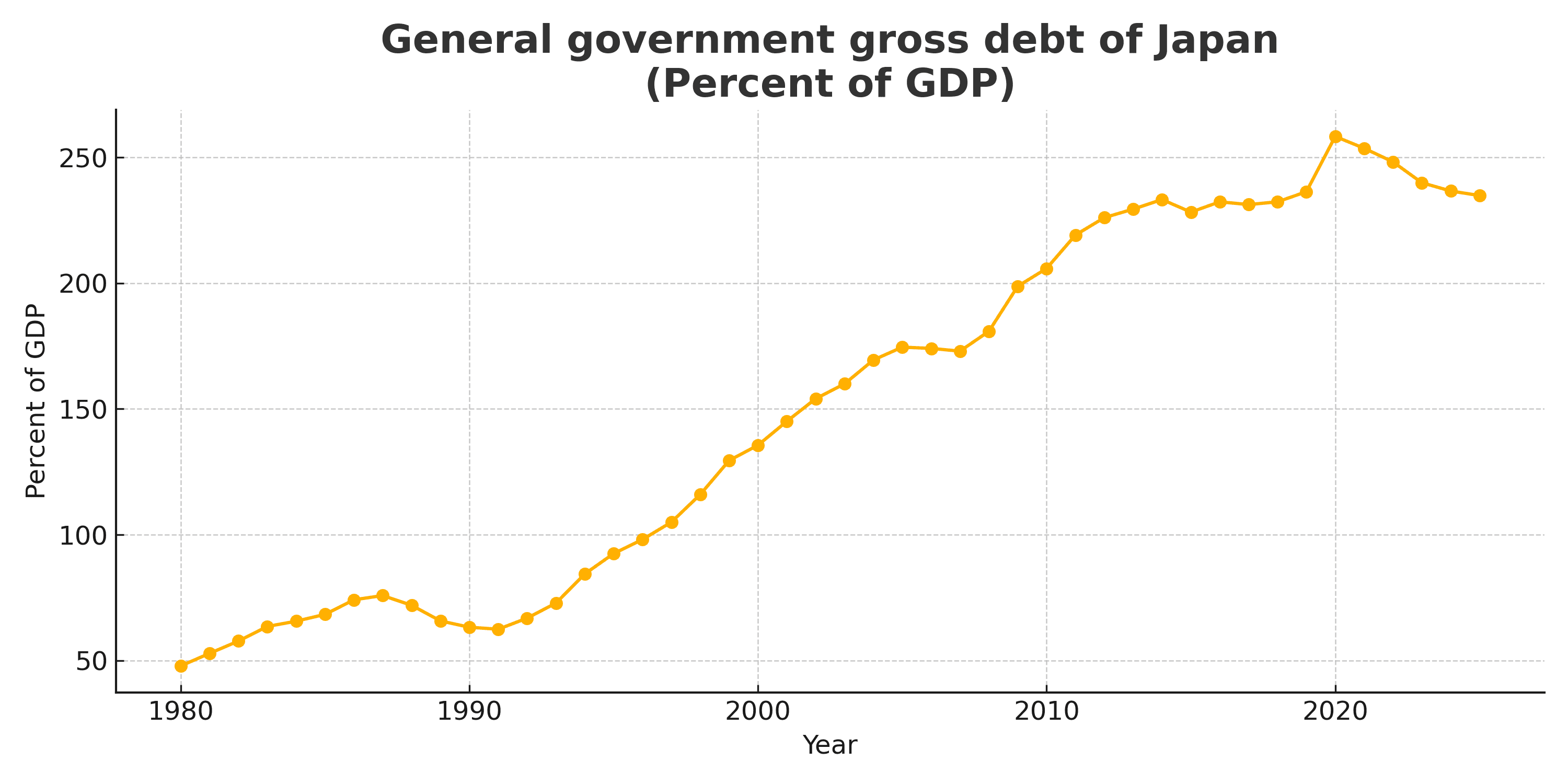

Everyone's watching Washington's debt ceiling drama while the real time bomb ticks in Tokyo. Japan's government debt stands at 235% of GDP—the highest among developed nations—and the bond market that's kept this Ponzi scheme alive for decades is finally cracking.

The warning signs aren't subtle. In May 2025, a routine bond auction attracted the weakest demand since 2012. The "tail"—the spread between average and lowest-accepted price—was the ugliest since 1987. Since then, 20-year, 30-year, and 40-year Japanese Government Bonds have been alarmingly undersubscribed.

"Japan is much closer to a debt crisis than people think," argues economist Robin Brooks at Brookings Institution. The question isn't if this blows up—it's when, and how much collateral damage the rest of us eat.

The Arithmetic Doesn't Work Anymore

Here's the setup that made Japan the "widow-maker trade" for two decades: the Bank of Japan owns 46.3% of all government debt, artificially suppressing yields while the government borrows to pay interest on existing bonds. It's financial engineering that would make Ponzi blush.

The machine worked as long as three conditions held:

Inflation stayed dormant (check, for 30 years)

The BOJ could keep buying unlimited bonds (check, until recently)

Demographics didn't matter because debt was all internal (check, until it wasn't)

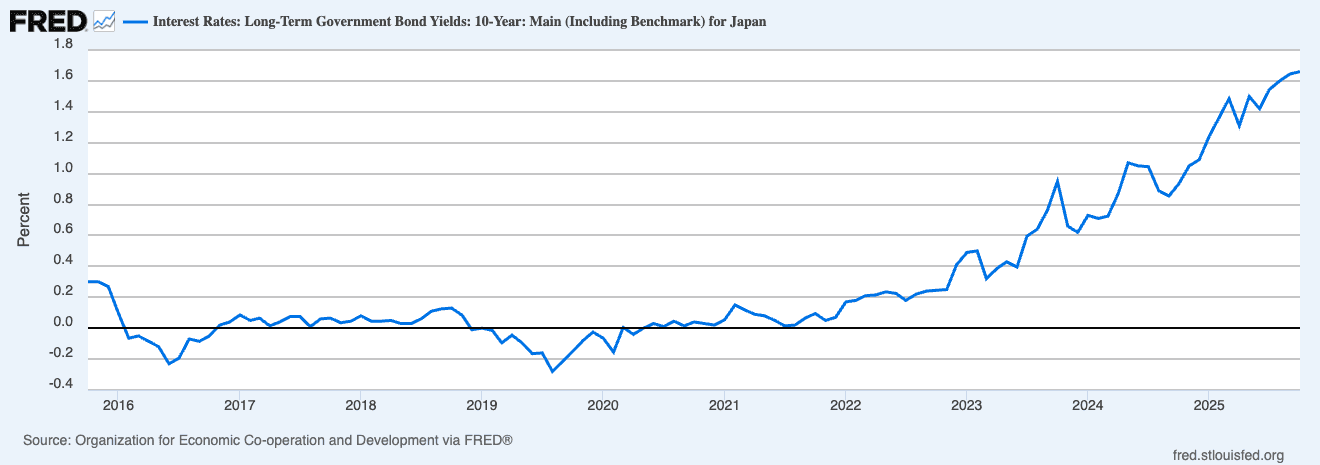

All three assumptions are now breaking simultaneously. Japanese inflation hit 3.1% year-over-year—well above the BOJ's 2% target—and has stayed elevated for over three years. The central bank raised rates to 0.5% in January 2025, the highest since 2008, and markets expect more hikes coming.

Meanwhile, Japan's population shrank by 0.75% in 2024—the largest drop since records began in 1968. An aging, shrinking workforce means fewer taxpayers servicing more debt. The share of population aged 65+ hit 30.2% in 2024 and is projected to reach 36.7% by 2045.

The Carry Trade Unwind Was Just the Warm-Up

August 2024 gave us a preview. When the BOJ hiked rates unexpectedly, the yen appreciated 6.15% in a week, triggering a cascade of forced liquidations. Japan's Nikkei plunged over 12% on August 5th—the steepest single-day drop since 1987. The S&P 500 fell 3% in sympathy.

The yen carry trade—borrowing in cheap yen to invest in higher-yielding assets globally—had grown to an estimated $1.1 trillion to $4 trillion depending on who's counting. The BIS estimated a middle range around ¥40 trillion ($250 billion) going into the August event, though that's likely understated due to data gaps.

JPMorgan's FX strategist said the carry trade unwind was only 50-60% complete as of August. That means there's still $500 billion to $2 trillion of levered positions that could unwind violently if Japanese yields keep climbing or the yen strengthens further.

Japanese investors have been buying U.S. equities and bonds largely unhedged for years. When the currency reverses, they don't sell Treasuries—they frantically hedge, which amounts to the same thing for market dynamics. U.S. momentum stocks got hammered in August because they were the most appreciated assets Japanese funds could liquidate quickly.

Bond Vigilantes Are Circling

The term "bond vigilantes"—investors who punish governments for fiscal irresponsibility by dumping their debt—was coined in the 1980s. They've been dormant in Japan for decades because the BOJ was the buyer of last resort. That's changing.

Foreign investors had been the dominant source of demand for super-long JGBs in the first half of 2025. Their sharp pullback in net buying raises serious concerns about instability at the long end of the yield curve. When your marginal buyer disappears, price discovery gets ugly fast.

The BOJ is trying to extricate itself from bond buying through "quantitative tightening." It plans to slow monthly purchases to ¥2 trillion by early 2027 from ¥3.5 trillion in September 2025. Sounds gradual, except the BOJ's holdings are so massive that huge amounts mature every month. Net purchases are already substantially negative even as it remains a gross buyer.

Translation: the BOJ is quietly letting bonds roll off its balance sheet while pretending to still support the market. It's trying to slowly deflate a bubble without anyone noticing. Good luck with that.

The Fiscal Path Is Unsustainable

The servicing cost of Japan's national debt ate 22% of the budget as of 2023—and that's with artificially suppressed rates. Every 1% increase in average borrowing costs adds trillions of yen to annual debt service.

Japan's new Prime Minister Sanae Takaichi is planning large fiscal stimulus including energy subsidies and cash handouts for households. This is how Japan ended up with 235% debt-to-GDP in the first place: responding to every economic hiccup with more debt-financed spending while pretending Modern Monetary Theory works if you just believe hard enough.

The parallels to what precipitated the UK's 2022 gilt crisis are uncomfortable:

Unsustainable fiscal expansion announced

Bond market revolts

Central bank forced to intervene

Currency collapses

Political chaos ensues

Except Japan's debt burden is 3x larger than the UK's was, and the global financial system is far more exposed to Japanese flows.

The Contagion Mechanism Is Already Built

Japan runs persistent current account surpluses with the U.S., meaning it lends to American government and corporations. Japanese institutional investors—banks, pensions, insurance companies—hold massive amounts of U.S. assets. When JGB yields become attractive relative to overseas alternatives, that capital comes home.

Albert Edwards at Societe Generale warned: "Both the US treasury and equity markets are vulnerable", having been inflated by Japanese flows. "If sharply higher JGB yields entice Japanese investors to return home, the unwinding of the carry trade could cause a loud sucking sound in US financial assets."

We got a taste in July-August 2024 when a BOJ rate hike triggered a 6% drop in the S&P 500. That was with rates moving from basically zero to 0.25%. Imagine what happens when they normalize to 2-3%.

The transmission channels are straightforward:

Higher JGB yields → capital repatriation → selling of U.S. Treasuries and equities

Yen strengthening → further carry trade unwind → forced selling of levered positions globally

Japanese bank losses on bond holdings → credit crunch → real economy impact

Contagion to other overleveraged sovereigns (looking at you, Italy and France)

Why This Time Really Is Different

Every Japan bear has been wrong for 30 years. The "widow-maker trade" earned its name because shorting JGBs has been consistently unprofitable despite fundamentals screaming it should work.

Here's what's different now:

Inflation has returned: The BOJ spent decades trying to create inflation. It succeeded, except now it can't control it. Core inflation stayed at 2.4% even after multiple rate hikes. Real wages are negative. The political pressure to fight inflation is building.

The demographics finally matter: Japan's working-age population is shrinking by nearly 1 million people per year. Fewer workers = less tax revenue = harder to service debt. This isn't theoretical anymore.

The BOJ has lost control: For decades, the central bank could suppress yields through unlimited buying. Now it's trying to normalize while holding 46.3% of outstanding debt. Any attempt to shrink its balance sheet pushes yields higher, making the debt unsustainable. It's trapped.

Global debt levels have spiked: Post-COVID, every developed nation borrowed massively. Markets are less forgiving of fiscal profligacy everywhere. The UK learned this in 2022. France is learning it now. Japan's turn is coming.

The Optimist's Case Is Unconvincing

Bulls point to several factors that supposedly make Japan special:

88% of debt is held domestically (mostly by the BOJ and banks)

Net debt is only 78% of GDP when accounting for government assets

Japan earns 6% annual return on its assets vs. funding costs between 2013-2023

Private sector savings are enormous—households hold over ¥2,000 trillion in financial assets

These arguments worked when rates were negative. They break down when the BOJ is forced to raise rates to combat inflation while simultaneously trying to shrink its balance sheet. The 6% return spread disappears when funding costs rise and asset values fall.

The "net debt" argument is accounting fiction. Most of those government assets are illiquid or represent claims on future tax revenues. You can't sell highways and bridges to pay bondholders.

As for domestic ownership, that just means the pain is concentrated domestically rather than imported. Japanese banks, insurers, and pension funds would eat catastrophic losses. The financial system would seize. Does that sound better?

What Happens When It Breaks

The most likely scenario isn't a sudden collapse but a grinding crisis that unfolds over 12-24 months:

Bond yields spike as foreign buyers disappear and the BOJ's taper accelerates

Currency volatility explodes as carry trades unwind in waves

Japanese financial institutions take massive losses on bond holdings

Capital flows reverse - repatriation out of U.S. assets, pressure on Treasuries

BOJ forced to choose between fighting inflation and supporting the bond market

Political crisis as government can't fund spending without printing money

Global contagion as overleveraged sovereigns face their own bond vigilantes

The catalyst could be anything: another bad bond auction, a political misstep on fiscal policy, an external shock that forces more BOJ tightening, or simply yields crossing a psychological threshold that triggers systematic deleveraging.

Markets will price this in gradually, then suddenly. The August 2024 carry trade unwind was a warning shot. The next one won't be temporary.

Portfolio Implications

If you're not positioned for Japanese systemic risk, you're not positioned for the next crisis. The playbook is straightforward:

Avoid long-duration Japanese bonds - you want to be a seller, not a buyer

Hedge yen carry exposure - if you're levered in global risk assets, understand your implicit yen short

Own gold - central banks are buying for a reason, and that reason rhymes with "fiat currency crisis"

Watch JGB yields - when 10-year breaks 2%, things accelerate

Prepare for Treasury weakness - Japanese repatriation will pressure U.S. bonds

The consensus view is that Japan muddles through because it always has. That's backward-looking thinking. The structural conditions that allowed the muddle—deflation, captive domestic buyers, BOJ dominance—are all reversing.

When a $7.8 trillion bond market with 235% debt-to-GDP breaks, the shrapnel hits everyone. Tokyo might be ground zero, but the blast radius is global.

Watch Japan. The widow-maker trade might finally collect.

NEVER MISS A THING!

Subscribe and get freshly baked articles. Join the community!

Join the newsletter to receive the latest updates in your inbox.