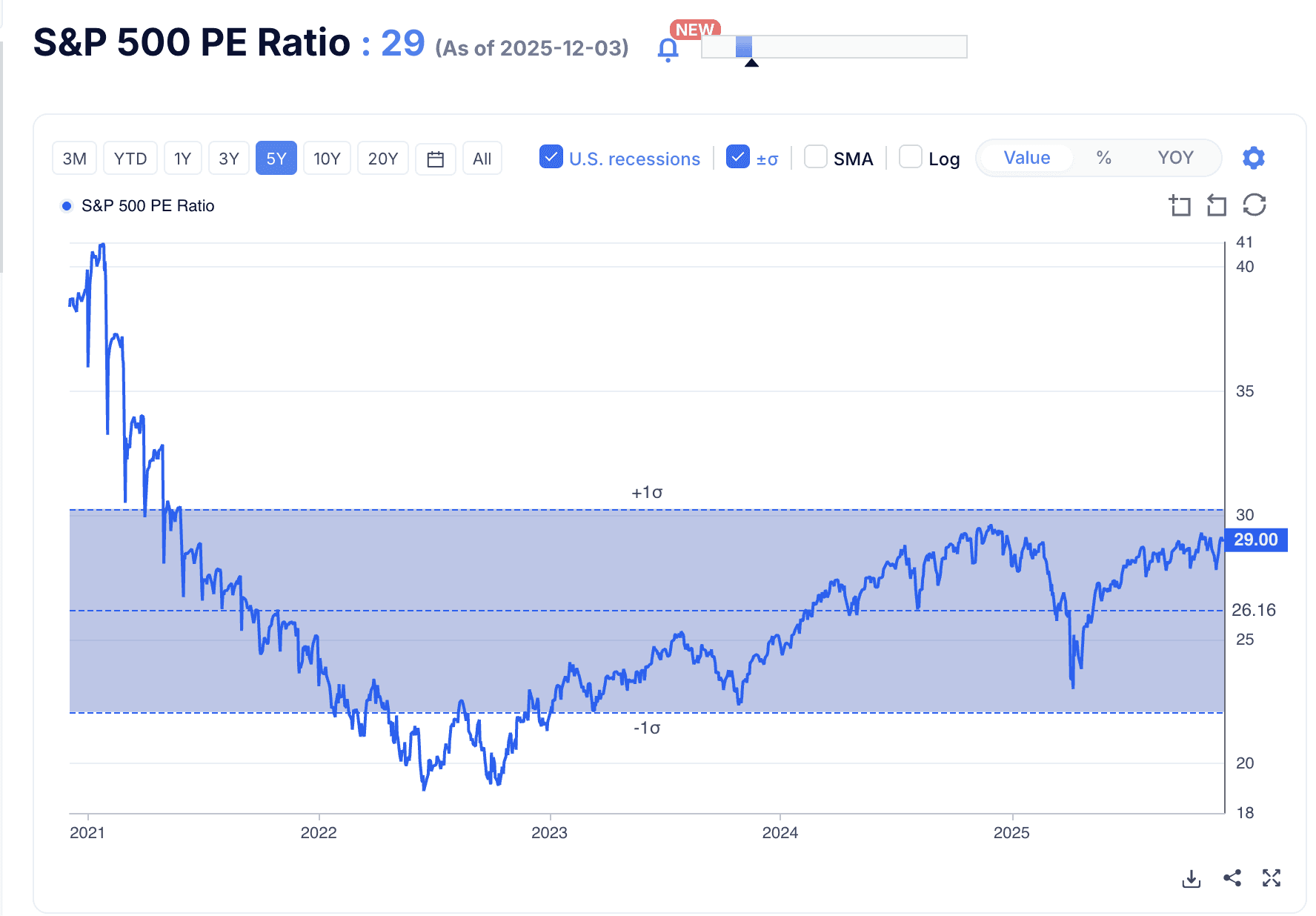

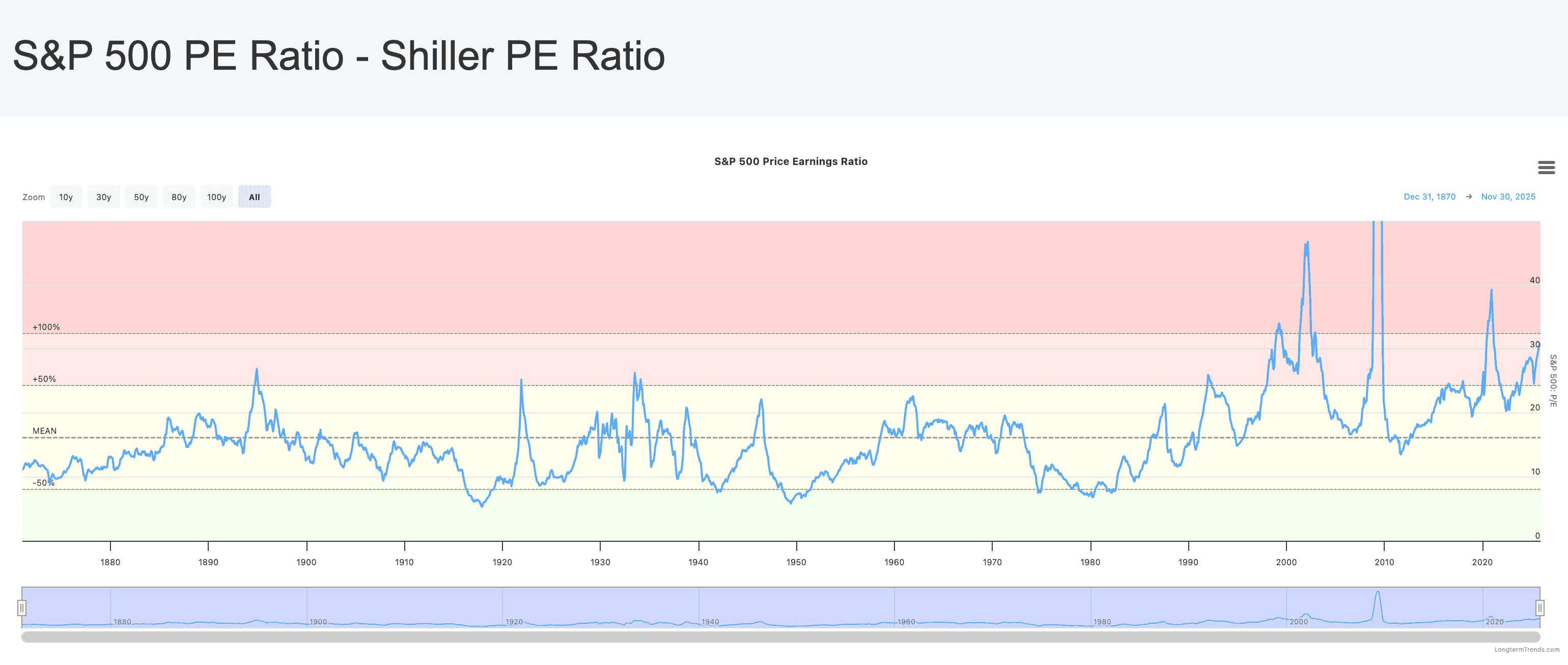

The market's drunk on optimism. The S&P 500's P/E ratio hit 30.73 in December 2025—a level 90% above its historical average and only exceeded during the dot-com bubble. Yet amid this froth, genuine bargains still exist. You just need to know where to look.

Finding stocks trading below intrinsic value isn't rocket science, but it does require abandoning the herd mentality. While CNBC talking heads chase momentum and Robinhood traders pile into whatever's trending on Reddit, value investors are doing the math—calculating what businesses are actually worth versus what Mr. Market is charging for them.

Here's how to stop overpaying and start finding real value.

The Ground Truth: What Intrinsic Value Actually Means

Intrinsic value is simple: it's what a business is genuinely worth based on the cash it'll generate over its lifetime. Not what some analyst thinks. Not what the market "values" it at today. What it's actually worth.

Warren Buffett's mentor Benjamin Graham called this the cornerstone of intelligent investing. The concept is straightforward—calculate all future cash flows a company will generate and discount them to present value. If that number is higher than the stock price, you've found an opportunity.

The market hates this approach because it requires patience and independent thinking. But here's the thing: when you buy $1 of value for 70 cents, you've got a built-in margin of safety—a cushion against your own miscalculations and market volatility.

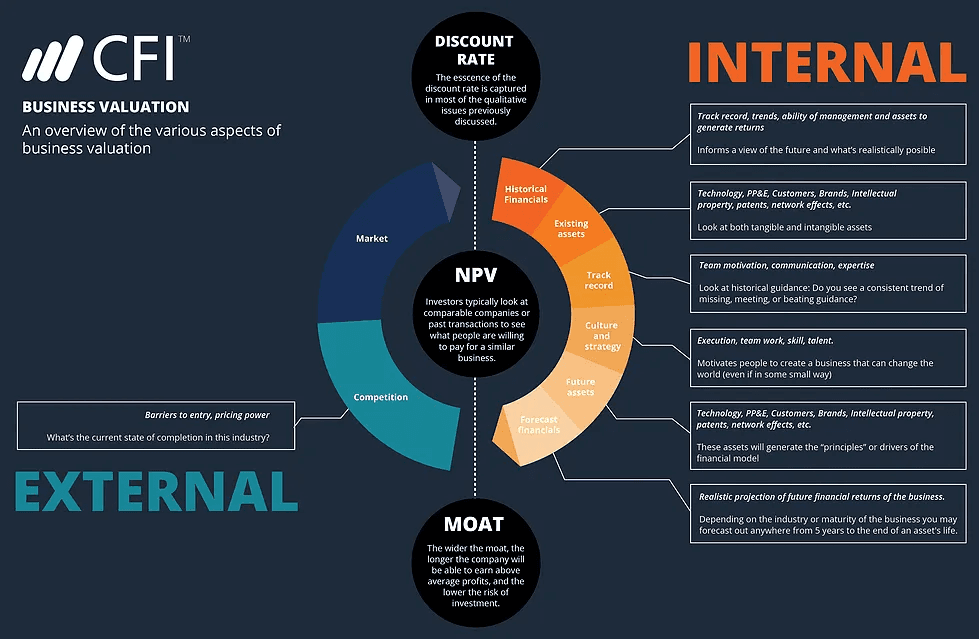

Method 1: Discounted Cash Flow—The Gold Standard

DCF analysis is how the pros actually value companies. It's not sexy, but it works.

The formula itself is elegantly simple: take each year of future free cash flow, discount it back to today using an appropriate rate (usually 8-12% depending on risk), then sum it all up. Add the terminal value—what the business is worth beyond your projection period—and you've got intrinsic value.

Here's what you need:

Free cash flow projections for 5-10 years (be conservative)

A discount rate that reflects the risk (your required return)

Terminal growth assumptions (usually 2-3%, matching GDP)

Current debt and cash to adjust enterprise value to equity value

The beauty of DCF? It forces you to think critically about a business. Can this company actually grow earnings 15% annually? What competitive advantages protect its margins? What could go wrong?

According to GuruFocus, Apple's intrinsic value based on projected free cash flow sits around $93.30 per share—yet the stock trades at $270, suggesting it's richly valued at 2.9x intrinsic value. Meanwhile, NVIDIA shows an intrinsic value of $209.12 against a market price of $179.92—a rare 14% discount in today's expensive market.

Show Image Source: Corporate Finance Institute

Method 2: The P/E Ratio Reality Check

Price-to-earnings ratios get dismissed as too simple. That's precisely why they're valuable—everyone else is overcomplicating things.

Here's the brutal truth: the median historical P/E ratio is around 17.98. Anything substantially below that deserves investigation. Anything substantially above it requires extraordinary justification.

In late 2025, Information Technology stocks trade at P/E ratios of 40.65, while Energy languishes at 15.03 and Financials at 18.09. This spread matters. It tells you where optimism has gotten out of hand and where pessimism has created opportunities.

The trick? Compare P/E ratios within sectors, not across them. A utility with a P/E of 18 might be expensive. A high-growth software company with the same multiple could be a steal—if growth justifies it.

Look for:

Companies with P/E ratios 20-30% below their industry average

Businesses where earnings are stable or growing but the multiple compressed

Situations where temporary problems dragged down the price but not the fundamentals

Method 3: Asset-Based Valuation—The Floor Value

Sometimes the simple stuff works best. Asset-based valuation asks: if you liquidated this company tomorrow, what would shareholders get?

The formula: Total Assets - Total Liabilities = Book Value

Divide that by shares outstanding and you've got book value per share. If a stock trades below book value, you're theoretically buying assets for less than they're worth. This method works best for:

Financial companies (banks, insurers)

Asset-heavy businesses (real estate, natural resources)

Distressed situations where the market has given up

The limitation? It ignores future earnings power. A company might have valuable brands, patents, or market position that don't show up on the balance sheet. Still, it provides a useful floor for valuation.

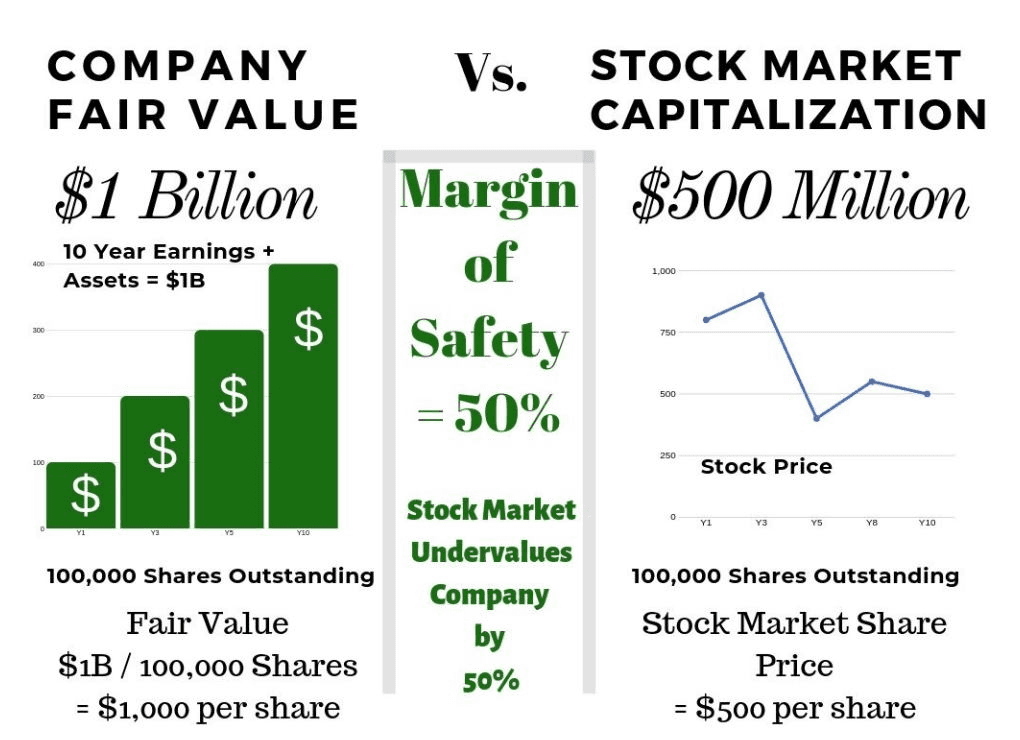

The Margin of Safety: Your Insurance Policy

Buffett calls it the "three most important words in investing." The margin of safety is the gap between intrinsic value and purchase price—your cushion against being wrong.

Calculate it simply:

Margin of Safety = (Intrinsic Value - Stock Price) / Intrinsic Value

Buffett typically demands at least 20-30%, though he'll take less for businesses he deeply understands. If you calculate a company is worth $100 per share, wait for it to hit $70 before buying. That 30% discount protects you if your projections prove optimistic or unforeseen problems emerge.

As Buffett puts it: "When you build a bridge, you insist it can carry 30,000 pounds, but you only drive 10,000 pound trucks across it."

Where to Actually Find Undervalued Stocks

Theory is useless without application. Here's where to hunt:

Sector rotations: When entire industries fall out of favor, quality companies get dragged down with the garbage. Healthcare stocks traded 5% below fair value in Q4 2025, creating opportunities.

Earnings misses: A company misses quarterly estimates by 2% and the stock drops 15%. If the long-term thesis remains intact, that's your chance.

Market panics: Tariff fears hammered names like SharkNinja in 2025 despite operational improvements. Fear creates discounts.

Boring businesses: Nobody wants to talk about Campbell's Soup at parties, yet it trades 50% below Morningstar's fair value estimate of $60 per share. Unsexy can be profitable.

The Screener Approach

Stop manually reviewing 5,000 stocks. Use screeners to filter for:

P/E ratios below 15

Price-to-book ratios under 1.5

Debt-to-equity below 0.5

Positive free cash flow

5-year earnings growth above 5%

This narrows your universe to maybe 50-100 names. Then do the actual work—read financial statements, understand the business model, calculate intrinsic value.

Red Flags to Watch For

Not every "cheap" stock is undervalued. Some are cheap for damn good reasons:

Declining revenues year over year with no turnaround plan

Mounting debt that could cripple the business in a downturn

Obsolete business models (think newspapers or mall retailers)

Accounting shenanigans that inflate earnings

Management with poor capital allocation track records

The difference between value and a value trap is whether fundamentals will improve or deteriorate. If a company is cheap because it's dying, that's not opportunity—that's a falling knife.

Actually Calculating It: A Quick Example

Let's say you're eyeing a regional bank trading at $25 per share:

DCF: Project $3/share in free cash flow growing 5% annually. Using a 10% discount rate over 10 years plus terminal value, you get intrinsic value of $35

P/E Check: Trades at 8x earnings vs. sector average of 12x

Book value: $30 per share

With intrinsic value around $35 and a price of $25, you've got a 29% margin of safety. The sector P/E discount and below-book trading confirm the discount. If you understand the business and risks, that's an attractive entry point.

The Contrarian's Edge

Here's what Wall Street won't tell you: most stocks trade at fair value most of the time. Finding genuine mispricing requires contrarian thinking and emotional discipline.

You're looking for situations where:

The market overreacts to temporary bad news

Good businesses get tarred with their industry's problems

Complex situations scare off lazy investors

Mr. Market is being irrational

Campbell's, Micron, and Intel all faced skepticism in 2025, yet each possessed competitive advantages and traded well below calculated fair value. The crowd's skepticism created opportunity.

The Bottom Line

With the market trading at nose-bleed valuations and euphoria replacing analysis, finding intrinsic value matters more than ever. The process isn't complicated—calculate what businesses are worth, buy them for less, wait for the market to recognize the gap.

Most investors won't do this work. They'll chase trends, buy high, and wonder why they underperform. That's fine. Their impatience is your opportunity.

The formula hasn't changed since Graham wrote it down decades ago: Know what you own, know what it's worth, and don't overpay. In a market where the P/E10 ratio sits 120% above historic averages, that discipline isn't just smart—it's survival.

NEVER MISS A THING!

Subscribe and get freshly baked articles. Join the community!

Join the newsletter to receive the latest updates in your inbox.