The "petrodollar agreement" supposedly expired in June 2024—except it never actually existed. Yet something real is dying, and the implications are seismic.

For fifty years, global oil trade operated on a simple premise: if you want oil, you need dollars. This arrangement gave Washington an "exorbitant privilege"—perpetual currency demand, artificially low borrowing costs, and weaponized financial control.

But the architecture is cracking. Saudi Arabia joined China's mBridge digital currency project in June 2024, a blockchain platform designed to bypass the dollar entirely. The kingdom's Treasury holdings swing wildly—$143.9 billion in September 2024, down to $126.4 billion by February, back to $131.7 billion by July. Meanwhile, China imports $63 billion in Saudi oil annually and settles 50% of cross-border trade in yuan.

The narrative that "nothing has changed" is cope. The data tells a different story:

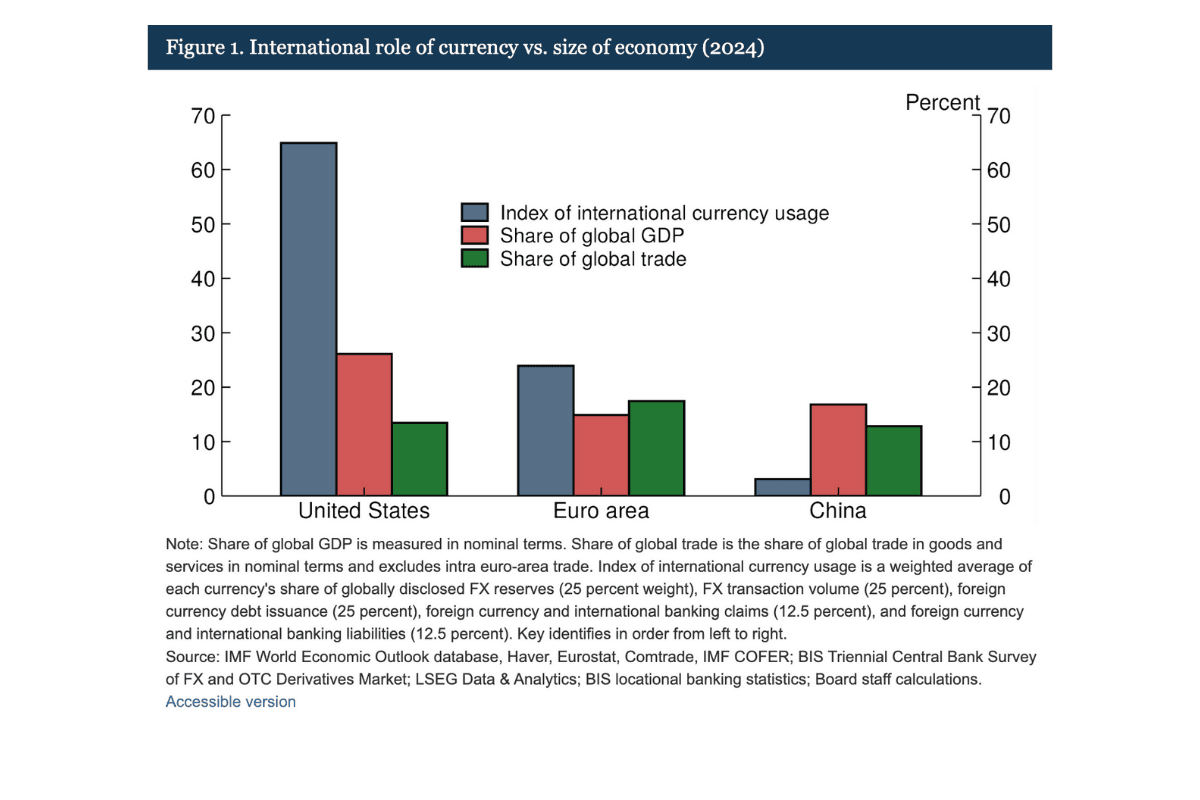

Dollar dominance is eroding:

Reserve share fell from 72% (2001) to 56.3% (Q2 2025)—a 30-year low

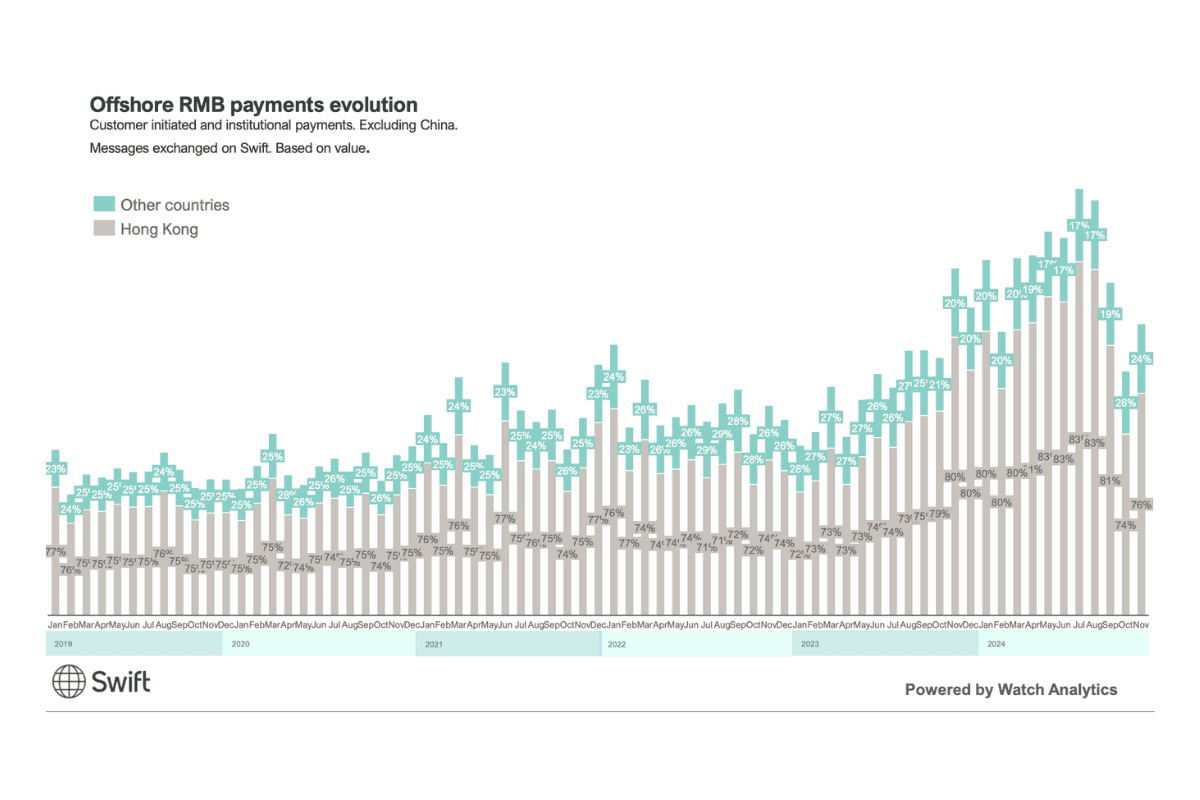

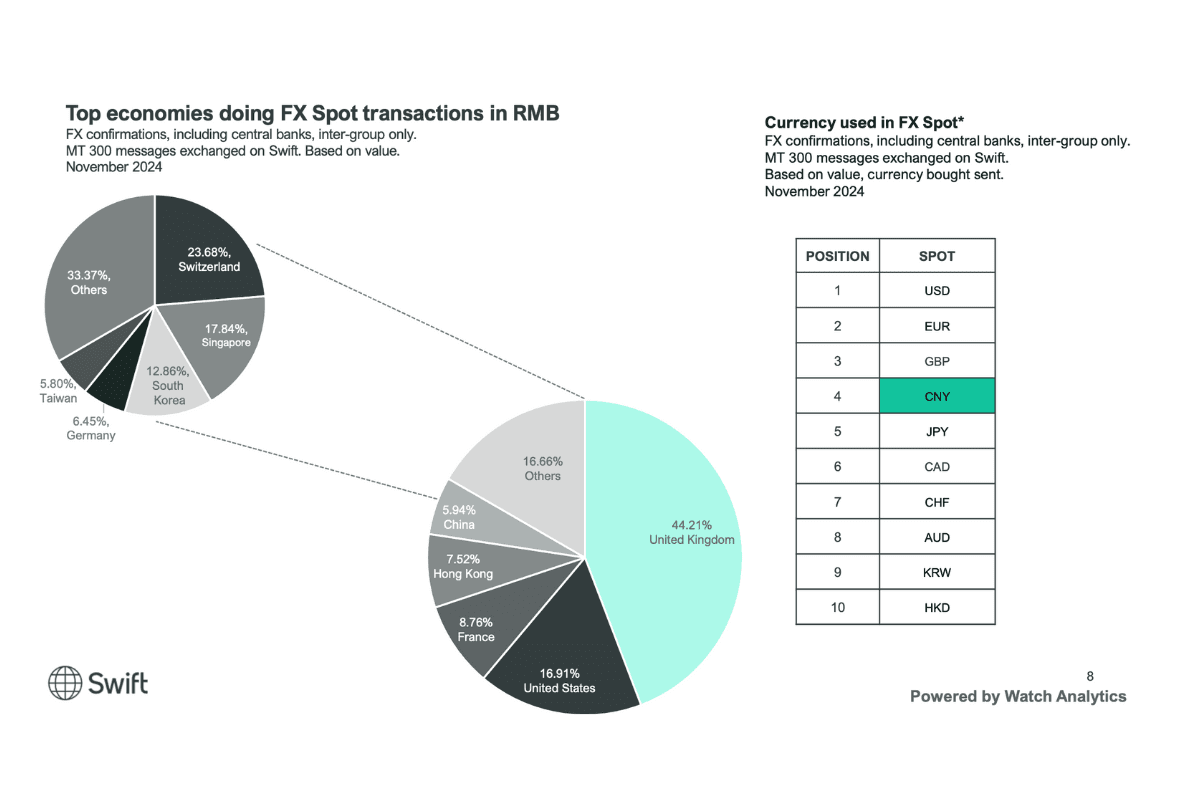

Yuan SWIFT payments hit 3.89% in November 2024, overtaking the yen

Roughly 80% of oil still prices in dollars, but "still" is doing heavy lifting

The Real System Behind the Fake Agreement

No formal "50-year petrodollar agreement" ever existed. What did exist: Nixon-era diplomacy securing Saudi commitment to dollar-denominated oil in exchange for military protection. The arrangement was always informal, built on mutual interest.

The petrodollar system rests on three pillars:

Oil priced in dollars

Transactions settled in dollars

Oil revenues recycled into U.S. Treasuries

Saudi Arabia executed this playbook faithfully for decades—$143.9 billion in Treasuries as of September 2024, $435 billion in dollar reserves, and a riyal pegged at 3.75:1 since 1986.

Now Riyadh is installing plumbing to bypass it entirely.

Enter mBridge: The SWIFT Killer

Saudi Arabia became a full mBridge participant in June 2024—a multi-CBDC platform using distributed ledger technology for instant cross-border payments. No correspondent banks, no dollar conversion, no SWIFT required.

The capabilities are real:

Transactions clear in 10 seconds vs. days through traditional banking

35 commercial banks processed real-value payments in four digital currencies (Feb-Sept 2024)

Then came the telling moment: BIS suddenly exited in October 2024 after Putin floated a "BRICS Bridge" concept. Atlantic Council's Josh Lipsky admitted: "If there's even a possibility that mBridge could be helpful to those ambitions the West wants no part of it."

Translation: It works too well, and Washington can't control it.

Why the "Limited Progress" Narrative Is Wrong

Establishment sources like S&P Global claim yuan-oil trade "may take decades to scale." Their arguments: yuan isn't widely used, limited spending outlets exist, and Saudi's dollar peg constrains flexibility.

These arguments fight the last war. The world changed:

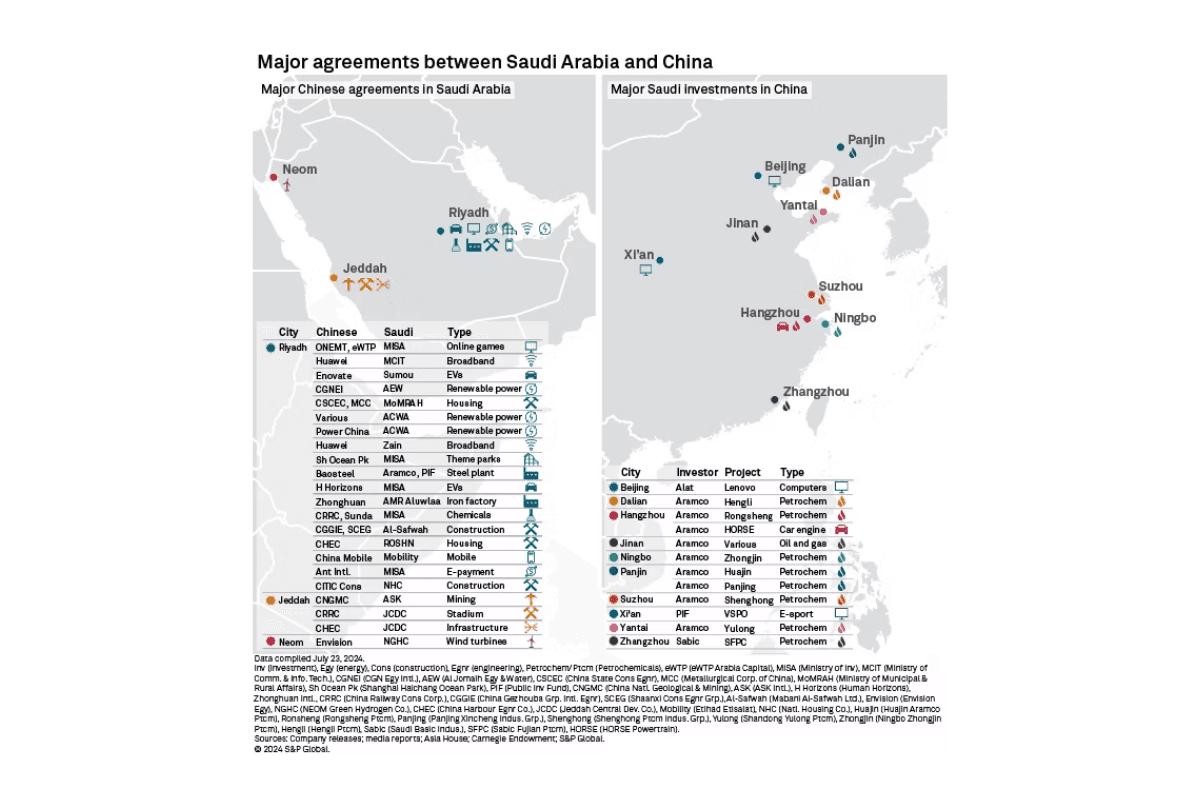

Saudi-China economic integration accelerated:

China now Saudi's largest trading partner—$87.3 billion annually

Oil comprises 84% of Saudi exports to China, up from 66% a decade ago

Trade surplus with Beijing ballooned from $5-10B (2015-16) to $20-40B recently

New deployment channels emerged:

Chinese firms building Saudi infrastructure (Vision 2030 alignment)

First Asia ETF tracking Saudi stocks launched with PIF backing

Belt and Road yuan financing for diversification projects

The calculus shifted. If China offers yuan infrastructure financing, seamless mBridge settlement, and fewer political strings than IMF/World Bank loans, why maintain dollar exclusivity?

The Network Effect Runs in Reverse

Reserve currency dominance follows network effects—self-reinforcing on the way up, self-reinforcing on the way down.

Yuan internationalization is accelerating:

Trade finance share hit 6%—matching the euro

China's CIPS processes $60-67B daily across 1,530 institutions in 115 countries

Central banks are hedging:

Gold's reserve share doubled from 10% (2015) to 23% (2024)

China's 11-month gold buying spree: 2,303 tonnes ($283B)

Beijing dumped Treasuries 45%: from $1.317T peak to $730.7B (July 2025)

What Happens Next

The petrodollar isn't dying dramatically—it's dying the way the British pound lost reserve status after WWII. Gradually, then suddenly.

Saudi Arabia is building capacity to:

Settle China trade in digital currency

Recycle petroyuan into Belt and Road investments

Diversify security partnerships beyond Washington

Meanwhile, hedging both sides: joined BRICS (invited Aug 2023), became SCO dialogue partner (March 2023), signed $6.93B yuan currency swap (Nov 2023).

These moves are incremental, reversible, deniable. That's what makes them dangerous.

Once Saudi Arabia—the largest oil exporter—demonstrates that major crude transactions can settle in yuan without catastrophe, game theory shifts. Other OPEC members will follow. If mBridge offers cheaper, faster settlement than SWIFT, what's the counterargument?

The endgame isn't a dollar-free world. But the dollar falling from 80% of oil trade to 50%, from 56% of reserves to 40%, from 88% of FX transactions to 70% fundamentally changes U.S. ability to set global monetary policy, run persistent deficits at low cost, and weaponize finance for foreign policy.

Network effects cut both ways. The petrodollar didn't die when a fake agreement "expired" in June 2024. But make no mistake—it's dying. The infrastructure is built. The rails are live.

The question isn't whether Saudi Arabia can trade oil in yuan. The question is: why wouldn't they?

NEVER MISS A THING!

Subscribe and get freshly baked articles. Join the community!

Join the newsletter to receive the latest updates in your inbox.