The casino has new dealers.

After years of tech supremacy—where NVDA could sneeze and the Nasdaq would rally 2%—the 2025 market has decided it's bored with the Magnificent Seven party. The Nasdaq plunged over 6% year-to-date through early March while value stocks climbed nearly 2% and international equities surged over 11%. The crowd that spent three years buying every AI dip is now staring at red portfolios, wondering what happened.

What happened is sector rotation. And if you weren't watching the signals, you got caught holding the bag.

The good news? Sector rotation isn't black magic. It's detectable, measurable, and—if you know where to look—exploitable before the herd even realizes the music stopped.

Here's how to ride the wave instead of drowning in it.

The Rotation No One Saw Coming (Except Those Who Did)

Let's get something straight: the market's rotation from growth to value in 2025 wasn't a "surprise." It was telegraphed for months by anyone bothering to watch the actual data instead of CNBC's breathless AI hype.

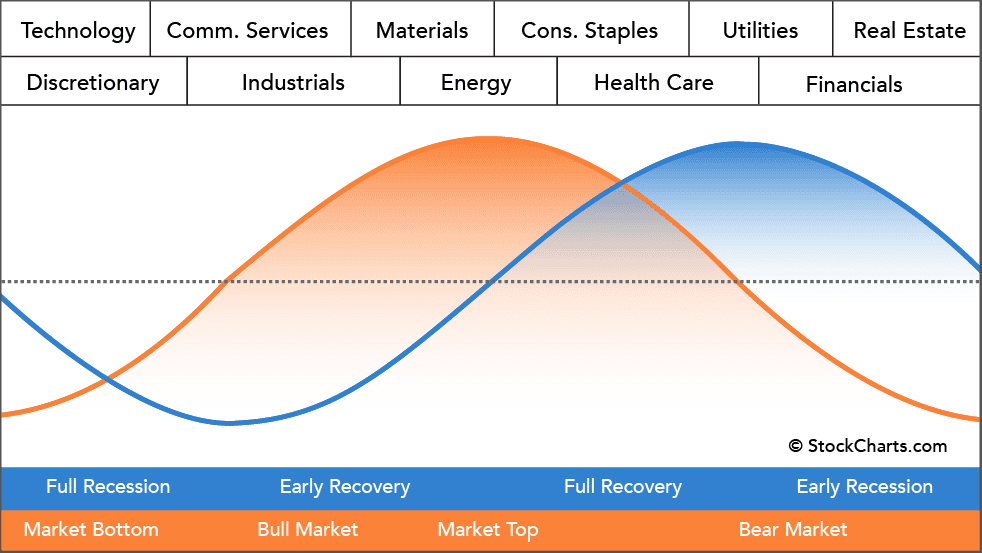

In November 2025, the shift accelerated. Capital flooded out of high-growth tech and into traditional, undervalued cyclicals. Why? Moderating global growth, persistent inflation, and evolving central bank policies created a perfect storm for rotation. The multi-year dominance of mega-cap tech stocks gave way to diversified market leadership.

Translation: When everyone's chasing the same trade, smart money quietly exits stage left.

The Four Quadrants That Tell You Everything

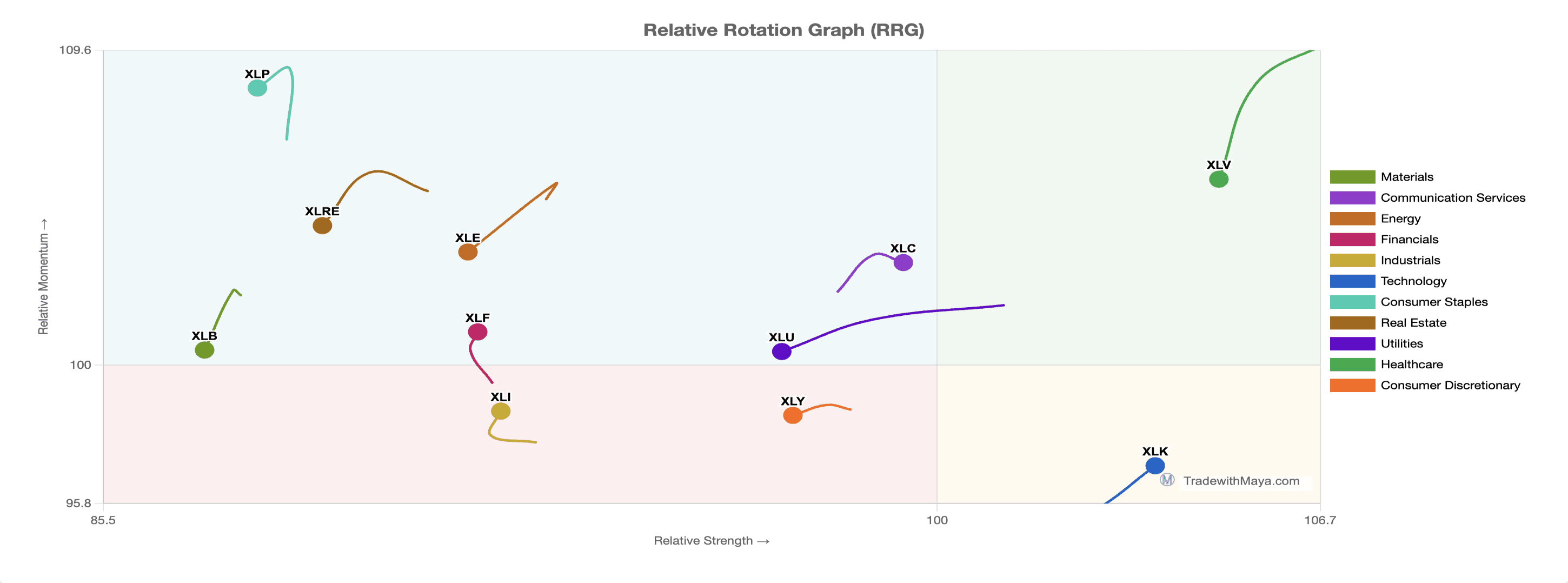

Forget crystal balls. The best tool for spotting rotation early is the Relative Rotation Graph (RRG)—a visual that plots sectors across four quadrants based on relative strength and momentum.

Leading: Upper right. Strong performance, positive momentum. This is where the money is now.

Weakening: Lower right. Still strong, but momentum fading. Smart money starts trimming here.

Lagging: Lower left. Poor performance, negative momentum. Where portfolios go to die.

Improving: Upper left. Weak but gaining steam. This is where contrarians make their money.

Healthcare (XLV) has been rotating from lagging into improving, signaling relative strength is building. Meanwhile, technology is sliding from leading into weakening—not a sell signal yet, but a flashing yellow light that leadership doesn't last forever.

The beauty of RRGs? They show you not just where sectors are, but where they're going. Sectors typically rotate clockwise through these quadrants, following economic cycles like a predictable drunk stumbling home.

Economic Indicators: The Signals Everyone Ignores

You want to spot rotation before it happens? Watch the economic data the market pretends doesn't exist until it's too late.

ISM Manufacturing PMI: Fell to 48.2 in November 2025, marking nine consecutive months of contraction. Below 50 means the manufacturing sector is shrinking—bad news for industrials and materials, potentially good for defensives.

Services PMI: Held at 52.6 in November, barely above expansion territory. Services make up most of the economy, so when this number starts sliding toward 50, brace yourself.

These aren't abstract numbers. They're early-warning systems. When manufacturing contracts for nine straight months, cyclicals suffer and defensives shine. When services growth stalls, consumer discretionary gets hammered and staples hold firm.

Follow the Money (Not the Narrative)

Here's the dirty secret Wall Street won't tell you: narratives follow money flows, not the other way around.

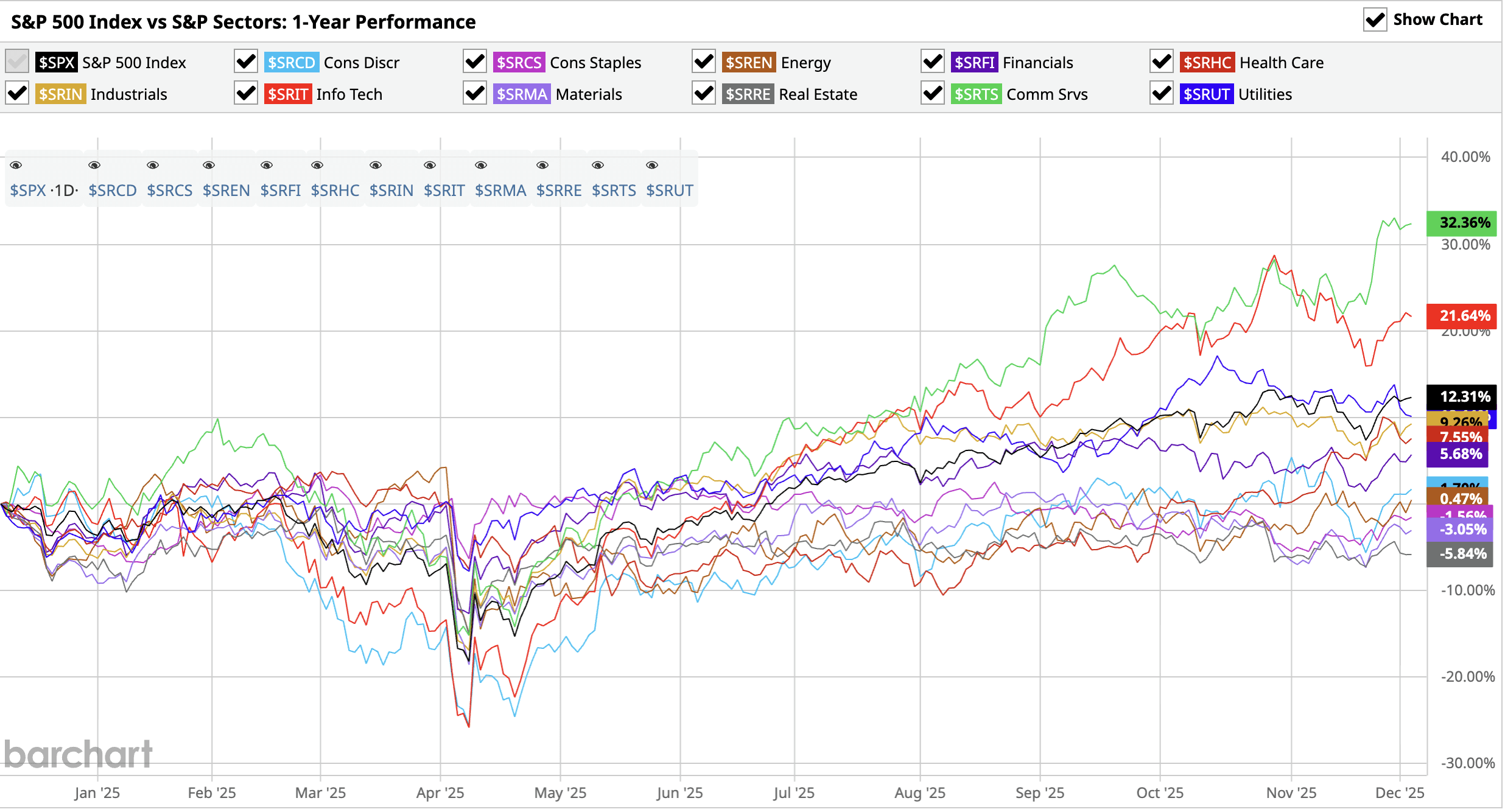

In early 2025, energy and healthcare led Q1 performance with gains of 10% and 7% respectively, while the S&P 500 dropped 4.59%. The narrative? "Investors seek safety amid uncertainty." The reality? Smart money rotated into sectors with strong fundamentals before the headlines caught up.

Gold surged 1.9% in November while tech consolidated. Silver spiked 4%, extending its 80% year-to-date surge—the strongest since 2010. These aren't coincidences. They're capital flows screaming that risk appetite is shifting.

Tools like insider trading data can provide prescient signals. Corporate insiders—the people who actually know their businesses—often telegraph sector strength or weakness before it becomes common knowledge. When insider buying outpaces selling in consumer staples and real estate while tech sees selling ratios above 13:1, that's not noise.

The DeepSeek Disruption and Why Tech's Throne Is Wobbly

In January 2025, DeepSeek disrupted the AI narrative, raising uncomfortable questions about mega-cap tech's $50+ billion annual capital expenditures. If competitors can deliver comparable AI performance cheaper, will that capex generate sufficient returns?

The market's answer so far: maybe not. Tech stocks faced growing differentiation in performance, regulatory heat, and slower consumer hardware cycles. The "buy everything AI" trade fractured into winners and losers.

Meanwhile, the Dow broke above 48,000 as investors rotated into financials and industrials—stocks with earnings visibility, dividends, and balance sheet strength. Tangible earnings power over speculative AI valuations.

How to Actually Use This Information

Spotting rotation is worthless if you don't act on it. Here's the playbook:

1. Monitor sector ETF fund flows weekly. When capital starts rotating out of XLK (tech) and into XLV (healthcare) or XLE (energy), that's your signal.

2. Use momentum indicators with a 90-120 day window. Quarterly rebalancing strikes the balance between capturing opportunities and managing transaction costs.

3. Watch the VIX and correlations. Lower correlation among S&P 500 stocks creates opportunity for sector rotation strategies. When stocks move independently, stock-picking and sector-picking matter more.

4. Track the yield curve and Fed policy. When rate cuts are priced in (about three cuts currently), financials and utilities get more attractive. Falling rates benefit debt-laden sectors.

5. Don't fight the business cycle. Early expansion favors consumer discretionary, financials, and tech. Late expansion benefits industrials, materials, and energy. Early contraction? Utilities and consumer staples. Know the cycle, position accordingly.

The Contrarian's Edge

Here's where it gets interesting: defensive sectors like healthcare are moving from lagging into improving. The crowd isn't there yet—they're still chasing last quarter's winners in communication services and consumer discretionary.

But the RRG doesn't lie. Healthcare is pressing against resistance near $140, with a Bollinger Band squeeze suggesting volatility is building. If it breaks above $140 with volume, early movers could capture 15-20% before the institutional herd arrives.

The key is patience. Rotation takes time. By the time CNBC hosts are breathlessly recommending healthcare stocks, the easy money is gone.

The Macro Mess Underneath Everything

Let's not pretend this is happening in a vacuum. Tariffs, government shutdowns, and geopolitical tensions are creating the volatility that enables rotation. Trade policy uncertainty makes it nearly impossible for analysts to forecast sector impacts with confidence.

Manufacturing has contracted for nine months. Services growth is barely positive. The economy is neither hot nor cold—it's tepid, confused, and vulnerable to shocks.

This environment rewards nimbleness over conviction. The days of buying tech and holding for five years are over. Welcome to tactical reallocation.

Final Word: Be Early or Be Average

The herd is always late. By the time sector rotation becomes "consensus," the alpha is gone and you're left fighting for scraps.

The 2025 rotation from growth to value, from domestic to international, from tech to tangibles—this wasn't a surprise to anyone watching RRG charts, monitoring economic indicators, and tracking fund flows. They saw the music stopping and moved to cash, treasuries, or undervalued sectors before the stampede.

You can do the same. Tools exist. Data is available. The question is whether you're disciplined enough to use them instead of chasing narratives.

Because in markets, there are two types of investors: those who spot rotation early, and those who ask later, "What happened to my tech stocks?"

Choose wisely.

NEVER MISS A THING!

Subscribe and get freshly baked articles. Join the community!

Join the newsletter to receive the latest updates in your inbox.