The headlines say everything's fine. Only two banks failed in 2024 and 2025 each—historically normal, right? The FDIC is quick to reassure us that banking system vulnerabilities have decreased. Regulators point to improved capital ratios. Wall Street analysts nod along.

But dig beneath the surface and you'll find something far more unsettling: a perfect storm brewing in slow motion, hidden in accounting footnotes and regulatory carve-outs, waiting for the right catalyst to detonate.

The Ghost of SVB Still Haunts Balance Sheets

Remember March 2023? Silicon Valley Bank imploded in spectacular fashion, taking $209 billion in assets down with it. Two days later, Signature Bank followed. Then First Republic. The common thread? Unrealized losses on securities portfolios that looked fine on paper until depositors got spooked.

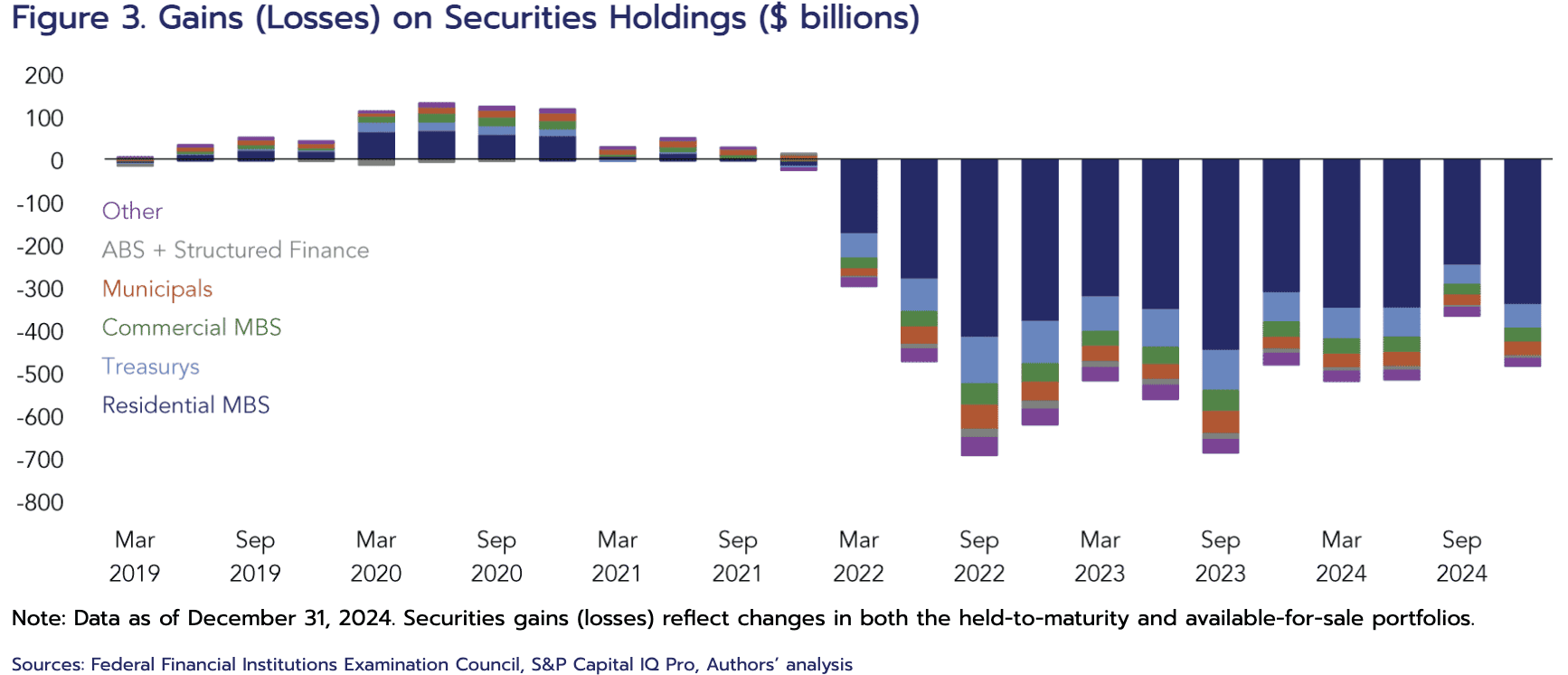

Fast forward to today. U.S. banks are sitting on $482.4 billion in unrealized losses on their securities as of Q4 2024—up $118 billion from just one quarter earlier. That's a 32.5% spike in three months.

These aren't losses that show up on income statements. They're the paper cuts that only bleed when you're forced to sell. And here's the kicker: the problem was supposed to be getting better as the Fed cut rates. Instead, long-term Treasury yields spiked from 3.80% to 4.57% between September and December 2024, hammering banks that loaded up on low-yield securities during the pandemic era.

As of Q4 2024, 34 banks with over $1 billion in assets reported unrealized losses equal to 50% or more of their Common Equity Tier 1 Capital—nearly triple the 12 banks in that category just one quarter prior. When half your capital cushion exists only because you haven't been forced to recognize your losses, you're not financially stable. You're playing accounting Jenga.

The Commercial Real Estate Time Bomb

If unrealized securities losses are the powder keg, commercial real estate is the fuse. And it's burning faster than anyone wants to admit.

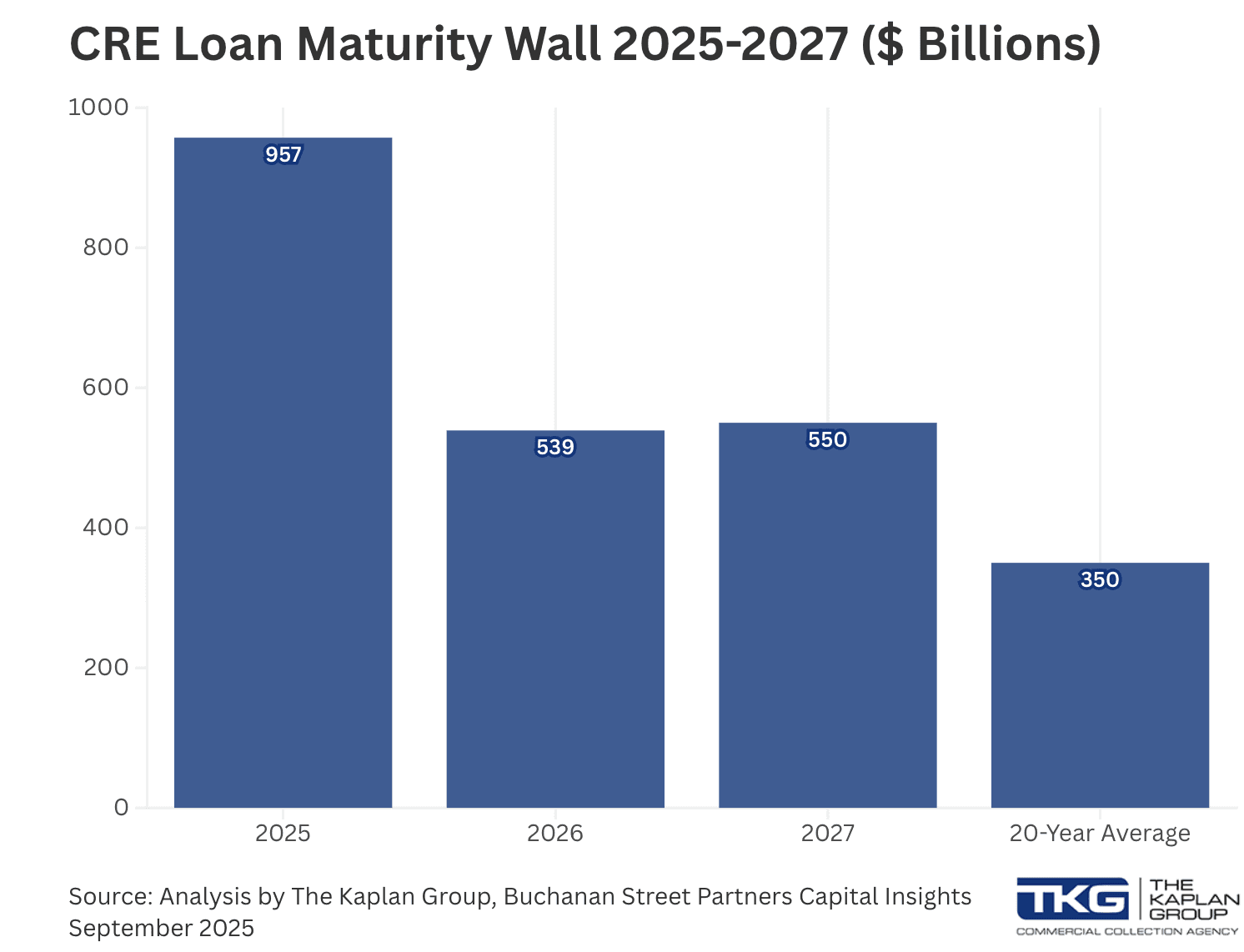

Nearly $957 billion in CRE loans are maturing in 2025—nearly triple the 20-year average. Banks hold roughly $452 billion of that. Another $936 billion matures in 2026. We're staring down a two-year refinancing gauntlet of unprecedented scale.

The problem isn't just the volume. It's the math. Many of these loans were originated when rates were 3-4%. Today's refinancing rates? Try 6-7%, sometimes higher. Office vacancy rates are hovering near 20% nationally, with CMBS delinquency rates at 7.29%—nearly six times higher than traditional bank loans.

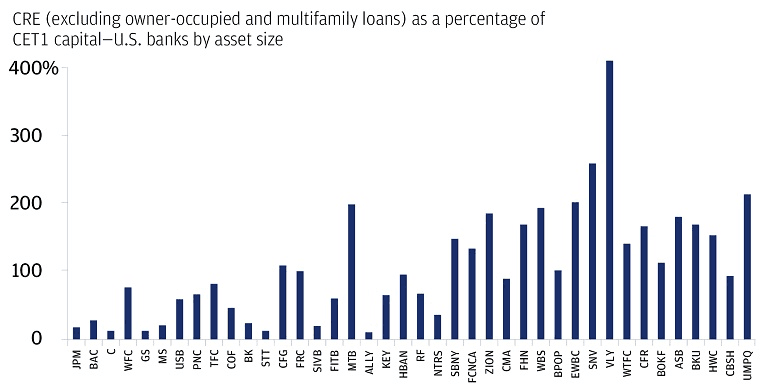

Regional banks are particularly exposed. 59 of the largest 158 U.S. banks have CRE exposures exceeding 300% of their equity capital. Banks like Flagstar, Zion Bancorp, Synovus, and Valley National Bank are sitting on powder kegs. New York Community Bancorp—with 57% of its loans in CRE—reported a $2.7 billion loss in late 2023 and needed a recapitalization.

CRE loan delinquencies have climbed to 1.57% as of Q4 2024—the highest in a decade. But here's what's really happening: "extend and pretend." Banks are restructuring loans, pushing out maturities, anything to avoid recognizing losses. It's a short-term salve that kicks the problem down the road while letting it metastasize.

The Uninsured Deposit Problem Nobody Fixed

SVB's collapse exposed an uncomfortable truth: 39% of all bank deposits are uninsured, sitting above the $250,000 FDIC limit. When SVB failed, the government made an "extraordinary decision" to protect all depositors, even those exceeding the limit, because the alternative was systemic panic.

But that decision created moral hazard on steroids. Too-big-to-fail banks implicitly know they'll get bailed out. Smaller banks watched and learned that if things get hairy enough, the backstop appears. Meanwhile, the FDIC estimates that providing blanket coverage would require increasing the insurance fund by at least 70% from its current $129.2 billion.

What we've created is a system where the rulebook says deposits above $250K are at risk, but everyone knows—everyone expects—that when push comes to shove, the government will step in. That's not deposit insurance. That's a put option written by taxpayers.

Regulatory Theater and Basel III Chaos

The post-SVB regulatory response has been… underwhelming. The Basel III implementation has fractured along national lines, with different jurisdictions implementing wildly different capital requirements. The UK postponed until January 2026. The EU signals further modifications. The result? Regulatory arbitrage—booking transactions wherever capital requirements are lowest.

Meanwhile, regulators still rely heavily on capital triggers to identify troubled banks. But as the GAO pointed out, SVB and Signature Bank had strong capital measures in 2022 before they failed in 2023. Capital ratios are lagging indicators. By the time they flash red, it's often too late.

The New York Fed's analysis shows that while banking system vulnerabilities have decreased from March 2023 levels, this improvement is fragile. It doesn't account for new vulnerabilities like CRE distress or delayed effects from pandemic-era loan forbearance. We're measuring yesterday's risk with yesterday's tools.

The Macro Headwinds

Let's talk about the elephant in the room: U.S. GDP growth has stalled at just 1.5%, down from 2.7% in 2024. Net interest margins are projected to compress to approximately 3% by year-end. Banks are caught in a vice—deposit competition forces funding costs up while asset yields decline.

The 10-year Treasury is hovering above 4.5%. One finance professor put it bluntly: the banking system starts "seeing serious problems" at this level. "It becomes quite bad at 5%," which would equate to $600-700 billion in unrealized losses.

If stagflation takes hold—persistent inflation with stagnant growth—banks will face the worst of all worlds: higher rates (more unrealized losses), slower economic activity (more loan defaults), and limited policy options to paper over the cracks.

What Happens Next?

Bank failures follow a predictable pattern. Rising asset losses, deteriorating solvency, increasing reliance on expensive noncore funding. Federal Reserve research spanning 1863 through 2024 confirms it: bank failures are highly predictable using simple accounting metrics.

The question isn't whether banks face stress. The data screams that they do. The question is whether this stress concentrates enough to trigger contagion or spreads out enough to be absorbed over time.

Big banks have diversified earnings and loan books. They've been reducing CRE exposure. They'll weather this storm. It's the regional and community banks—the ones with 300%+ CRE exposure, the ones sitting on unrealized losses equal to half their capital, the ones relying on uninsured deposits—that are vulnerable.

The Uncomfortable Truth

We're not in a banking crisis. Not yet. But we're walking a tightrope without a net, pretending the rope isn't fraying.

$480 billion in unrealized losses. $1 trillion in CRE debt maturing over two years. 39% of deposits uninsured. Regulatory frameworks playing catch-up. Economic growth stalling. It only takes one bad news story—one regional bank that can't extend another CRE loan, one unexpected deposit flight—to remind everyone that these paper losses are very real.

The ingredients for stress are present. The question is whether we get a controlled burn or a conflagration. History suggests that when you combine weak fundamentals, vulnerable funding structures, and adverse macro conditions, you don't get to choose.

Banks aren't on the brink. But they're closer than the headlines admit.

NEVER MISS A THING!

Subscribe and get freshly baked articles. Join the community!

Join the newsletter to receive the latest updates in your inbox.