Remember when Beyond Meat was supposed to revolutionize the global food system? When institutional investors were tripping over themselves to throw billions at plant-based protein, convinced they were funding the next Tesla of food?

Yeah, about that…

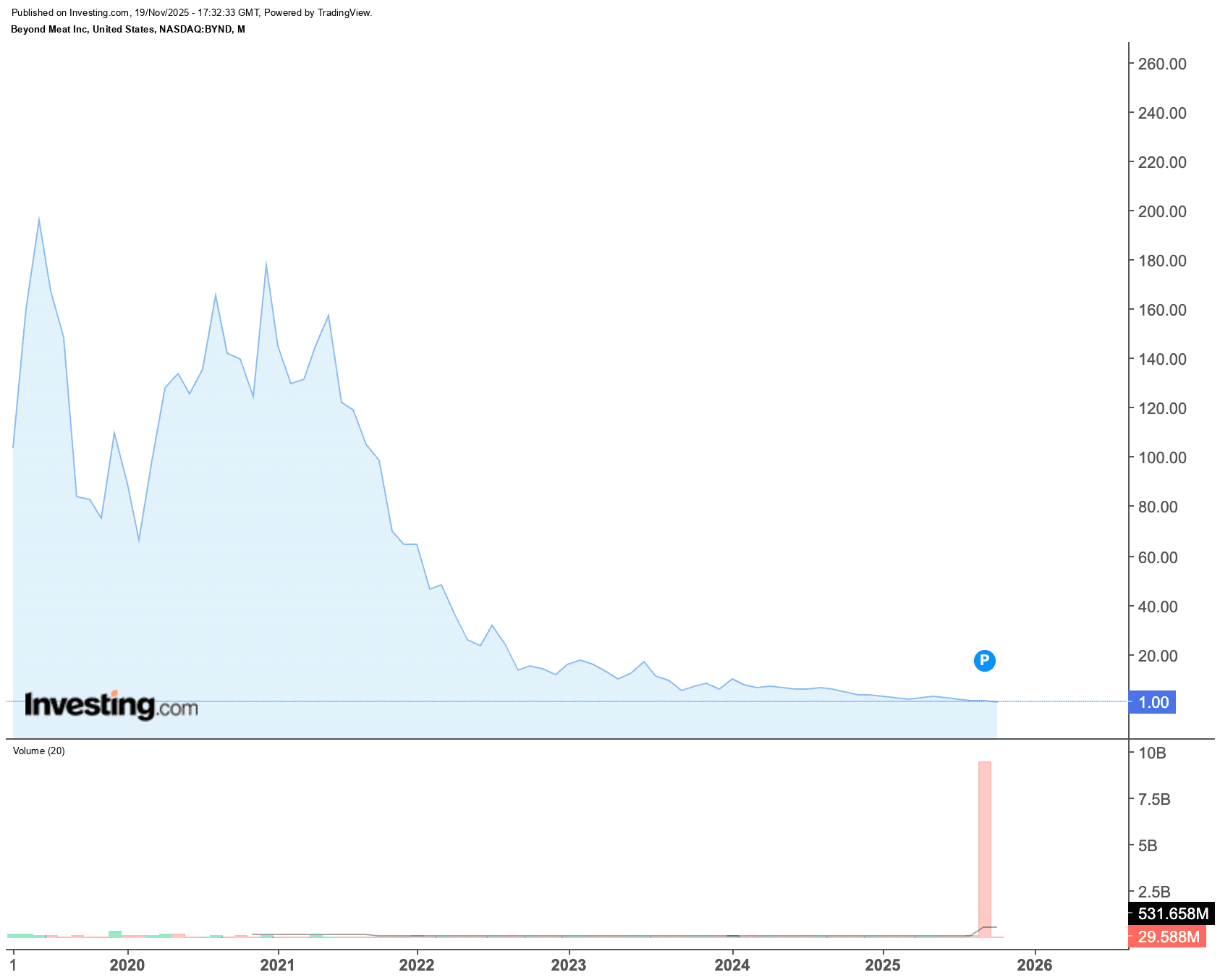

BYND now trades around $1 per share—down over 99% from its all-time high of $234.90 in July 2019. If you bought $10,000 worth of shares at the peak, you're looking at roughly $12 today. Not $12,000. Twelve dollars.

But here's the contrarian take nobody wants to hear: even at a buck a share, Beyond Meat might still be overpriced. Let me explain why this isn't a beaten-down value play—it's a masterclass in financial destruction.

The IPO Hangover That Became a Coma

When Beyond Meat went public in May 2019, shares soared 163% on day one—the best IPO performance in nearly two decades. Within months, the company commanded a market cap of $13.4 billion. Media outlets declared the end of the beef industry. VCs started hunting for the next plant-based unicorn.

The thesis was elegant: consumers would abandon traditional meat for health, environmental, and ethical reasons. Beyond would capture massive market share as the category leader. Margins would expand as production scaled.

Every single assumption proved catastrophically wrong.

Revenue peaked at $464.7 million in 2021 and has declined every year since—dropping to $343 million in 2023 and $326 million in 2024. The company hasn't turned a profit since going public. And the plant-based meat category itself? It's contracting.

The Category That Couldn't

Here's the brutal truth about plant-based meat: consumers tried it, and most decided they didn't want it.

According to the Good Food Institute, U.S. retail sales of plant-based meat dropped 7% in 2024 to $1.2 billion, with unit sales cratering 11%. That's the third consecutive year of decline. Meanwhile, conventional meat sales rose 4% over the same period.

The problems are structural:

Price premium: Plant-based products cost significantly more than traditional meat, and inflation-squeezed consumers aren't paying extra for something that doesn't taste as good

Taste gap: Despite billions in R&D, most plant-based products still don't satisfy consumers—36% of lapsed buyers say they'd return only if products tasted exactly like real meat

Ultra-processed backlash: Health-conscious consumers increasingly view plant-based meats as highly processed foods, undermining the wellness marketing angle

Repeat purchase failure: Only 15% of U.S. households purchased plant-based meat in 2023, and repurchase rates remain dismal

Funding for plant-based startups plummeted 64% in 2024 to just $309 million. The smart money isn't just leaving—it's sprinting for the exits.

Q3 2025: A Masterpiece of Destruction

Beyond Meat's latest quarterly results read like a corporate autopsy.

Net revenues fell 13.3% year-over-year to $70.2 million. Volume dropped 10.3%. U.S. retail sales cratered 18.4%. U.S. foodservice plunged 27%. The company reported a net loss of $110.7 million—compared to $26.6 million in the same quarter last year.

The headline number that should terrify existing shareholders: $77.4 million in non-cash impairment charges on long-lived assets. Translation? The company is writing down the value of production facilities it built during the growth-at-all-costs era because those assets will never generate the cash flows management projected.

Operating margin hit -160% in Q3. Not a typo. The company lost $112.3 million from operations on just $70 million in revenue.

CEO Ethan Brown acknowledged on the earnings call that the company has been in "turnaround mode for too long" and promised "more action than talk." Shareholders have heard variations of this sentiment for years.

The Debt Swap: A Pyrrhic Victory

In October 2025, Beyond Meat executed a debt restructuring that technically reduced its leverage but effectively destroyed existing shareholders.

The company exchanged $1.15 billion in 0% convertible notes due 2027 for new 7% convertible notes due 2030 worth about $208.7 million—plus over 316 million new shares of common stock.

Read that again: they issued 316 million shares against a previous base of 76.65 million. The share count more than quadrupled overnight.

Nearly 97% of bondholders accepted the exchange. Why? Because they knew the company couldn't repay the debt otherwise. The stock crashed 56% in a single session when the deal settled.

Now here's the kicker: note holders control approximately 81% of all outstanding shares—a stake that could grow to nearly 88% if the new convertible notes are fully converted. Existing shareholders are left holding a tiny fraction of a deeply troubled company.

The debt is gone. The company survives. Shareholders paid for that relief with nearly all their equity.

The Meme Stock Interlude

Just when you thought BYND couldn't get more absurd, meme traders arrived.

In mid-October 2025, social media influencers started pushing the stock as a short squeeze play, claiming short interest exceeded 100% of the float. The stock rocketed from $0.52 on October 16 to a pre-market high of $8.85 on October 22—a 1,600% gain in four days.

Then it collapsed back to around $1 within weeks.

The rally wasn't really a short squeeze. It was social media misinformation combined with FOMO. Short interest was elevated but nowhere near the levels being advertised on X. The newly issued shares from the debt swap actually gave short sellers more room to maneuver.

If you're looking at BYND as a squeeze candidate, understand what you're betting on: a company burning cash, losing revenue, facing securities fraud investigations, and with a share count that can expand further through note conversions. This is not GameStop in January 2021.

The Bull Case (Such As It Is)

Let's steelman the optimists for a moment.

Beyond Meat just expanded distribution to 2,000+ Walmart stores with a new value-pack Beyond Burger. The company's chicken pieces were named one of the best supermarket products of 2025. Product reformulations have improved taste scores, with the Beyond Burger IV winning blind taste tests against competitors.

Management is targeting run-rate EBITDA-positive operations by year-end 2026. They've reduced operating expenses and cut 6% of their workforce. The balance sheet, while still carrying $1.2 billion in debt, has extended maturities to 2030.

Long-term projections for the plant-based meat market remain optimistic. Various research firms forecast growth to anywhere from $24 billion to $100 billion by the early 2030s, depending on whose numbers you believe.

But here's the problem with the bull case: Beyond Meat has to survive long enough for any of these trends to matter. At current burn rates, that's far from guaranteed.

The Math That Matters

Let's talk numbers that actually matter.

Beyond Meat's cash position was $131.1 million as of September 2025. Net cash used in operations was $98.1 million through the first nine months of the year. At that rate, the company has roughly a year of runway without additional financing.

Total debt stands at $1.2 billion. The new convertible notes carry a 7% PIK interest rate—meaning the company can pay interest in stock instead of cash, further diluting shareholders.

Revenue guidance for Q4 2025 is $60-65 million, reflecting "ongoing demand weakness in the plant-based meat category and the anticipated impact from distribution losses at certain QSR customers."

The company's market cap is approximately $490 million. Its debt is roughly 2.5x its enterprise value. Gross margin, even excluding China suspension charges, sits around 12-13%—far below the 30%+ levels that would indicate a viable standalone business.

Even if you believe the category will eventually recover, you're buying into a capital structure where most of the upside accrues to note holders, not common shareholders.

Securities Fraud Investigations (Plural)

As if the fundamentals weren't concerning enough, multiple law firms have launched securities fraud investigations into Beyond Meat.

The investigations center on whether the company inflated the value of certain long-lived assets and misled investors about potential impairment charges. Beyond Meat had previously reclassified some assets as "held for sale" and indicated there were no impairments. Then came the $77.4 million impairment charge.

The company also disclosed that it expects to report a material weakness in internal control over financial reporting related to its impairment assessment.

These investigations may go nowhere. Class action lawyers chase ambulances. But the timing—right after a massive debt restructuring that transferred value from equity holders to note holders—raises legitimate governance questions.

What Happens Next

Let's map the scenarios.

Base case: Beyond Meat continues to shrink, cutting costs to chase break-even while the category stagnates. The company survives but generates minimal value for common shareholders. The stock trades between $0.50 and $2.00, subject to periodic meme-driven volatility.

Bull case: Plant-based meat demand rebounds as companies solve the taste/price equation. Beyond Meat captures outsized share through distribution wins like Walmart. The company reaches EBITDA profitability by 2027 and eventually refinances its debt. Stock trades to $5-10 over several years.

Bear case: Revenue continues declining. Cash runs out before profitability. The company raises additional dilutive capital or sells itself to a strategic buyer at a fraction of historical valuations. Common shareholders receive little to nothing.

Based on current trends, the base-to-bear cases appear most probable. The company has already "exhausted its main options" to drive growth, as one analyst noted. Product reformulation, consumer education, price reductions—none have moved the needle.

The Contrarian Take

Here's the uncomfortable conclusion: Beyond Meat isn't a contrarian buy just because it's down 99%.

True contrarian investing requires finding situations where the market is wrong—where fundamentals are better than prices suggest. With BYND, the market has arguably been too optimistic for years. The stock traded at 67x sales at its peak when Hormel traded at 2.6x. The category thesis failed. The financial execution failed. The capital structure now favors creditors over equity.

If you're genuinely contrarian, you might argue the short is still the better trade—even at these levels. The company can still dilute shareholders further through note conversions and ATM offerings. Revenue shows no signs of stabilizing. The meme rallies create periodic windows to short into strength.

Or you could simply step aside entirely. Not everything deserves capital. Sometimes the most contrarian move is refusing to play a rigged game.

Beyond Meat was supposed to change the world. Instead, it became a case study in why narrative investing destroys wealth—and why "down 99%" doesn't mean "can't go lower."

Disclosure: This analysis is for informational purposes only and does not constitute investment advice.

NEVER MISS A THING!

Subscribe and get freshly baked articles. Join the community!

Join the newsletter to receive the latest updates in your inbox.